Instructions For Form Lgl-002 - Request For Disclosure Of Tax Return Or Tax Return Information

ADVERTISEMENT

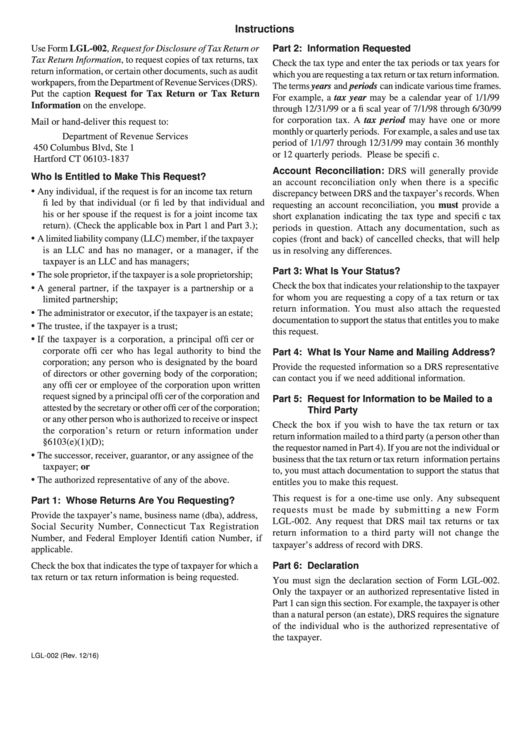

Instructions

Use Form LGL-002, Request for Disclosure of Tax Return or

Part 2: Information Requested

Tax Return Information, to request copies of tax returns, tax

Check the tax type and enter the tax periods or tax years for

return information, or certain other documents, such as audit

which you are requesting a tax return or tax return information.

workpapers, from the Department of Revenue Services (DRS).

The terms years and periods can indicate various time frames.

Put the caption Request for Tax Return or Tax Return

For example, a tax year may be a calendar year of 1/1/99

Information on the envelope.

through 12/31/99 or a fi scal year of 7/1/98 through 6/30/99

for corporation tax. A tax period may have one or more

Mail or hand-deliver this request to:

monthly or quarterly periods. For example, a sales and use tax

Department of Revenue Services

period of 1/1/97 through 12/31/99 may contain 36 monthly

450 Columbus Blvd, Ste 1

or 12 quarterly periods. Please be specifi c.

Hartford CT 06103-1837

Account Reconciliation: DRS will generally provide

Who Is Entitled to Make This Request?

an account reconciliation only when there is a specific

•

Any individual, if the request is for an income tax return

discrepancy between DRS and the taxpayer’s records. When

fi led by that individual (or fi led by that individual and

requesting an account reconciliation, you must provide a

his or her spouse if the request is for a joint income tax

short explanation indicating the tax type and specifi c tax

return). (Check the applicable box in Part 1 and Part 3.);

periods in question. Attach any documentation, such as

•

A limited liability company (LLC) member, if the taxpayer

copies (front and back) of cancelled checks, that will help

is an LLC and has no manager, or a manager, if the

us in resolving any differences.

taxpayer is an LLC and has managers;

Part 3: What Is Your Status?

•

The sole proprietor, if the taxpayer is a sole proprietorship;

Check the box that indicates your relationship to the taxpayer

•

A general partner, if the taxpayer is a partnership or a

for whom you are requesting a copy of a tax return or tax

limited partnership;

return information. You must also attach the requested

•

The administrator or executor, if the taxpayer is an estate;

documentation to support the status that entitles you to make

•

The trustee, if the taxpayer is a trust;

this request.

•

If the taxpayer is a corporation, a principal offi cer or

corporate offi cer who has legal authority to bind the

Part 4: What Is Your Name and Mailing Address?

corporation; any person who is designated by the board

Provide the requested information so a DRS representative

of directors or other governing body of the corporation;

can contact you if we need additional information.

any offi cer or employee of the corporation upon written

request signed by a principal offi cer of the corporation and

Part 5: Request for Information to be Mailed to a

attested by the secretary or other offi cer of the corporation;

Third Party

or any other person who is authorized to receive or inspect

Check the box if you wish to have the tax return or tax

the corporation’s return or return information under

return information mailed to a third party (a person other than

I.R.C. §6103(e)(1)(D);

the requestor named in Part 4). If you are not the individual or

•

The successor, receiver, guarantor, or any assignee of the

business that the tax return or tax return information pertains

taxpayer; or

to, you must attach documentation to support the status that

•

The authorized representative of any of the above.

entitles you to make this request.

This request is for a one-time use only. Any subsequent

Part 1: Whose Returns Are You Requesting?

requests must be made by submitting a new Form

Provide the taxpayer’s name, business name (dba), address,

LGL-002. Any request that DRS mail tax returns or tax

Social Security Number, Connecticut Tax Registration

return information to a third party will not change the

Number, and Federal Employer Identifi cation Number, if

taxpayer’s address of record with DRS.

applicable.

Check the box that indicates the type of taxpayer for which a

Part 6: Declaration

tax return or tax return information is being requested.

You must sign the declaration section of Form LGL-002.

Only the taxpayer or an authorized representative listed in

Part 1 can sign this section. For example, the taxpayer is other

than a natural person (an estate), DRS requires the signature

of the individual who is the authorized representative of

the taxpayer.

LGL-002 (Rev. 12/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1