Instructions For Form Et-30 - Release(S) Of Estate Tax Lien

ADVERTISEMENT

ET-30 (1/99) (back)

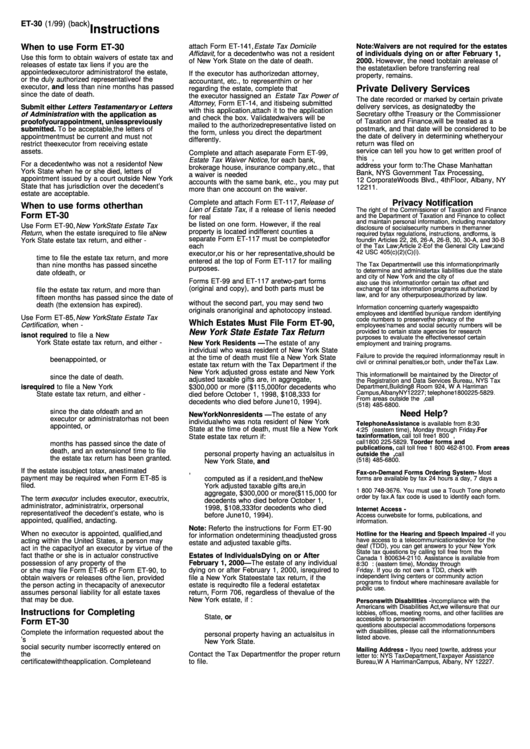

Instructions

When to use Form ET-30

attach Form ET-141, Estate Tax Domicile

Note: Waivers are not required for the estates

Affidavit, for a decedent who was not a resident

of individuals dying on or after February 1,

Use this form to obtain waivers of estate tax and

of New York State on the date of death.

2000. However, the need to obtain a release of

releases of estate tax liens if you are the

the estate tax lien before transferring real

appointed executor or administrator of the estate,

If the executor has authorized an attorney,

property, remains.

or the duly authorized representative of the

accountant, etc., to represent him or her

executor, and less than nine months has passed

Private Delivery Services

regarding the estate, complete that information. If

since the date of death.

the executor has signed an Estate Tax Power of

The date recorded or marked by certain private

Attorney , Form ET-14, and it is being submitted

delivery services, as designated by the U.S.

Submit either Letters Testamentary or Letters

with this application, attach it to the application

Secretary of the Treasury or the Commissioner

of Administration with the application as

and check the box. Validated waivers will be

of Taxation and Finance, will be treated as a

proof of your appointment, unless previously

mailed to the authorized representative listed on

postmark, and that date will be considered to be

submitted. To be acceptable, the letters of

the form, unless you direct the department

the date of delivery in determining whether your

appointment must be current and must not

differently.

return was filed on time. The private delivery

restrict the executor from receiving estate

service can tell you how to get written proof of

assets.

Complete and attach a separate Form ET-99,

this date. If you use one of these services,

Estate Tax Waiver Notice, for each bank,

For a decedent who was not a resident of New

address your form to: The Chase Manhattan

brokerage house, insurance company, etc., that

York State when he or she died, letters of

Bank, NYS Government Tax Processing,

a waiver is needed for. If there are multiple

appointment issued by a court outside New York

12 Corporate Woods Blvd., 4th Floor, Albany, NY

accounts with the same bank, etc., you may put

State that has jurisdiction over the decedent’s

12211.

more than one account on the waiver.

estate are acceptable.

Complete and attach Form ET-117, Release of

Privacy Notification

When to use forms other than

Lien of Estate Tax, if a release of lien is needed

The right of the Commissioner of Taxation and Finance

Form ET-30

and the Department of Taxation and Finance to collect

for real property. Three parcels of real estate can

and maintain personal information, including mandatory

be listed on one form. However, if the real

Use Form ET-90, New York State Estate Tax

disclosure of social security numbers in the manner

property is located in different counties a

Return, when the estate is required to file a New

required by tax regulations, instructions, and forms, is

separate Form ET-117 must be completed for

York State estate tax return, and either -

found in Articles 22, 26, 26-A, 26-B, 30, 30-A, and 30-B

each county. The name and address of the

of the Tax Law; Article 2-E of the General City Law; and

1.

the estate has not obtained an extension of

42 USC 405(c)(2)(C)(i).

executor, or his or her representative, should be

time to file the estate tax return, and more

entered at the top of Form ET-117 for mailing

The Tax Department will use this information primarily

than nine months has passed since the

purposes.

to determine and administer tax liabilities due the state

date of death, or

and city of New York and the city of Yonkers. We will

Forms ET-99 and ET-117 are two-part forms

2.

the estate obtained an extension of time to

also use this information for certain tax offset and

(original and copy), and both parts must be

exchange of tax information programs authorized by

file the estate tax return, and more than

law, and for any other purpose authorized by law.

submitted. If you are using a copy of the form

fifteen months has passed since the date of

without the second part, you may send two

death (the extension has expired).

Information concerning quarterly wages paid to

originals or an original and a photocopy instead.

employees and identified by unique random identifying

Use Form ET-85, New York State Estate Tax

code numbers to preserve the privacy of the

Which Estates Must File Form ET-90,

Certification, when -

employees’ names and social security numbers will be

New York State Estate Tax Return

provided to certain state agencies for research

1.

The estate is not required to file a New

purposes to evaluate the effectiveness of certain

York State estate tax return, and either -

New York Residents — The estate of any

employment and training programs.

individual who was a resident of New York State

a.

an executor or administrator has not

Failure to provide the required information may result in

at the time of death must file a New York State

been appointed, or

civil or criminal penalties, or both, under the Tax Law.

estate tax return with the Tax Department if the

b.

more than nine months has passed

New York adjusted gross estate and New York

This information will be maintained by the Director of

since the date of death.

adjusted taxable gifts are, in aggregate,

the Registration and Data Services Bureau, NYS Tax

2.

The estate is required to file a New York

$300,000 or more ($115,000 for decedents who

Department, Building 8 Room 924, W A Harriman

Campus, Albany NY 12227; telephone 1 800 225-5829.

State estate tax return, and either -

died before October 1, 1998, $108,333 for

From areas outside the U.S. and outside Canada, call

decedents who died before June 10, 1994).

a.

less than nine months has passed

(518) 485-6800.

since the date of death and an

Need Help?

New York Nonresidents — The estate of any

executor or administrator has not been

individual who was not a resident of New York

Telephone Assistance is available from 8:30 a.m. to

appointed, or

State at the time of death, must file a New York

4:25 p.m. (eastern time), Monday through Friday. For

tax information, call toll free 1 800 641-0004. If busy,

b.

more than nine but less than fifteen

State estate tax return if:

call 1 800 225-5829. To order forms and

months has passed since the date of

1.

the estate includes real property or tangible

publications, call toll free 1 800 462-8100. From areas

death, and an extension of time to file

personal property having an actual situs in

outside the U.S. and outside Canada, call

the estate tax return has been granted.

(518) 485-6800.

New York State, and

If the estate is subject to tax, an estimated

2.

the New York adjusted gross estate,

Fax-on-Demand Forms Ordering System - Most

payment may be required when Form ET-85 is

computed as if a resident, and the New

forms are available by fax 24 hours a day, 7 days a

week. Call toll free from the U.S. and Canada

filed.

York adjusted taxable gifts are, in

1 800 748-3676. You must use a Touch Tone phone to

aggregate, $300,000 or more ($115,000 for

order by fax. A fax code is used to identify each form.

The term executor includes executor, executrix,

decedents who died before October 1,

administrator, administratrix, or personal

1998, $108,333 for decedents who died

Internet Access -

representative of the decedent’s estate, who is

before June 10, 1994).

Access our website for forms, publications, and

appointed, qualified, and acting.

information.

Note: Refer to the instructions for Form ET-90

When no executor is appointed, qualified, and

Hotline for the Hearing and Speech Impaired - If you

for information on determining the adjusted gross

have access to a telecommunications device for the

acting within the United States, a person may

estate and adjusted taxable gifts.

deaf (TDD), you can get answers to your New York

act in the capacity of an executor by virtue of the

State tax questions by calling toll free from the U.S. and

fact that he or she is in actual or constructive

Estates of Individuals Dying on or After

Canada 1 800 634-2110. Assistance is available from

possession of any property of the decedent. He

February 1, 2000 — The estate of any individual

8:30 a.m. to 4:15 p.m. (eastern time), Monday through

or she may file Form ET-85 or Form ET-90, to

dying on or after February 1, 2000, is required to

Friday. If you do not own a TDD, check with

independent living centers or community action

obtain waivers or releases of the lien, provided

file a New York State estate tax return, if the

programs to find out where machines are available for

the person acting in the capacity of an executor

estate is required to file a federal estate tax

public use.

assumes personal liability for all estate taxes

return, Form 706, regardless of the value of the

that may be due.

New York estate, if :

Persons with Disabilities - In compliance with the

Americans with Disabilities Act, we will ensure that our

1.

the individual was a resident of New York

Instructions for Completing

lobbies, offices, meeting rooms, and other facilities are

State, or

accessible to persons with disabilities. If you have

Form ET-30

questions about special accommodations for persons

2.

the estate includes real property or tangible

with disabilities, please call the information numbers

Complete the information requested about the

personal property having an actual situs in

listed above.

decedent. Please verify that the decedent’s

New York State.

social security number is correctly entered on

Mailing Address - If you need to write, address your

the application. Submit a photocopy of the death

Contact the Tax Department for the proper return

letter to: NYS Tax Department, Taxpayer Assistance

certificate with the application. Complete and

to file.

Bureau, W A Harriman Campus, Albany, NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1