Instructions For Schedule I (Form 1040 Or Form 1040a) - Nebraska Adjustments To Income

ADVERTISEMENT

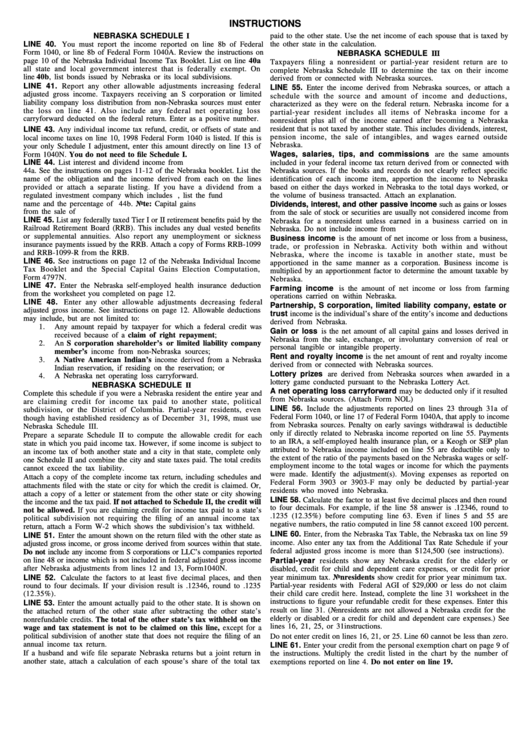

INSTRUCTIONS

NEBRASKA SCHEDULE I

paid to the other state. Use the net income of each spouse that is taxed by

LINE 40. You must report the income reported on line 8b of Federal

the other state in the calculation.

Form 1040, or line 8b of Federal Form 1040A. Review the instructions on

NEBRASKA SCHEDULE III

page 10 of the Nebraska Individual Income Tax Booklet. List on line 40a

Taxpayers filing a nonresident or partial-year resident return are to

all state and local government interest that is federally exempt. On

complete Nebraska Schedule III to determine the tax on their income

line 40b, list bonds issued by Nebraska or its local subdivisions.

derived from or connected with Nebraska sources.

LINE 41. Report any other allowable adjustments increasing federal

LINE 55. Enter the income derived from Nebraska sources, or attach a

adjusted gross income. Taxpayers receiving an S corporation or limited

schedule with the source and amount of income and deductions,

liability company loss distribution from non-Nebraska sources must enter

characterized as they were on the federal return. Nebraska income for a

the loss on line 41. Also include any federal net operating loss

partial-year resident includes all items of Nebraska income for a

carryforward deducted on the federal return. Enter as a positive number.

nonresident plus all of the income earned after becoming a Nebraska

resident that is not taxed by another state. This includes dividends, interest,

LINE 43. Any individual income tax refund, credit, or offsets of state and

pension income, the sale of intangibles, and wages earned outside

local income taxes on line 10, 1998 Federal Form 1040 is listed. If this is

Nebraska.

your only Schedule I adjustment, enter this amount directly on line 13 of

Wages, salaries, tips, and commissions are the same amounts

Form 1040N. You do not need to file Schedule I.

LINE 44. List interest and dividend income from U.S. obligations on line

included in your federal income tax return derived from or connected with

44a. See the instructions on pages 11-12 of the Nebraska booklet. List the

Nebraska sources. If the books and records do not clearly reflect specific

name of the obligation and the income derived from each on the lines

identification of each income item, apportion the income to Nebraska

provided or attach a separate listing. If you have a dividend from a

based on either the days worked in Nebraska to the total days worked, or

the volume of business transacted. Attach an explanation.

regulated investment company which includes U.S. interest, list the fund

name and the percentage of U.S. interest on line 44b. Note: Capital gains

Dividends, interest, and other passive income such as gains or losses

from the sale of U.S. obligations are not deductible.

from the sale of stock or securities are usually not considered income from

LINE 45. List any federally taxed Tier I or II retirement benefits paid by the

Nebraska for a nonresident unless earned in a business carried on in

Railroad Retirement Board (RRB). This includes any dual vested benefits

Nebraska. Do not include income from U.S. obligations listed on line 44.

or supplemental annuities. Also report any unemployment or sickness

Business income is the amount of net income or loss from a business,

insurance payments issued by the RRB. Attach a copy of Forms RRB-1099

trade, or profession in Nebraska. Activity both within and without

and RRB-1099-R from the RRB.

Nebraska, where the income is taxable in another state, must be

LINE 46. See instructions on page 12 of the Nebraska Individual Income

apportioned in the same manner as a corporation. Business income is

Tax Booklet and the Special Capital Gains Election Computation,

multiplied by an apportionment factor to determine the amount taxable by

Form 4797N.

Nebraska.

LINE 47. Enter the Nebraska self-employed health insurance deduction

Farming income is the amount of net income or loss from farming

from the worksheet you completed on page 12.

operations carried on within Nebraska.

LINE 48. Enter any other allowable adjustments decreasing federal

Partnership, S corporation, limited liability company, estate or

adjusted gross income. See instructions on page 12. Allowable deductions

trust income is the individual’s share of the entity’s income and deductions

may include, but are not limited to:

derived from Nebraska.

1.

Any amount repaid by taxpayer for which a federal credit was

Gain or loss is the net amount of all capital gains and losses derived in

received because of a claim of right repayment;

Nebraska from the sale, exchange, or involuntary conversion of real or

2.

An S corporation shareholder’s or limited liability company

personal tangible or intangible property.

member’s income from non-Nebraska sources;

Rent and royalty income is the net amount of rent and royalty income

3.

A Native American Indian’s income derived from a Nebraska

derived from or connected with Nebraska sources.

Indian reservation, if residing on the reservation; or

Lottery prizes are derived from Nebraska sources when awarded in a

4.

A Nebraska net operating loss carryforward.

lottery game conducted pursuant to the Nebraska Lottery Act.

NEBRASKA SCHEDULE II

A net operating loss carryforward may be deducted only if it resulted

Complete this schedule if you were a Nebraska resident the entire year and

from Nebraska sources. (Attach Form NOL)

are claiming credit for income tax paid to another state, political

LINE 56. Include the adjustments reported on lines 23 through 31a of

subdivision, or the District of Columbia. Partial-year residents, even

Federal Form 1040, or line 17 of Federal Form 1040A, that apply to income

though having established residency as of December 31, 1998, must use

from Nebraska sources. Penalty on early savings withdrawal is deductible

Nebraska Schedule III.

only if directly related to Nebraska income reported on line 55. Payments

Prepare a separate Schedule II to compute the allowable credit for each

to an IRA, a self-employed health insurance plan, or a Keogh or SEP plan

state in which you paid income tax. However, if some income is subject to

attributed to Nebraska income included on line 55 are deductible only to

an income tax of both another state and a city in that state, complete only

the extent of the ratio of the payments based on the Nebraska wages or self-

one Schedule II and combine the city and state taxes paid. The total credits

employment income to the total wages or income for which the payments

cannot exceed the tax liability.

were made. Identify the adjustment(s). Moving expenses as reported on

Attach a copy of the complete income tax return, including schedules and

Federal Form 3903 or 3903-F may only be deducted by partial-year

attachments filed with the state or city for which the credit is claimed. Or,

residents who moved into Nebraska.

attach a copy of a letter or statement from the other state or city showing

LINE 58. Calculate the factor to at least five decimal places and then round

the income and the tax paid. If not attached to Schedule II, the credit will

to four decimals. For example, if the line 58 answer is .12346, round to

not be allowed. If you are claiming credit for income tax paid to a state’s

.1235 (12.35%) before computing line 63. Even if lines 5 and 55 are

political subdivision not requiring the filing of an annual income tax

negative numbers, the ratio computed in line 58 cannot exceed 100 percent.

return, attach a Form W-2 which shows the subdivision’s tax withheld.

LINE 60. Enter, from the Nebraska Tax Table, the Nebraska tax on line 59

LINE 51. Enter the amount shown on the return filed with the other state as

income. Also enter any tax from the Additional Tax Rate Schedule if your

adjusted gross income, or gross income derived from sources within that state.

federal adjusted gross income is more than $124,500 (see instructions).

Do not include any income from S corporations or LLC’s companies reported

on line 48 or income which is not included in federal adjusted gross income

Partial-year residents show any Nebraska credit for the elderly or

after Nebraska adjustments from lines 12 and 13, Form 1040N.

disabled, credit for child and dependent care expenses, or credit for prior

LINE 52. Calculate the factors to at least five decimal places, and then

year minimum tax. Nonresidents show credit for prior year minimum tax.

Partial-year residents with Federal AGI of $29,000 or less do not claim

round to four decimals. If your division result is .12346, round to .1235

their child care credit here. Instead, complete the line 31 worksheet in the

(12.35%).

instructions to figure your refundable credit for these expenses. Enter this

LINE 53. Enter the amount actually paid to the other state. It is shown on

result on line 31. (Nonresidents are not allowed a Nebraska credit for the

the attached return of the other state after subtracting the other state’s

elderly or disabled or a credit for child and dependent care expenses.) See

nonrefundable credits. The total of the other state’s tax withheld on the

lines 16, 21, 25, or 31instructions.

wage and tax statement is not to be claimed on this line, except for a

political subdivision of another state that does not require the filing of an

Do not enter credit on lines 16, 21, or 25. Line 60 cannot be less than zero.

annual income tax return.

LINE 61. Enter your credit from the personal exemption chart on page 9 of

If a husband and wife file separate Nebraska returns but a joint return in

the instructions. Multiply the credit listed in the chart by the number of

another state, attach a calculation of each spouse’s share of the total tax

exemptions reported on line 4. Do not enter on line 19.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1