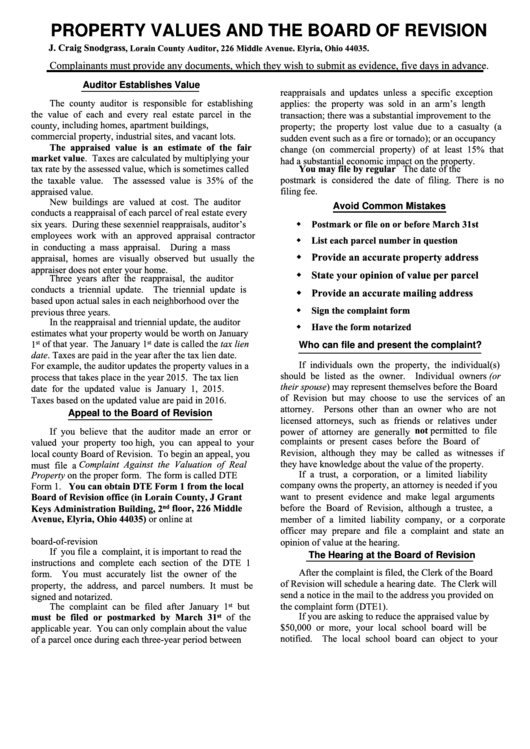

PROPERTY VALUES AND THE BOARD OF REVISION

J. Craig Snodgrass

, Lorain County Auditor, 226 Middle Avenue. Elyria, Ohio 44035.

Complainants must provide any documents, which they wish to submit as evidence, five days in advance.

Auditor Establishes Value

reappraisals and updates unless a specific exception

The county auditor is responsible for establishing

applies: the property was sold in an arm’s length

the value of each and every real estate parcel in the

transaction; there was a substantial improvement to the

including

homes,

apartment

buildings,

county,

property; the property lost value due to a casualty (a

commercial property, industrial sites, and vacant lots.

sudden event such as a fire or tornado); or an occupancy

The appraised value is an estimate of the fair

change (on commercial property) of at least 15% that

market value. Taxes are calculated by multiplying your

had a substantial economic impact on the property.

tax rate by the assessed value, which is sometimes called

You may file by regular U.S. mail. The date of the

postmark is considered the date of filing. There is no

the taxable value. The assessed value is 35% of the

filing fee.

appraised value.

New buildings are valued at cost. The auditor

Avoid Common Mistakes

conducts a reappraisal of each parcel of real estate every

Postmark or file on or before March 31st

six years. During these sexenniel reappraisals, auditor’s

employees work with an approved appraisal contractor

List each parcel number in question

in conducting a mass appraisal. During a mass

Provide an accurate property address

appraisal, homes are visually observed but usually the

appraiser does not enter your home.

State your opinion of value per parcel

Three years after the reappraisal, the auditor

conducts a triennial update. The triennial update is

Provide an accurate mailing address

based upon actual sales in each neighborhood over the

Sign the complaint form

previous three years.

In the reappraisal and triennial update, the auditor

Have the form notarized

estimates what your property would be worth on January

date is called the tax lien

of that year. The January 1

1

st

st

Who can file and present the complaint?

date. Taxes are paid in the year after the tax lien date.

If individuals own the property, the individual(s)

For example, the auditor updates the property values in a

should be listed as the owner. Individual owners (or

process that takes place in the year 2015. The tax lien

their spouse) may represent themselves before the Board

date for the updated value is January 1, 2015.

of Revision but may choose to use the services of an

Taxes based on the updated value are paid in 2016.

attorney. Persons other than an owner who are not

Appeal to the Board of Revision

licensed attorneys, such as friends or relatives under

power of attorney are generally not permitted to file

If you believe that the auditor made an error or

complaints or present cases before the Board of

valued your property too high, you can appeal to your

Revision, although they may be called as witnesses if

local county Board of Revision. To begin an appeal, you

must file a Complaint Against the Valuation of Real

they have knowledge about the value of the property.

If a trust, a corporation, or a limited liability

Property on the proper form. The form is called DTE

company owns the property, an attorney is needed if you

Form 1. You can obtain DTE Form 1 from the local

want to present evidence and make legal arguments

Board of Revision office (in Lorain County, J Grant

floor, 226 Middle

before the Board of Revision, although a trustee, a

Keys Administration Building, 2

nd

Avenue,

Elyria,

Ohio

44035)

or

online

at

member of a limited liability company, or a corporate

officer may prepare and file a complaint and state an

board-of-revision

opinion of value at the hearing.

If you file a complaint, it is important to read the

The Hearing at the Board of Revision

instructions and complete each section of the DTE 1

After the complaint is filed, the Clerk of the Board

form. You must accurately list the owner of the

of Revision will schedule a hearing date. The Clerk will

property, the address, and parcel numbers. It must be

send a notice in the mail to the address you provided on

signed and notarized.

The complaint can be filed after January 1

but

the complaint form (DTE1).

st

If you are asking to reduce the appraised value by

must be filed or postmarked by March 31

of the

st

$50,000 or more, your local school board will be

applicable year. You can only complain about the value

notified. The local school board can object to your

of a parcel once during each three-year period between

1

1 2

2 3

3 4

4 5

5