Form Td22 - Tda Direct Rollover Election Form

ADVERTISEMENT

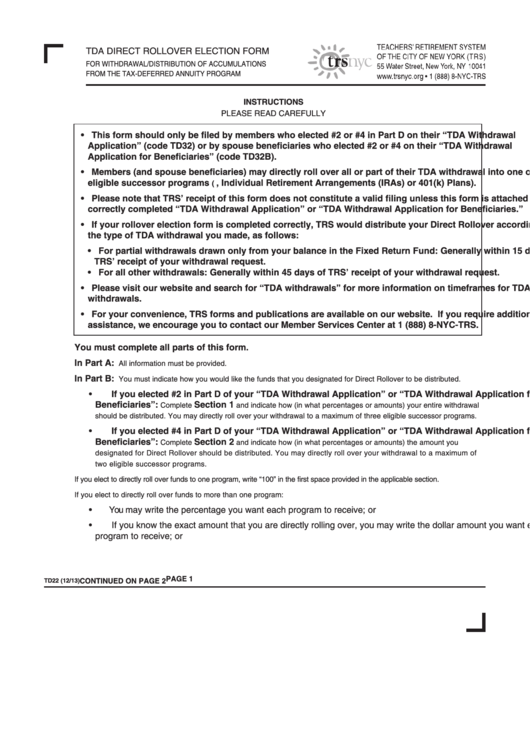

TDA DIRECT ROLLOVER ELECTION FORM

FOR WITHDRAWAL/DISTRIBUTION OF ACCUMULATIONS

FROM THE TAX-DEFERRED ANNUITY PROGRAM

INSTRUCTIONS

PLEASE READ CAREFULLY

• This form should only be filed by members who elected #2 or #4 in Part D on their “TDA Withdrawal

Application” (code TD32) or by spouse beneficiaries who elected #2 or #4 on their “TDA Withdrawal

Application for Beneficiaries” (code TD32B).

• Members (and spouse beneficiaries) may directly roll over all or part of their TDA withdrawal into one or more

eligible successor programs (i.e., Individual Retirement Arrangements (IRAs) or 401(k) Plans).

• Please note that TRS’ receipt of this form does not constitute a valid filing unless this form is attached to your

correctly completed “TDA Withdrawal Application” or “TDA Withdrawal Application for Beneficiaries.”

• If your rollover election form is completed correctly, TRS would distribute your Direct Rollover according to

the type of TDA withdrawal you made, as follows:

• For partial withdrawals drawn only from your balance in the Fixed Return Fund: Generally within 15 days of

TRS’ receipt of your withdrawal request.

• For all other withdrawals: Generally within 45 days of TRS’ receipt of your withdrawal request.

• Please visit our website and search for “TDA withdrawals” for more information on timeframes for TDA

withdrawals.

• For your convenience, TRS forms and publications are available on our website. If you require additional

assistance, we encourage you to contact our Member Services Center at 1 (888) 8-NYC-TRS.

You must complete all parts of this form.

In Part A: All information must be provided.

In Part B: You must indicate how you would like the funds that you designated for Direct Rollover to be distributed.

• If you elected #2 in Part D of your “TDA Withdrawal Application” or “TDA Withdrawal Application for

Beneficiaries”: Complete Section 1 and indicate how (in what percentages or amounts) your entire withdrawal

should be distributed. You may directly roll over your withdrawal to a maximum of three eligible successor programs.

• If you elected #4 in Part D of your “TDA Withdrawal Application” or “TDA Withdrawal Application for

Beneficiaries”: Complete Section 2 and indicate how (in what percentages or amounts) the amount you

designated for Direct Rollover should be distributed. You may directly roll over your withdrawal to a maximum of

two eligible successor programs.

If you elect to directly roll over funds to one program, write “100” in the first space provided in the applicable section.

If you elect to directly roll over funds to more than one program:

• You may write the percentage you want each program to receive; or

• If you know the exact amount that you are directly rolling over, you may write the dollar amount you want each

program to receive; or

PAGE 1

CONTINUED ON PAGE 2

TD22 (12/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4