Instructions For Form 13 - Nebraska Resale Or Exempt Sale Certificate

ADVERTISEMENT

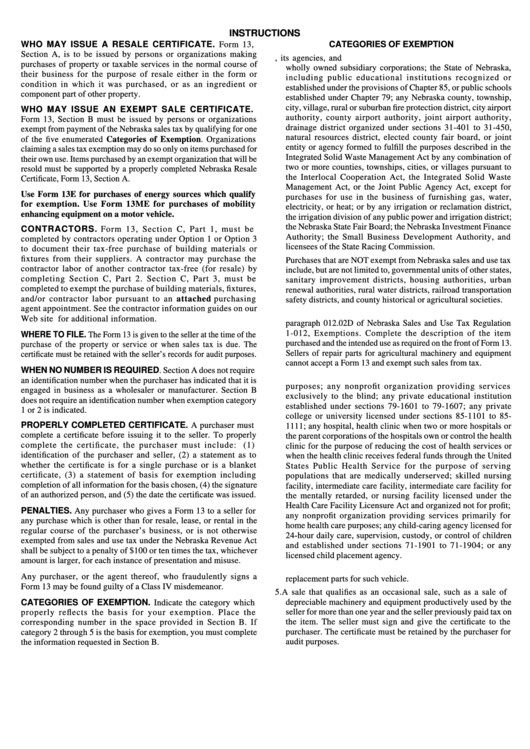

INSTRUCTIONS

WHO MAY ISSUE A RESALE CERTIFICATE. Form 13,

CATEGORIES OF EXEMPTION

Section A, is to be issued by persons or organizations making

1. Purchase by the United States Government, its agencies, and

purchases of property or taxable services in the normal course of

wholly owned subsidiary corporations; the State of Nebraska,

their business for the purpose of resale either in the form or

including public educational institutions recognized or

condition in which it was purchased, or as an ingredient or

established under the provisions of Chapter 85, or public schools

component part of other property.

established under Chapter 79; any Nebraska county, township,

city, village, rural or suburban fire protection district, city airport

WHO MAY ISSUE AN EXEMPT SALE CERTIFICATE.

authority, county airport authority, joint airport authority,

Form 13, Section B must be issued by persons or organizations

drainage district organized under sections 31-401 to 31-450,

exempt from payment of the Nebraska sales tax by qualifying for one

natural resources district, elected county fair board, or joint

of the five enumerated Categories of Exemption. Organizations

entity or agency formed to fulfill the purposes described in the

claiming a sales tax exemption may do so only on items purchased for

Integrated Solid Waste Management Act by any combination of

their own use. Items purchased by an exempt organization that will be

two or more counties, townships, cities, or villages pursuant to

resold must be supported by a properly completed Nebraska Resale

the Interlocal Cooperation Act, the Integrated Solid Waste

Certificate, Form 13, Section A.

Management Act, or the Joint Public Agency Act, except for

Use Form 13E for purchases of energy sources which qualify

purchases for use in the business of furnishing gas, water,

for exemption. Use Form 13ME for purchases of mobility

electricity, or heat; or by any irrigation or reclamation district,

enhancing equipment on a motor vehicle.

the irrigation division of any public power and irrigation district;

the Nebraska State Fair Board; the Nebraska Investment Finance

CONTRACTORS. Form 13, Section C, Part 1, must be

Authority; the Small Business Development Authority, and

completed by contractors operating under Option 1 or Option 3

licensees of the State Racing Commission.

to document their tax-free purchase of building materials or

fixtures from their suppliers. A contractor may purchase the

Purchases that are NOT exempt from Nebraska sales and use tax

contractor labor of another contractor tax-free (for resale) by

include, but are not limited to, governmental units of other states,

completing Section C, Part 2. Section C, Part 3, must be

sanitary improvement districts, housing authorities, urban

completed to exempt the purchase of building materials, fixtures,

renewal authorities, rural water districts, railroad transportation

and/or contractor labor pursuant to an attached purchasing

safety districts, and county historical or agricultural societies.

agent appointment. See the contractor information guides on our

2. Purchase when the intended use renders it exempt as set out in

Web site for additional information.

paragraph 012.02D of Nebraska Sales and Use Tax Regulation

1-012, Exemptions. Complete the description of the item

WHERE TO FILE. The Form 13 is given to the seller at the time of the

purchased and the intended use as required on the front of Form 13.

purchase of the property or service or when sales tax is due. The

Sellers of repair parts for agricultural machinery and equipment

certificate must be retained with the seller’s records for audit purposes.

cannot accept a Form 13 and exempt such sales from tax.

WHEN NO NUMBER IS REQUIRED. Section A does not require

3. Purchase by any organization created exclusively for religious

an identification number when the purchaser has indicated that it is

purposes; any nonprofit organization providing services

engaged in business as a wholesaler or manufacturer. Section B

exclusively to the blind; any private educational institution

does not require an identification number when exemption category

established under sections 79-1601 to 79-1607; any private

1 or 2 is indicated.

college or university licensed under sections 85-1101 to 85-

PROPERLY COMPLETED CERTIFICATE. A purchaser must

1111; any hospital, health clinic when two or more hospitals or

complete a certificate before issuing it to the seller. To properly

the parent corporations of the hospitals own or control the health

complete the certificate, the purchaser must include: (1)

clinic for the purpose of reducing the cost of health services or

identification of the purchaser and seller, (2) a statement as to

when the health clinic receives federal funds through the United

whether the certificate is for a single purchase or is a blanket

States Public Health Service for the purpose of serving

certificate, (3) a statement of basis for exemption including

populations that are medically underserved; skilled nursing

completion of all information for the basis chosen, (4) the signature

facility, intermediate care facility, intermediate care facility for

of an authorized person, and (5) the date the certificate was issued.

the mentally retarded, or nursing facility licensed under the

Health Care Facility Licensure Act and organized not for profit;

PENALTIES. Any purchaser who gives a Form 13 to a seller for

any nonprofit organization providing services primarily for

any purchase which is other than for resale, lease, or rental in the

home health care purposes; any child-caring agency licensed for

regular course of the purchaser’s business, or is not otherwise

24-hour daily care, supervision, custody, or control of children

exempted from sales and use tax under the Nebraska Revenue Act

and established under sections 71-1901 to 71-1904; or any

shall be subject to a penalty of $100 or ten times the tax, whichever

licensed child placement agency.

amount is larger, for each instance of presentation and misuse.

4. Purchase of a common or contract carrier vehicle and repair and

Any purchaser, or the agent thereof, who fraudulently signs a

replacement parts for such vehicle.

Form 13 may be found guilty of a Class IV misdemeanor.

5. A sale that qualifies as an occasional sale, such as a sale of

CATEGORIES OF EXEMPTION. Indicate the category which

depreciable machinery and equipment productively used by the

seller for more than one year and the seller previously paid tax on

properly reflects the basis for your exemption. Place the

the item. The seller must sign and give the certificate to the

corresponding number in the space provided in Section B. If

purchaser. The certificate must be retained by the purchaser for

category 2 through 5 is the basis for exemption, you must complete

audit purposes.

the information requested in Section B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1