Instructions For Form 16 - Nebraska Revenue Contractor Database And Election

ADVERTISEMENT

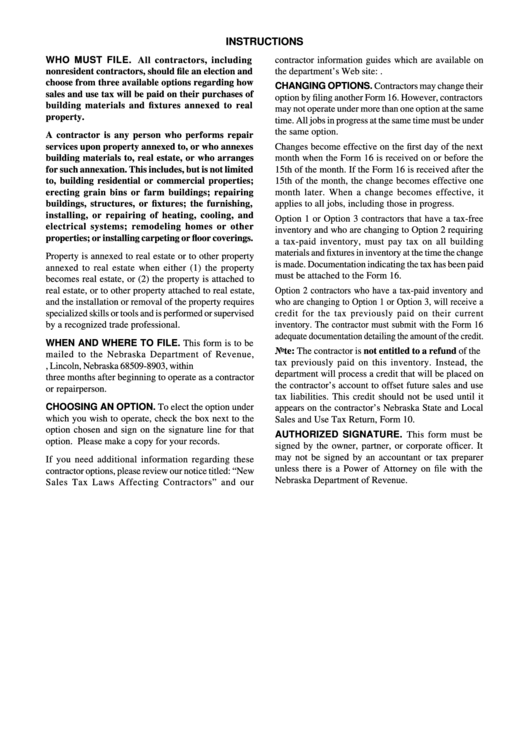

INSTRUCTIONS

WHO MUST FILE. All contractors, including

contractor information guides which are available on

nonresident contractors, should file an election and

the department’s Web site:

choose from three available options regarding how

CHANGING OPTIONS. Contractors may change their

sales and use tax will be paid on their purchases of

option by filing another Form 16. However, contractors

building materials and fixtures annexed to real

may not operate under more than one option at the same

property.

time. All jobs in progress at the same time must be under

the same option.

A contractor is any person who performs repair

services upon property annexed to, or who annexes

Changes become effective on the first day of the next

building materials to, real estate, or who arranges

month when the Form 16 is received on or before the

for such annexation. This includes, but is not limited

15th of the month. If the Form 16 is received after the

to, building residential or commercial properties;

15th of the month, the change becomes effective one

erecting grain bins or farm buildings; repairing

month later. When a change becomes effective, it

buildings, structures, or fixtures; the furnishing,

applies to all jobs, including those in progress.

installing, or repairing of heating, cooling, and

Option 1 or Option 3 contractors that have a tax-free

electrical systems; remodeling homes or other

inventory and who are changing to Option 2 requiring

properties; or installing carpeting or floor coverings.

a tax-paid inventory, must pay tax on all building

materials and fixtures in inventory at the time the change

Property is annexed to real estate or to other property

is made. Documentation indicating the tax has been paid

annexed to real estate when either (1) the property

must be attached to the Form 16.

becomes real estate, or (2) the property is attached to

real estate, or to other property attached to real estate,

Option 2 contractors who have a tax-paid inventory and

and the installation or removal of the property requires

who are changing to Option 1 or Option 3, will receive a

specialized skills or tools and is performed or supervised

credit for the tax previously paid on their current

by a recognized trade professional.

inventory. The contractor must submit with the Form 16

adequate documentation detailing the amount of the credit.

WHEN AND WHERE TO FILE. This form is to be

Note: The contractor is not entitled to a refund of the

mailed to the Nebraska Department of Revenue,

tax previously paid on this inventory. Instead, the

P.O. Box 98903, Lincoln, Nebraska 68509-8903, within

department will process a credit that will be placed on

three months after beginning to operate as a contractor

the contractor’s account to offset future sales and use

or repairperson.

tax liabilities. This credit should not be used until it

CHOOSING AN OPTION. To elect the option under

appears on the contractor’s Nebraska State and Local

which you wish to operate, check the box next to the

Sales and Use Tax Return, Form 10.

option chosen and sign on the signature line for that

AUTHORIZED SIGNATURE. This form must be

option. Please make a copy for your records.

signed by the owner, partner, or corporate officer. It

may not be signed by an accountant or tax preparer

If you need additional information regarding these

unless there is a Power of Attorney on file with the

contractor options, please review our notice titled: “New

Nebraska Department of Revenue.

Sales Tax Laws Affecting Contractors” and our

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1