Instructions For Form 10 - Nebraska And Local Sales And Use Tax Return

ADVERTISEMENT

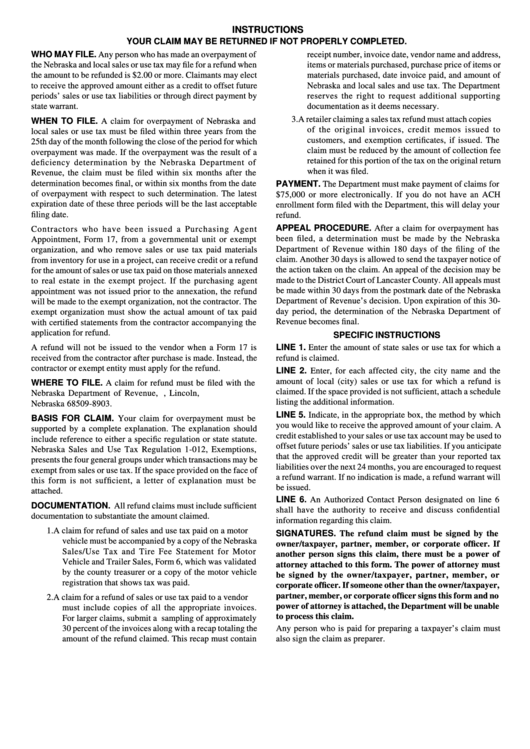

INSTRUCTIONS

YOUR CLAIM MAY BE RETURNED IF NOT PROPERLY COMPLETED.

WHO MAY FILE. Any person who has made an overpayment of

receipt number, invoice date, vendor name and address,

the Nebraska and local sales or use tax may file for a refund when

items or materials purchased, purchase price of items or

the amount to be refunded is $2.00 or more. Claimants may elect

materials purchased, date invoice paid, and amount of

to receive the approved amount either as a credit to offset future

Nebraska and local sales and use tax. The Department

periods’ sales or use tax liabilities or through direct payment by

reserves the right to request additional supporting

state warrant.

documentation as it deems necessary.

3. A retailer claiming a sales tax refund must attach copies

WHEN TO FILE. A claim for overpayment of Nebraska and

of the original invoices, credit memos issued to

local sales or use tax must be filed within three years from the

customers, and exemption certificates, if issued. The

25th day of the month following the close of the period for which

claim must be reduced by the amount of collection fee

overpayment was made. If the overpayment was the result of a

retained for this portion of the tax on the original return

deficiency determination by the Nebraska Department of

when it was filed.

Revenue, the claim must be filed within six months after the

determination becomes final, or within six months from the date

PAYMENT. The Department must make payment of claims for

of overpayment with respect to such determination. The latest

$75,000 or more electronically. If you do not have an ACH

expiration date of these three periods will be the last acceptable

enrollment form filed with the Department, this will delay your

filing date.

refund.

APPEAL PROCEDURE. After a claim for overpayment has

Contractors who have been issued a Purchasing Agent

been filed, a determination must be made by the Nebraska

Appointment, Form 17, from a governmental unit or exempt

Department of Revenue within 180 days of the filing of the

organization, and who remove sales or use tax paid materials

claim. Another 30 days is allowed to send the taxpayer notice of

from inventory for use in a project, can receive credit or a refund

the action taken on the claim. An appeal of the decision may be

for the amount of sales or use tax paid on those materials annexed

made to the District Court of Lancaster County. All appeals must

to real estate in the exempt project. If the purchasing agent

be made within 30 days from the postmark date of the Nebraska

appointment was not issued prior to the annexation, the refund

Department of Revenue’s decision. Upon expiration of this 30-

will be made to the exempt organization, not the contractor. The

day period, the determination of the Nebraska Department of

exempt organization must show the actual amount of tax paid

Revenue becomes final.

with certified statements from the contractor accompanying the

application for refund.

SPECIFIC INSTRUCTIONS

A refund will not be issued to the vendor when a Form 17 is

LINE 1. Enter the amount of state sales or use tax for which a

received from the contractor after purchase is made. Instead, the

refund is claimed.

contractor or exempt entity must apply for the refund.

LINE 2. Enter, for each affected city, the city name and the

amount of local (city) sales or use tax for which a refund is

WHERE TO FILE. A claim for refund must be filed with the

claimed. If the space provided is not sufficient, attach a schedule

Nebraska Department of Revenue, P.O. Box 98903, Lincoln,

listing the additional information.

Nebraska 68509-8903.

LINE 5. Indicate, in the appropriate box, the method by which

BASIS FOR CLAIM. Your claim for overpayment must be

you would like to receive the approved amount of your claim. A

supported by a complete explanation. The explanation should

credit established to your sales or use tax account may be used to

include reference to either a specific regulation or state statute.

offset future periods’ sales or use tax liabilities. If you anticipate

Nebraska Sales and Use Tax Regulation 1-012, Exemptions,

that the approved credit will be greater than your reported tax

presents the four general groups under which transactions may be

liabilities over the next 24 months, you are encouraged to request

exempt from sales or use tax. If the space provided on the face of

a refund warrant. If no indication is made, a refund warrant will

this form is not sufficient, a letter of explanation must be

be issued.

attached.

LINE 6. An Authorized Contact Person designated on line 6

DOCUMENTATION. All refund claims must include sufficient

shall have the authority to receive and discuss confidential

documentation to substantiate the amount claimed.

information regarding this claim.

1. A claim for refund of sales and use tax paid on a motor

SIGNATURES. The refund claim must be signed by the

vehicle must be accompanied by a copy of the Nebraska

owner/taxpayer, partner, member, or corporate officer. If

Sales/Use Tax and Tire Fee Statement for Motor

another person signs this claim, there must be a power of

Vehicle and Trailer Sales, Form 6, which was validated

attorney attached to this form. The power of attorney must

by the county treasurer or a copy of the motor vehicle

be signed by the owner/taxpayer, partner, member, or

registration that shows tax was paid.

corporate officer. If someone other than the owner/taxpayer,

partner, member, or corporate officer signs this form and no

2. A claim for a refund of sales or use tax paid to a vendor

power of attorney is attached, the Department will be unable

must include copies of all the appropriate invoices.

to process this claim.

For larger claims, submit a sampling of approximately

30 percent of the invoices along with a recap totaling the

Any person who is paid for preparing a taxpayer’s claim must

amount of the refund claimed. This recap must contain

also sign the claim as preparer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1