Automobile Expenses Sheet

ADVERTISEMENT

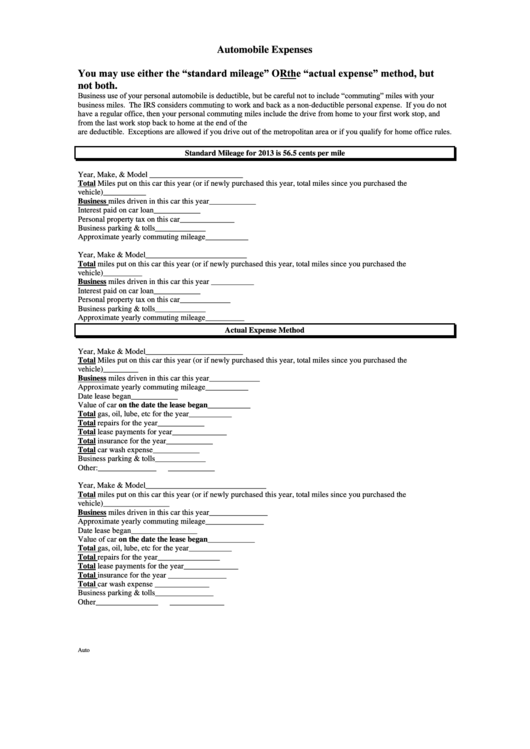

Automobile Expenses

You may use either the “standard mileage” OR the “actual expense” method, but

not both.

Business use of your personal automobile is deductible, but be careful not to include “commuting” miles with your

business miles. The IRS considers commuting to work and back as a non-deductible personal expense. If you do not

have a regular office, then your personal commuting miles include the drive from home to your first work stop, and

from the last work stop back to home at the end of the day. Any other business miles in between these two daily trips

are deductible. Exceptions are allowed if you drive out of the metropolitan area or if you qualify for home office rules.

Standard Mileage for 2013 is 56.5 cents per mile

Year, Make, & Model ________________________

Total Miles put on this car this year (or if newly purchased this year, total miles since you purchased the

vehicle)___________

Business miles driven in this car this year____________

Interest paid on car loan____________

Personal property tax on this car______________

Business parking & tolls_____________

Approximate yearly commuting mileage___________

Year, Make & Model__________________________

Total miles put on this car this year (or if newly purchased this year, total miles since you purchased the

vehicle)__________

Business miles driven in this car this year ___________

Interest paid on car loan____________

Personal property tax on this car_____________

Business parking & tolls_____________

Approximate yearly commuting mileage__________

Actual Expense Method

Year, Make & Model_________________________

Total Miles put on this car this year (or if newly purchased this year, total miles since you purchased the

vehicle)_________

Business miles driven in this car this year_____________

Approximate yearly commuting mileage___________

Date lease began____________

Value of car on the date the lease began___________

Total gas, oil, lube, etc for the year___________

Total repairs for the year____________

Total lease payments for year______________

Total insurance for the year____________

Total car wash expense____________

Business parking & tolls_____________

Other:_______________

____________

Year, Make & Model_______________________________

Total miles put on this car this year (or if newly purchased this year, total miles since you purchased the

vehicle)_________________

Business miles driven in this car this year_______________

Approximate yearly commuting mileage_______________

Date lease began_________________

Value of car on the date the lease began____________

Total gas, oil, lube, etc for the year___________

Total repairs for the year________________

Total lease payments for the year______________

Total insurance for the year _______________

Total car wash expense ______________

Business parking & tolls_______________

Other________________

______________

Auto

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1