Form 9661 - Cooperative Agreement

Download a blank fillable Form 9661 - Cooperative Agreement in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 9661 - Cooperative Agreement with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

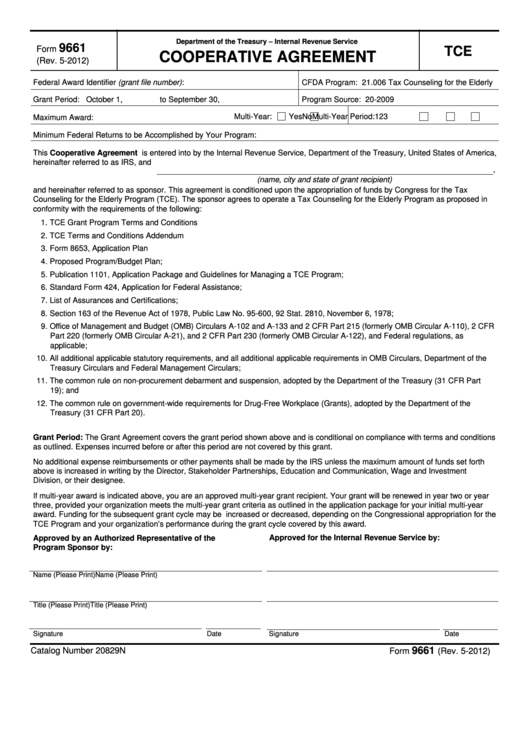

Department of the Treasury – Internal Revenue Service

9661

Form

TCE

COOPERATIVE AGREEMENT

(Rev. 5-2012)

Federal Award Identifier (grant file number):

CFDA Program: 21.006 Tax Counseling for the Elderly

Grant Period: October 1,

to September 30,

Program Source: 20-2009

Multi-Year:

Yes

No

Multi-Year Period:

1

2

3

Maximum Award:

Minimum Federal Returns to be Accomplished by Your Program:

This Cooperative Agreement is entered into by the Internal Revenue Service, Department of the Treasury, United States of America,

hereinafter referred to as IRS, and

,

(name, city and state of grant recipient)

and hereinafter referred to as sponsor. This agreement is conditioned upon the appropriation of funds by Congress for the Tax

Counseling for the Elderly Program (TCE). The sponsor agrees to operate a Tax Counseling for the Elderly Program as proposed in

conformity with the requirements of the following:

1. TCE Grant Program Terms and Conditions

2. TCE Terms and Conditions Addendum

3. Form 8653, Application Plan

4. Proposed Program/Budget Plan;

5. Publication 1101, Application Package and Guidelines for Managing a TCE Program;

6. Standard Form 424, Application for Federal Assistance;

7. List of Assurances and Certifications;

8. Section 163 of the Revenue Act of 1978, Public Law No. 95-600, 92 Stat. 2810, November 6, 1978;

9. Office of Management and Budget (OMB) Circulars A-102 and A-133 and 2 CFR Part 215 (formerly OMB Circular A-110), 2 CFR

Part 220 (formerly OMB Circular A-21), and 2 CFR Part 230 (formerly OMB Circular A-122), and Federal regulations, as

applicable;

10. All additional applicable statutory requirements, and all additional applicable requirements in OMB Circulars, Department of the

Treasury Circulars and Federal Management Circulars;

11. The common rule on non-procurement debarment and suspension, adopted by the Department of the Treasury (31 CFR Part

19); and

12. The common rule on government-wide requirements for Drug-Free Workplace (Grants), adopted by the Department of the

Treasury (31 CFR Part 20).

Grant Period: The Grant Agreement covers the grant period shown above and is conditional on compliance with terms and conditions

as outlined. Expenses incurred before or after this period are not covered by this grant.

No additional expense reimbursements or other payments shall be made by the IRS unless the maximum amount of funds set forth

above is increased in writing by the Director, Stakeholder Partnerships, Education and Communication, Wage and Investment

Division, or their designee.

If multi-year award is indicated above, you are an approved multi-year grant recipient. Your grant will be renewed in year two or year

three, provided your organization meets the multi-year grant criteria as outlined in the application package for your initial multi-year

award. Funding for the subsequent grant cycle may be increased or decreased, depending on the Congressional appropriation for the

TCE Program and your organization’s performance during the grant cycle covered by this award.

Approved for the Internal Revenue Service by:

Approved by an Authorized Representative of the

Program Sponsor by:

Name (Please Print)

Name (Please Print)

Title (Please Print)

Title (Please Print)

Date

Date

Signature

Signature

9661

Catalog Number 20829N

Form

(Rev. 5-2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9