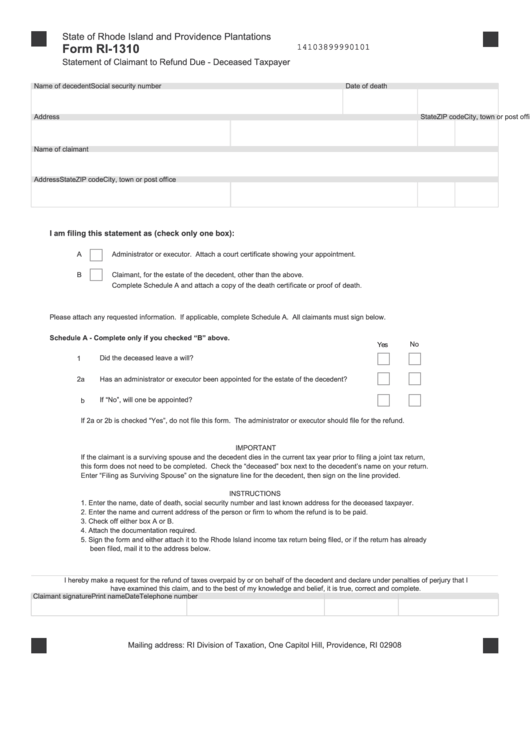

State of Rhode Island and Providence Plantations

Form RI-1310

14103899990101

Statement of Claimant to Refund Due - Deceased Taxpayer

Name of decedent

Date of death

Social security number

Address

City, town or post office

State

ZIP code

Name of claimant

Address

City, town or post office

State

ZIP code

I am filing this statement as (check only one box):

A

Administrator or executor. Attach a court certificate showing your appointment.

B

Claimant, for the estate of the decedent, other than the above.

Complete Schedule A and attach a copy of the death certificate or proof of death.

Please attach any requested information. If applicable, complete Schedule A. All claimants must sign below.

Schedule A - Complete only if you checked “B” above.

Yes

No

Did the deceased leave a will? ..........................................................................................

1

2

a

Has an administrator or executor been appointed for the estate of the decedent?..........

If “No”, will one be appointed?..........................................................................................

b

If 2a or 2b is checked “Yes”, do not file this form. The administrator or executor should file for the refund.

IMPORTANT

If the claimant is a surviving spouse and the decedent dies in the current tax year prior to filing a joint tax return,

this form does not need to be completed. Check the “deceased” box next to the decedent’s name on your return.

Enter “Filing as Surviving Spouse” on the signature line for the decedent, then sign on the line provided.

INSTRUCTIONS

1. Enter the name, date of death, social security number and last known address for the deceased taxpayer.

2. Enter the name and current address of the person or firm to whom the refund is to be paid.

3. Check off either box A or B.

4. Attach the documentation required.

5. Sign the form and either attach it to the Rhode Island income tax return being filed, or if the return has already

been filed, mail it to the address below.

I hereby make a request for the refund of taxes overpaid by or on behalf of the decedent and declare under penalties of perjury that I

have examined this claim, and to the best of my knowledge and belief, it is true, correct and complete.

Claimant signature

Print name

Date

Telephone number

Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI 02908

1

1