Form T-71sp - Self Procurement Insurance Premiums Return - 2012

ADVERTISEMENT

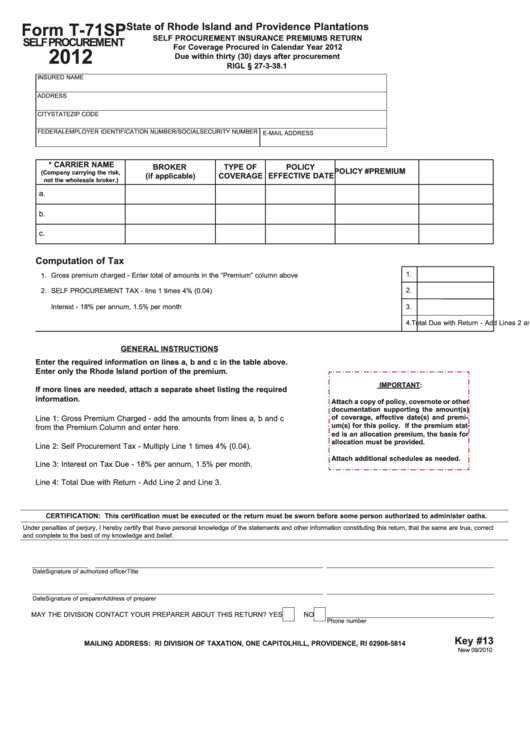

State of Rhode Island and Providence Plantations

Form T-71SP

SELF PROCUREMENT INSURANCE PREMIUMS RETURN

SELFPROCUREMENT

For Coverage Procured in Calendar Year 2012

2012

Due within thirty (30) days after procurement

RIGL § 27-3-38.1

INSURED NAME

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER/SOCIAL SECURITY NUMBER

E-MAIL ADDRESS

* CARRIER NAME

BROKER

TYPE OF

POLICY

POLICY #

PREMIUM

(Company carrying the risk,

(if applicable)

COVERAGE

EFFECTIVE DATE

not the wholesale broker.)

a.

b.

c.

Computation of Tax

1.

Gross premium charged - Enter total of amounts in the “Premium” column above .......................................................

1.

2.

2.

SELF PROCUREMENT TAX - line 1 times 4% (0.04) ....................................................................................................

3.

Interest - 18% per annum, 1.5% per month ....................................................................................................................

3.

4.

Total Due with Return - Add Lines 2 and 3 .....................................................................................................................

4.

GENERAL INSTRUCTIONS

Enter the required information on lines a, b and c in the table above.

Enter only the Rhode Island portion of the premium.

IMPORTANT:

If more lines are needed, attach a separate sheet listing the required

information.

Attach a copy of policy, covernote or other

documentation supporting the amount(s)

Line 1: Gross Premium Charged - add the amounts from lines a, b and c

of coverage, effective date(s) and premi-

um(s) for this policy. If the premium stat-

from the Premium Column and enter here.

ed is an allocation premium, the basis for

allocation must be provided.

Line 2: Self Procurement Tax - Multiply Line 1 times 4% (0.04).

Attach additional schedules as needed.

Line 3: Interest on Tax Due - 18% per annum, 1.5% per month.

Line 4: Total Due with Return - Add Line 2 and Line 3.

CERTIFICATION: This certification must be executed or the return must be sworn before some person authorized to administer oaths.

Under penalties of perjury, I hereby certify that I have personal knowledge of the statements and other information constituting this return, that the same are true, correct

and complete to the best of my knowledge and belief.

Date

Signature of authorized officer

Title

Date

Signature of preparer

Address of preparer

MAY THE DIVISION CONTACT YOUR PREPARER ABOUT THIS RETURN? YES

NO

Phone number

Key #13

MAILING ADDRESS: RI DIVISION OF TAXATION, ONE CAPITOL HILL, PROVIDENCE, RI 02908-5814

New 09/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1