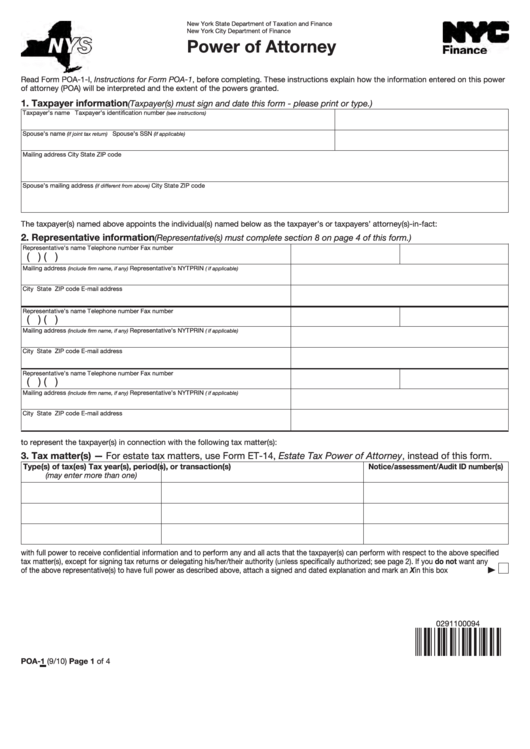

New York State Department of Taxation and Finance

New York City Department of Finance

Power of Attorney

Read Form POA-1-I, Instructions for Form POA-1, before completing. These instructions explain how the information entered on this power

of attorney (POA) will be interpreted and the extent of the powers granted.

1. Taxpayer information

(Taxpayer(s) must sign and date this form - please print or type.)

Taxpayer’s name

Taxpayer’s identification number

(see instructions)

Spouse’s name

Spouse’s SSN

(if joint tax return)

(if applicable)

Mailing address

City

State

ZIP code

Spouse’s mailing address

City

State

ZIP code

(if different from above)

The taxpayer(s) named above appoints the individual(s) named below as the taxpayer’s or taxpayers’ attorney(s)-in-fact:

2. Representative information

(Representative(s) must complete section 8 on page 4 of this form.)

Representative’s name

Telephone number

Fax number

(

)

(

)

Mailing address

Representative’s NYTPRIN

(include firm name, if any)

( if applicable)

City

State

ZIP code

E-mail address

Representative’s name

Telephone number

Fax number

(

)

(

)

Mailing address

Representative’s NYTPRIN

(include firm name, if any)

( if applicable)

City

State

ZIP code

E-mail address

Representative’s name

Telephone number

Fax number

(

)

(

)

Mailing address

Representative’s NYTPRIN

(include firm name, if any)

( if applicable)

City

State

ZIP code

E-mail address

to represent the taxpayer(s) in connection with the following tax matter(s):

3. Tax matter(s) — For estate tax matters, use Form ET-14, Estate Tax Power of Attorney, instead of this form.

Type(s) of tax(es)

Tax year(s), period(s), or transaction(s)

Notice/assessment/Audit ID number(s)

(may enter more than one)

with full power to receive confidential information and to perform any and all acts that the taxpayer(s) can perform with respect to the above specified

tax matter(s), except for signing tax returns or delegating his/her/their authority (unless specifically authorized; see page 2). If you do not want any

of the above representative(s) to have full power as described above, attach a signed and dated explanation and mark an X in this box ..................

0291100094

POA-1 (9/10) Page 1 of 4

1

1 2

2 3

3 4

4 5

5 6

6