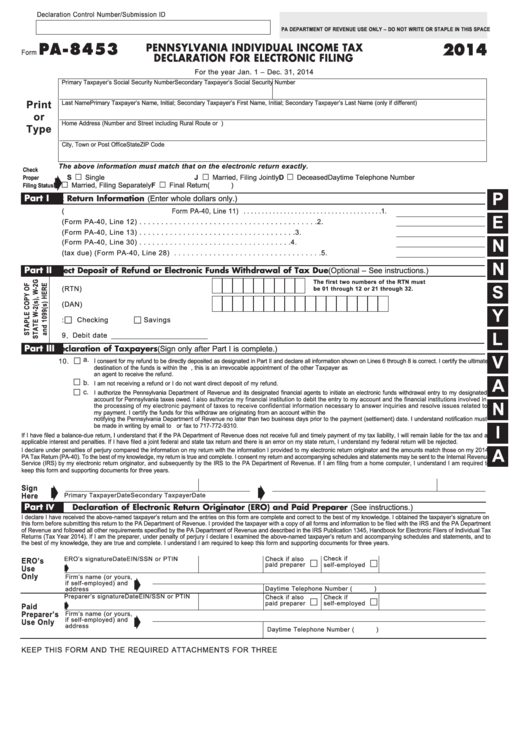

Form Pa-8453 - Pennsylvania Individual Income Tax Declaration For Electronic Filing - 2014

ADVERTISEMENT

Declaration Control Number/Submission ID

PA DEPARTMENT OF REVENUE USE ONLY – DO NOT WRITE OR STAPLE IN THIS SPACE

PA-8453

PENNSYLVANIA INDIVIDUAL INCOME TAX

2014

Form

DECLARATION FOR ELECTRONIC FILING

For the year Jan. 1 – Dec. 31, 2014

Primary Taxpayer’s Social Security Number

Secondary Taxpayer’s Social Security Number

Last Name

Primary Taxpayer’s Name, Initial; Secondary Taxpayer’s First Name, Initial; Secondary Taxpayer’s Last Name (only if different)

Print

or

Home Address (Number and Street including Rural Route or P.O. Box)

Type

City, Town or Post Office

State

ZIP Code

The above information must match that on the electronic return exactly.

Check

£

£

£

➧

S

Single

J

Married, Filing Jointly

D

Deceased

Daytime Telephone Number

Proper

£

£

M

Married, Filing Separately

F

Final Return

(

)

Filing Status

P

Part I

Tax Return Information (Enter whole dollars only.)

1. Adjusted PA taxable income (Form PA-40, Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

E

2. PA tax liability (Form PA-40, Line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Total PA tax withheld (Form PA-40, Line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

N

4. Amount to be refunded (Form PA-40, Line 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Total payment (tax due) (Form PA-40, Line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

N

Part II

Direct Deposit of Refund or Electronic Funds Withdrawal of Tax Due (Optional – See instructions.)

The first two numbers of the RTN must

6. Routing transit number (RTN)

S

be 01 through 12 or 21 through 32.

7. Depositor account number (DAN)

Y

£

£

8. Type of account:

Checking

Savings

.

9

Debit date

L

Part III

Declaration of Taxpayers (Sign only after Part I is complete.)

£

V

a.

10.

I

consent for my refund to be directly deposited as designated in Part II and declare all information shown on Lines 6 through 8 is correct. I certify the ultimate

destination of the funds is within the U.S. or one of its territories. If I have filed a joint return, this is an irrevocable appointment of the other Taxpayer as

an agent to receive the refund.

£

A

b.

I am not receiving a refund or I do not want direct deposit of my refund.

£

c.

I authorize the Pennsylvania Department of Revenue and its designated financial agents to initiate an electronic funds withdrawal entry to my designated

account for Pennsylvania taxes owed. I also authorize my financial institution to debit the entry to my account and the financial institutions involved in

N

the processing of my electronic payment of taxes to receive confidential information necessary to answer inquiries and resolve issues related to

my payment. I certify the funds for this withdraw are originating from an account within the U.S. or one of its territories. I may revoke this authorization by

notifying the Pennsylvania Department of Revenue no later than two business days prior to the payment (settlement) date. I understand notification must

be made in writing by email to ra-achrevok@state.pa.us or fax to 717-772-9310.

I

If I have filed a balance-due return, I understand that if the PA Department of Revenue does not receive full and timely payment of my tax liability, I will remain liable for the tax and all

applicable interest and penalties. If I have filed a joint federal and state tax return and there is an error on my state return, I understand my federal return will be rejected.

I declare under penalties of perjury compared the information on my return with the information I provided to my electronic return originator and the amounts match those on my 2014

A

PA Tax Return (PA-40). To the best of my knowledge, my return is true and complete. I consent my return and accompanying schedules and statements may be sent to the Internal Revenue

Service (IRS) by my electronic return originator, and subsequently by the IRS to the PA Department of Revenue. If I am filing from a home computer, I understand I am required to

keep this form and supporting documents for three years.

➧

➧

Sign

Here

Primary Taxpayer

Date

Secondary Taxpayer

Date

Part

IV

Declaration of Electronic Return Originator (ERO) and Paid Preparer (See instructions.)

I declare I have received the above-named taxpayer’s return and the entries on this form are complete and correct to the best of my knowledge. I obtained the taxpayer’s signature on

this form before submitting this return to the PA Department of Revenue. I provided the taxpayer with a copy of all forms and information to be filed with the IRS and the PA Department

of Revenue and followed all other requirements specified by the PA Department of Revenue and described in the IRS Publication 1345, Handbook for Electronic Filers of Individual Tax

Returns (Tax Year 2014). If I am the preparer, under penalty of perjury I declare I examined the above-named taxpayer’s return and accompanying schedules and statements, and to

the best of my knowledge, they are true and complete. I understand I am required to keep this form and supporting documents for three years.

Check if also

Check if

ERO’s signature

Date

EIN/SSN or PTIN

ERO’s

£

£

➧

paid preparer

self-employed

Use

Only

Firm’s name (or yours,

➧

if self-employed) and

Daytime Telephone Number (

)

address

Preparer’s signature

Date

EIN/SSN or PTIN

Check if also

Check if

£

£

➧

paid preparer

self-employed

Paid

Preparer’s

Firm’s name (or yours,

➧

if self-employed) and

Use Only

address

Daytime Telephone Number (

)

KEEP THIS FORM AND THE REQUIRED ATTACHMENTS FOR THREE YEARS.

Please DO NOT mail this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2