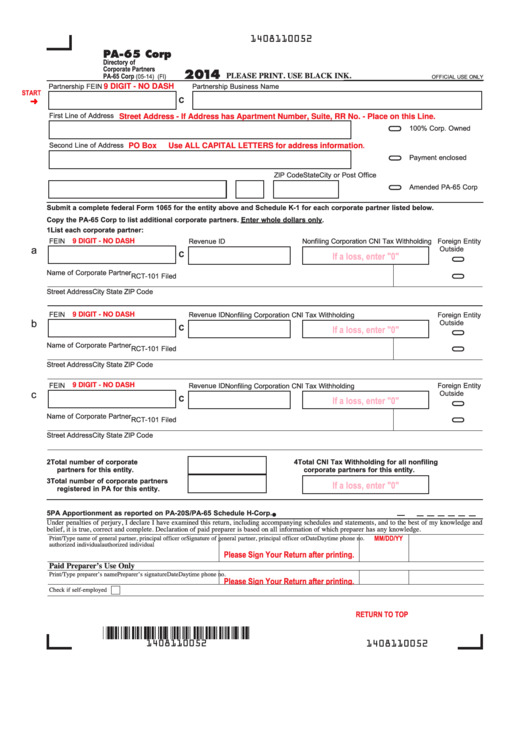

1408110052

PA-65 Corp

Directory of

Corporate Partners

2014

PLEASE PRINT. USE BLACK INK.

PA-65 Corp

(05-14) (FI)

OFFICIAL USE ONLY

9 DIGIT - NO DASH

Partnership FEIN

Partnership Business Name

START

C

First Line of Address

Street Address - If Address has Apartment Number, Suite, RR No. - Place on this Line.

100% Corp. Owned

Use ALL CAPITAL LETTERS for address information.

Second Line of Address

PO Box

Payment enclosed

City or Post Office

State

ZIP Code

Amended PA-65 Corp

Submit a complete federal Form 1065 for the entity above and Schedule K-1 for each corporate partner listed below.

Copy the PA-65 Corp to list additional corporate partners. Enter whole dollars only.

1 List each corporate partner:

FEIN

9 DIGIT - NO DASH

Revenue ID

Nonfiling Corporation CNI Tax Withholding

Foreign Entity

a

Outside U.S.

If a loss, enter "0"

C

Name of Corporate Partner

RCT-101 Filed

Street Address

City

State

ZIP Code

FEIN

9 DIGIT - NO DASH

Revenue ID

Nonfiling Corporation CNI Tax Withholding

Foreign Entity

b

Outside U.S.

If a loss, enter "0"

C

Name of Corporate Partner

RCT-101 Filed

Street Address

City

State

ZIP Code

9 DIGIT - NO DASH

FEIN

Revenue ID

Nonfiling Corporation CNI Tax Withholding

Foreign Entity

c

Outside U.S.

If a loss, enter "0"

C

Name of Corporate Partner

RCT-101 Filed

Street Address

City

State

ZIP Code

2 Total number of corporate

4 Total CNI Tax Withholding for all nonfiling

partners for this entity.

corporate partners for this entity.

3 Total number of corporate partners

If a loss, enter "0"

registered in PA for this entity.

5 PA Apportionment as reported on PA-20S/PA-65 Schedule H-Corp.

●

Under penalties of perjury, I declare I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct and complete. Declaration of paid preparer is based on all information of which preparer has any knowledge.

MM/DD/YY

Print/Type name of general partner, principal officer or

Signature of general partner, principal officer or

Date

Daytime phone no.

authorized individual

authorized individual

Please Sign Your Return after printing.

Paid Preparer’s Use Only

Print/Type preparer’s name

Preparer’s signature

Date

Daytime phone no.

Please Sign Your Return after printing.

Check if self-employed

RETURN TO TOP

PRINT FORM

Reset Entire Form

1408110052

1408110052

1

1