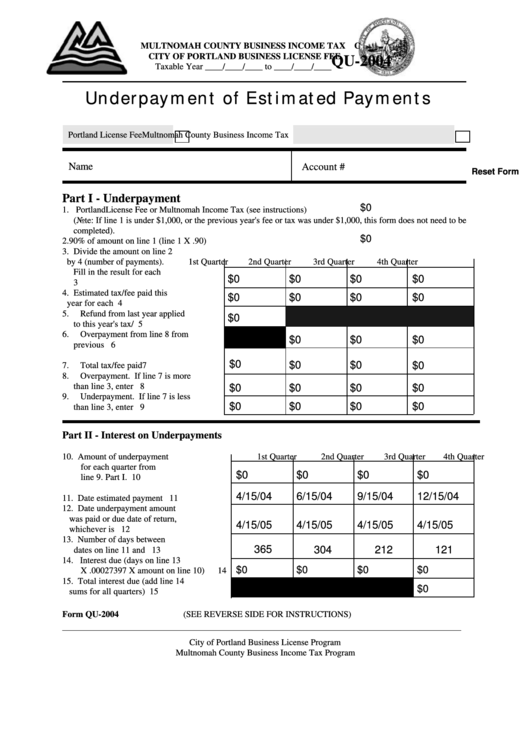

MULTNOMAH COUNTY BUSINESS INCOME TAX

C

CITY OF PORTLAND BUSINESS LICENSE FEE

QU-2004

Taxable Year ____/____/____ to ____/____/____

Underpayment of Estimated Payments

Portland License Fee

Multnomah County Business Income Tax

Name

Account #

Reset Form

Part I - Underpayment

$0

1. Portland License Fee or Multnomah Income Tax (see instructions).....................1._____________

(Note: If line 1 is under $1,000, or the previous year's fee or tax was under $1,000, this form does not need to be

completed).

$0

2. 90% of amount on line 1 (line 1 X .90)..............................................................2._____________

3. Divide the amount on line 2

by 4 (number of payments).

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

Fill in the result for each

$0

$0

$0

$0

quarter........................................

3

4. Estimated tax/fee paid this

$0

$0

$0

$0

year for each quarter..................

4

5. Refund from last year applied

$0

to this year's tax/fee...................

5

6. Overpayment from line 8 from

$0

$0

$0

previous quarter.........................

6

$0

$0

$0

$0

7. Total tax/fee paid......................

7

8. Overpayment. If line 7 is more

than line 3, enter difference.......

8

$0

$0

$0

$0

9. Underpayment. If line 7 is less

$0

$0

$0

$0

than line 3, enter difference.......

9

Part II - Interest on Underpayments

10. Amount of underpayment

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

for each quarter from

$0

$0

$0

$0

line 9. Part I. ...........................

10

4/15/04

6/15/04

9/15/04

12/15/04

11. Date estimated payment due...

11

12. Date underpayment amount

was paid or due date of return,

4/15/05

4/15/05

4/15/05

4/15/05

whichever is earlier..................

12

13. Number of days between

365

304

212

121

dates on line 11 and 12...........

13

14. Interest due (days on line 13

$0

$0

$0

$0

X .00027397 X amount on line 10)

14

15. Total interest due (add line 14

$0

sums for all quarters)...........

15

Form QU-2004

(SEE REVERSE SIDE FOR INSTRUCTIONS)

City of Portland Business License Program

Multnomah County Business Income Tax Program

1

1