Form Dr 0173 Draft - Retailer'S Use Tax Return

ADVERTISEMENT

1

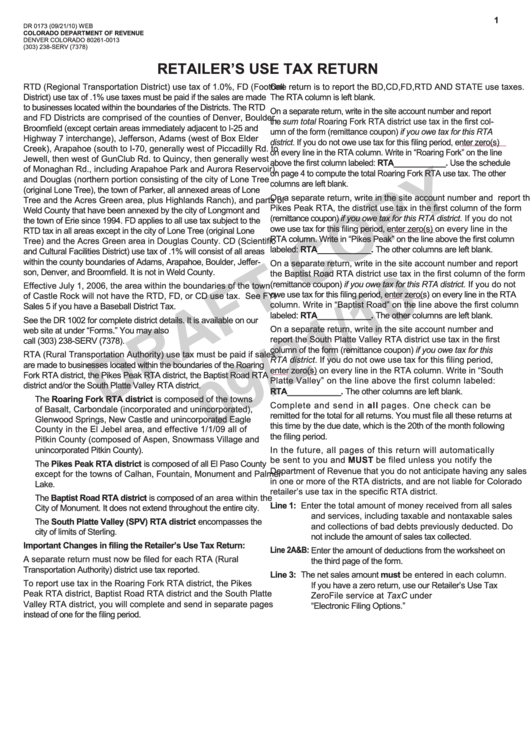

DR 0173 (09/21/10) WEB

COlORADO DePARTmenT OF ReVenUe

DENVER ColoRaDo 80261-0013

(303) 238-SERV (7378)

ReTAileR’s Use TAx ReTURn

RTD (Regional Transportation District) use tax of 1.0%, FD (Football

one return is to report the BD,CD,FD,RTD aND STaTE use taxes.

District) use tax of .1% use taxes must be paid if the sales are made

The RTa column is left blank.

to businesses located within the boundaries of the Districts. The RTD

on a separate return, write in the site account number and report

and FD Districts are comprised of the counties of Denver, Boulder,

the sum total Roaring Fork RTa district use tax in the first col-

Broomfield (except certain areas immediately adjacent to I-25 and

umn of the form (remittance coupon) if you owe tax for this RTA

Highway 7 interchange), Jefferson, Adams (west of Box Elder

district. If you do not owe use tax for this filing period, enter zero(s)

Creek), Arapahoe (south to I-70, generally west of Piccadilly Rd. to

on every line in the RTA column. Write in “Roaring Fork” on the line

Jewell, then west of GunClub Rd. to Quincy, then generally west

above the first column labeled: RTA____________. Use the schedule

of Monaghan Rd., including Arapahoe Park and Aurora Reservoir),

on page 4 to compute the total Roaring Fork RTa use tax. The other

and Douglas (northern portion consisting of the city of Lone Tree

columns are left blank.

(original Lone Tree), the town of Parker, all annexed areas of Lone

on a separate return, write in the site account number and report the

Tree and the Acres Green area, plus Highlands Ranch), and parts of

Pikes Peak RTA, the district use tax in the first column of the form

Weld County that have been annexed by the city of Longmont and

(remittance coupon) if you owe tax for this RTA district. If you do not

the town of Erie since 1994. FD applies to all use tax subject to the

owe use tax for this filing period, enter zero(s) on every line in the

RTD tax in all areas except in the city of Lone Tree (original Lone

RTA column. Write in “Pikes Peak” on the line above the first column

Tree) and the Acres Green area in Douglas County. CD (Scientific

labeled: RTA____________. The other columns are left blank.

and Cultural Facilities District) use tax of .1% will consist of all areas

within the county boundaries of Adams, Arapahoe, Boulder, Jeffer-

on a separate return, write in the site account number and report

son, Denver, and Broomfield. It is not in Weld County.

the Baptist Road RTA district use tax in the first column of the form

(remittance coupon) if you owe tax for this RTA district. If you do not

Effective July 1, 2006, the area within the boundaries of the town

owe use tax for this filing period, enter zero(s) on every line in the RTA

of Castle Rock will not have the RTD, FD, or CD use tax. See FYI

column. Write in “Baptist Road” on the line above the first column

Sales 5 if you have a Baseball District Tax.

labeled: RTA____________. The other columns are left blank.

See the DR 1002 for complete district details. It is available on our

on a separate return, write in the site account number and

web site at under “Forms.” You may also

report the South Platte Valley RTA district use tax in the first

call (303) 238-SERV (7378).

column of the form (remittance coupon) if you owe tax for this

RTA (Rural Transportation Authority) use tax must be paid if sales

RTA district. If you do not owe use tax for this filing period,

are made to businesses located within the boundaries of the Roaring

enter zero(s) on every line in the RTA column. Write in “South

Fork RTA district, the Pikes Peak RTA district, the Baptist Road RTA

Platte Valley” on the line above the first column labeled:

district and/or the South Platte Valley RTA district.

RTA____________. The other columns are left blank.

The Roaring Fork RTA district is composed of the towns

Complete and send in all pages. one check can be

of Basalt, Carbondale (incorporated and unincorporated),

remitted for the total for all returns. You must file all these returns at

Glenwood Springs, New Castle and unincorporated Eagle

this time by the due date, which is the 20th of the month following

County in the El Jebel area, and effective 1/1/09 all of

the filing period.

Pitkin County (composed of Aspen, Snowmass Village and

unincorporated Pitkin County).

In the future, all pages of this return will automatically

be sent to you and mUsT be filed unless you notify the

The Pikes Peak RTA district is composed of all El Paso County

Department of Revenue that you do not anticipate having any sales

except for the towns of Calhan, Fountain, Monument and Palmer

in one or more of the RTa districts, and are not liable for Colorado

lake.

retailer’s use tax in the specific RTA district.

The Baptist Road RTA district is composed of an area within the

Line 1:

Enter the total amount of money received from all sales

City of Monument. It does not extend throughout the entire city.

and services, including taxable and nontaxable sales

The south Platte Valley (sPV) RTA district encompasses the

and collections of bad debts previously deducted. Do

city of limits of Sterling.

not include the amount of sales tax collected.

Important Changes in filing the Retailer’s Use Tax Return:

Line 2A&B: Enter the amount of deductions from the worksheet on

a separate return must now be filed for each RTa (Rural

the third page of the form.

Transportation Authority) district use tax reported.

Line 3:

The net sales amount must be entered in each column.

To report use tax in the Roaring Fork RTA district, the Pikes

If you have a zero return, use our Retailer’s Use Tax

Peak RTA district, Baptist Road RTA district and the South Platte

ZeroFile service at under

Valley RTA district, you will complete and send in separate pages

“Electronic Filing options.”

instead of one for the filing period.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5