Instructions For Form Pda-49

ADVERTISEMENT

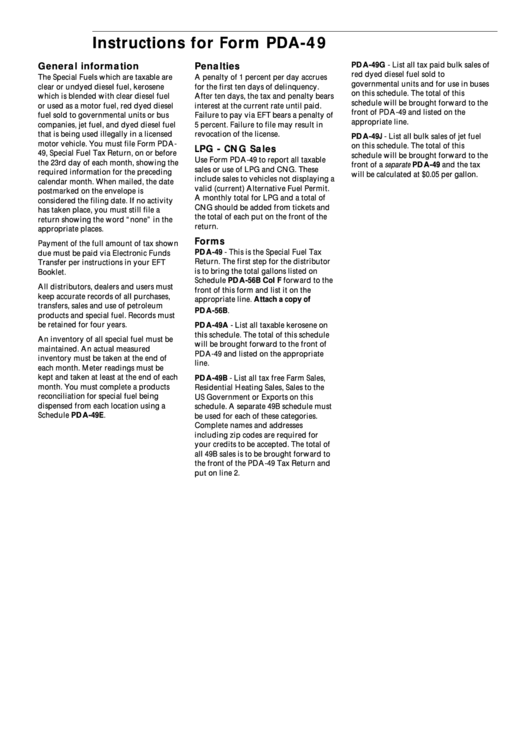

Instructions for Form PDA-49

General information

Penalties

PDA-49G - List all tax paid bulk sales of

red dyed diesel fuel sold to

The Special Fuels which are taxable are

A penalty of 1 percent per day accrues

governmental units and for use in buses

clear or undyed diesel fuel, kerosene

for the first ten days of delinquency.

on this schedule. The total of this

which is blended with clear diesel fuel

After ten days, the tax and penalty bears

schedule will be brought forward to the

or used as a motor fuel, red dyed diesel

interest at the current rate until paid.

front of PDA-49 and listed on the

fuel sold to governmental units or bus

Failure to pay via EFT bears a penalty of

appropriate line.

companies, jet fuel, and dyed diesel fuel

5 percent. Failure to file may result in

that is being used illegally in a licensed

revocation of the license.

PDA-49J - List all bulk sales of jet fuel

motor vehicle. You must file Form PDA-

on this schedule. The total of this

LPG - CNG Sales

49, Special Fuel Tax Return, on or before

schedule will be brought forward to the

Use Form PDA-49 to report all taxable

the 23rd day of each month, showing the

front of a separate PDA-49 and the tax

sales or use of LPG and CNG. These

required information for the preceding

will be calculated at $0.05 per gallon.

include sales to vehicles not displaying a

calendar month. When mailed, the date

valid (current) Alternative Fuel Permit.

postmarked on the envelope is

A monthly total for LPG and a total of

considered the filing date. If no activity

CNG should be added from tickets and

has taken place, you must still file a

the total of each put on the front of the

return showing the word “none” in the

return.

appropriate places.

Forms

Payment of the full amount of tax shown

PDA-49 - This is the Special Fuel Tax

due must be paid via Electronic Funds

Return. The first step for the distributor

Transfer per instructions in your EFT

is to bring the total gallons listed on

Booklet.

Schedule PDA-56B Col F forward to the

All distributors, dealers and users must

front of this form and list it on the

keep accurate records of all purchases,

appropriate line. Attach a copy of

transfers, sales and use of petroleum

PDA-56B.

products and special fuel. Records must

be retained for four years.

PDA-49A - List all taxable kerosene on

this schedule. The total of this schedule

An inventory of all special fuel must be

will be brought forward to the front of

maintained. An actual measured

PDA-49 and listed on the appropriate

inventory must be taken at the end of

line.

each month. Meter readings must be

kept and taken at least at the end of each

PDA-49B - List all tax free Farm Sales,

month. You must complete a products

Residential Heating Sales, Sales to the

reconciliation for special fuel being

US Government or Exports on this

dispensed from each location using a

schedule. A separate 49B schedule must

Schedule PDA-49E.

be used for each of these categories.

Complete names and addresses

including zip codes are required for

your credits to be accepted. The total of

all 49B sales is to be brought forward to

the front of the PDA-49 Tax Return and

put on line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1