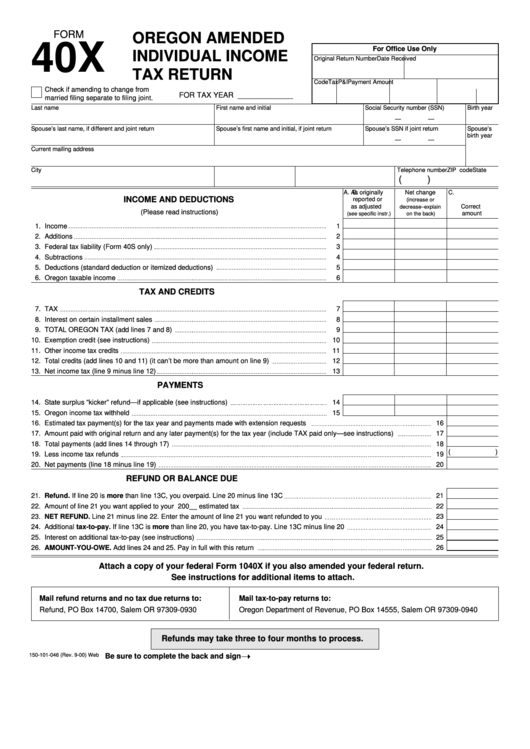

Form 40x - Oregon Amended Individual Income Tax Return

ADVERTISEMENT

FORM

OREGON AMENDED

40X

For Office Use Only

INDIVIDUAL INCOME

Original Return Number

Date Received

TAX RETURN

Code

Tax

P&I

Payment Amount

Check if amending to change from

FOR TAX YEAR _____________

married filing separate to filing joint.

Last name

First name and initial

Social Security number (SSN)

Birth year

—

—

Spouse’s last name, if different and joint return

Spouse’s first name and initial, if joint return

Spouse’s SSN if joint return

Spouse’s

birth year

—

—

Current mailing address

City

State

ZIP code

Telephone number

(

)

A.

As originally

B.

Net change

C.

INCOME AND DEDUCTIONS

reported or

(increase or

as adjusted

Correct

decrease–explain

(Please read instructions)

amount

(see specific instr.)

on the back)

1. Income

1

2. Additions

2

3. Federal tax liability (Form 40S only)

3

4. Subtractions

4

5. Deductions (standard deduction or itemized deductions)

5

6. Oregon taxable income

6

TAX AND CREDITS

7. TAX

7

8. Interest on certain installment sales

8

9. TOTAL OREGON TAX (add lines 7 and 8)

9

10. Exemption credit (see instructions)

10

11. Other income tax credits

11

12. Total credits (add lines 10 and 11) (it can’t be more than amount on line 9)

12

13. Net income tax (line 9 minus line 12)

13

PAYMENTS

14. State surplus “kicker” refund—if applicable (see instructions)

14

15. Oregon income tax withheld

15

16. Estimated tax payment(s) for the tax year and payments made with extension requests

16

17. Amount paid with original return and any later payment(s) for the tax year (include TAX paid only—see instructions)

17

18. Total payments (add lines 14 through 17)

18

(

)

19. Less income tax refunds

19

20. Net payments (line 18 minus line 19)

20

REFUND OR BALANCE DUE

21. Refund. If line 20 is more than line 13C, you overpaid. Line 20 minus line 13C

21

22. Amount of line 21 you want applied to your 200__ estimated tax

22

23. NET REFUND. Line 21 minus line 22. Enter the amount of line 21 you want refunded to you

23

24. Additional tax-to-pay. If line 13C is more than line 20, you have tax-to-pay. Line 13C minus line 20

24

25. Interest on additional tax-to-pay (see instructions)

25

26. AMOUNT-YOU-OWE. Add lines 24 and 25. Pay in full with this return

26

Attach a copy of your federal Form 1040X if you also amended your federal return.

See instructions for additional items to attach.

Mail refund returns and no tax due returns to:

Mail tax-to-pay returns to:

Refund, PO Box 14700, Salem OR 97309-0930

Oregon Department of Revenue, PO Box 14555, Salem OR 97309-0940

Refunds may take three to four months to process.

150-101-046 (Rev. 9-00) Web

Be sure to complete the back and sign

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2