Form It-2659 - Estimated Tax Penalties For Partnerships And New York S Corporations - 2005

ADVERTISEMENT

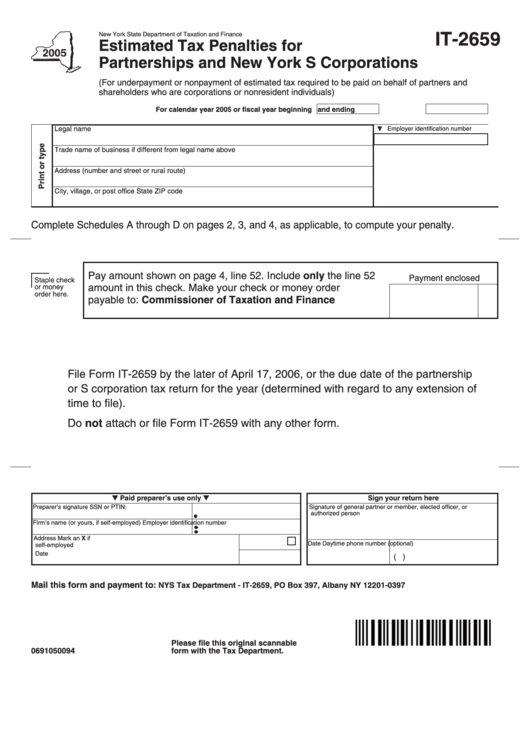

IT-2659

New York State Department of Taxation and Finance

Estimated Tax Penalties for

Partnerships and New York S Corporations

(For underpayment or nonpayment of estimated tax required to be paid on behalf of partners and

shareholders who are corporations or nonresident individuals)

For calendar year 2005 or fiscal year beginning

and ending

Legal name

Employer identification number

Trade name of business if different from legal name above

Address (number and street or rural route)

City, village, or post office

State

ZIP code

Complete Schedules A through D on pages 2, 3, and 4, as applicable, to compute your penalty.

Pay amount shown on page 4, line 52. Include only the line 52

Payment enclosed

Staple check

amount in this check. Make your check or money order

or money

order here.

payable to: Commissioner of Taxation and Finance

File Form IT-2659 by the later of April 17, 2006, or the due date of the partnership

or S corporation tax return for the year (determined with regard to any extension of

time to file).

Do not attach or file Form IT-2659 with any other form.

Paid preparer’s use only

Sign your return here

Preparer’s signature

SSN or PTIN:

Signature of general partner or member, elected officer, or

authorized person

Firm’s name (or yours, if self-employed)

Employer identification number

Address

Mark an X if

Date

Daytime phone number (optional)

self-employed

Date

(

)

Mail this form and payment to:

NYS Tax Department - IT-2659, PO Box 397, Albany NY 12201-0397

Please file this original scannable

0691050094

form with the Tax Department.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4