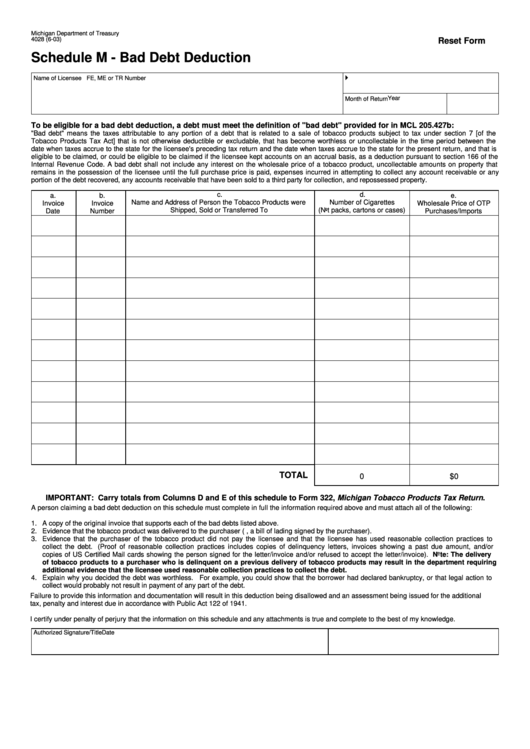

Form 4028 Schedule M - Bad Debt Deduction

ADVERTISEMENT

Michigan Department of Treasury

4028 (6-03)

Reset Form

Schedule M - Bad Debt Deduction

4

Name of Licensee

FE, ME or TR Number

Year

Month of Return

To be eligible for a bad debt deduction, a debt must meet the definition of "bad debt" provided for in MCL 205.427b:

"Bad debt" means the taxes attributable to any portion of a debt that is related to a sale of tobacco products subject to tax under section 7 [of the

Tobacco Products Tax Act] that is not otherwise deductible or excludable, that has become worthless or uncollectable in the time period between the

date when taxes accrue to the state for the licensee's preceding tax return and the date when taxes accrue to the state for the present return, and that is

eligible to be claimed, or could be eligible to be claimed if the licensee kept accounts on an accrual basis, as a deduction pursuant to section 166 of the

Internal Revenue Code. A bad debt shall not include any interest on the wholesale price of a tobacco product, uncollectable amounts on property that

remains in the possession of the licensee until the full purchase price is paid, expenses incurred in attempting to collect any account receivable or any

portion of the debt recovered, any accounts receivable that have been sold to a third party for collection, and repossessed property.

c.

d.

a.

b.

e.

Name and Address of Person the Tobacco Products were

Number of Cigarettes

Invoice

Invoice

Wholesale Price of OTP

Shipped, Sold or Transferred To

(Not packs, cartons or cases)

Date

Number

Purchases/Imports

TOTAL

0

$0

IMPORTANT: Carry totals from Columns D and E of this schedule to Form 322, Michigan Tobacco Products Tax Return.

A person claiming a bad debt deduction on this schedule must complete in full the information required above and must attach all of the following:

1.

A copy of the original invoice that supports each of the bad debts listed above.

2.

Evidence that the tobacco product was delivered to the purchaser (e.g., a bill of lading signed by the purchaser).

3.

Evidence that the purchaser of the tobacco product did not pay the licensee and that the licensee has used reasonable collection practices to

collect the debt. (Proof of reasonable collection practices includes copies of delinquency letters, invoices showing a past due amount, and/or

copies of US Certified Mail cards showing the person signed for the letter/invoice and/or refused to accept the letter/invoice). Note: The delivery

of tobacco products to a purchaser who is delinquent on a previous delivery of tobacco products may result in the department requiring

additional evidence that the licensee used reasonable collection practices to collect the debt.

4.

Explain why you decided the debt was worthless. For example, you could show that the borrower had declared bankruptcy, or that legal action to

collect would probably not result in payment of any part of the debt.

Failure to provide this information and documentation will result in this deduction being disallowed and an assessment being issued for the additional

tax, penalty and interest due in accordance with Public Act 122 of 1941.

I certify under penalty of perjury that the information on this schedule and any attachments is true and complete to the best of my knowledge.

Authorized Signature/Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1