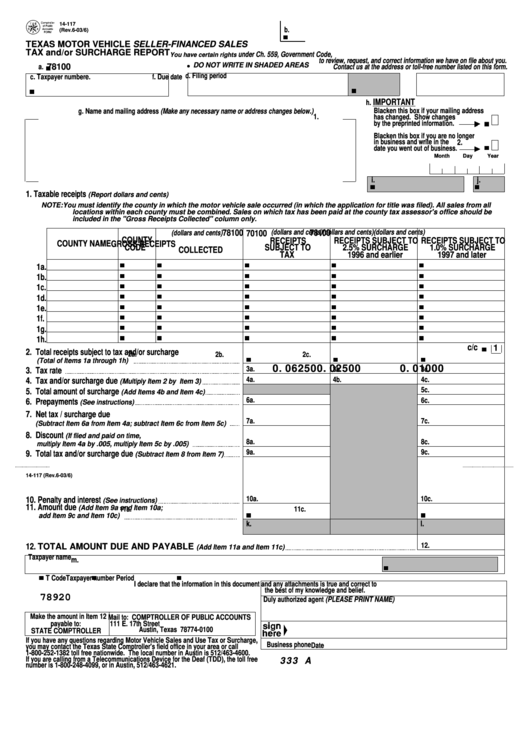

Form 14-117 - Texas Motor Vehicle Seller-Financed Sales Tax And/or Surcharge Report

ADVERTISEMENT

14-117

b.

(Rev.6-03/6)

TEXAS MOTOR VEHICLE SELLER-FINANCED SALES

TAX and/or SURCHARGE REPORT

You have certain rights

under Ch. 559, Government Code,

to review, request, and correct information we have on file about you.

DO NOT WRITE IN SHADED AREAS

78100

a.

Contact us at the address or toll-free number listed on this form.

d. Filing period

e.

c. Taxpayer number

f. Due date

IMPORTANT

h.

Blacken this box if your mailing address

g. Name and mailing address (Make any necessary name or address changes below.)

1.

has changed. Show changes

by the preprinted information.

Blacken this box if you are no longer

in business and write in the

2.

date you went out of business.

Month

Day

Year

i.

j.

1. Taxable receipts

(Report dollars and cents)

NOTE:

You must identify the county in which the motor vehicle sale occurred (in which the application for title was filed). All sales from all

locations within each county must be combined. Sales on which tax has been paid at the county tax assessor's office should be

included in the "Gross Receipts Collected" column only.

(dollars and cents)

(dollars and cents)

(dollars and cents)

(dollars and cents)

78100

78100

70100

COUNTY

RECEIPTS

RECEIPTS SUBJECT TO

RECEIPTS SUBJECT TO

COUNTY NAME

GROSS RECEIPTS

CODE

SUBJECT TO

2.5% SURCHARGE

1.0% SURCHARGE

COLLECTED

TAX

1996 and earlier

1997 and later

1a.

1b.

1c.

1d.

1e.

1f.

1g.

1h.

1

c/c

2. Total receipts subject to tax and/or surcharge

2a.

2b.

2c.

(Total of Items 1a through 1h)

0.06250

0.02500

0.01000

3a.

3b.

3c.

3. Tax rate

4a.

4b.

4c.

4. Tax and/or surcharge due

(Multiply Item 2 by Item 3)

5c.

5. Total amount of surcharge

(Add Items 4b and Item 4c)

6a.

6c.

6. Prepayments

(See instructions)

7. Net tax / surcharge due

7a.

7c.

(Subtract Item 6a from Item 4a; subtract Item 6c from Item 5c)

8. Discount

(If filed and paid on time,

8a.

8c.

multiply Item 4a by .005, multiply Item 5c by .005)

9a.

9c.

9. Total tax and/or surcharge due

(Subtract Item 8 from Item 7)

14-117 (Rev.6-03/6)

10a.

10c.

10. Penalty and interest

(See instructions)

11. Amount due

(Add Item 9a and Item 10a;

11a.

11c.

add Item 9c and Item 10c)

k.

l.

12. TOTAL AMOUNT DUE AND PAYABLE

12.

(Add Item 11a and Item 11c)

Taxpayer name

m.

T Code

Taxpayer number

Period

I declare that the information in this document and any attachments is true and correct to

the best of my knowledge and belief.

78920

Duly authorized agent (PLEASE PRINT NAME)

Make the amount in Item 12 Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

payable to:

111 E. 17th Street

Austin, Texas 78774-0100

STATE COMPTROLLER

If you have any questions regarding Motor Vehicle Sales and Use Tax or Surcharge,

Business phone

Date

you may contact the Texas State Comptroller's field office in your area or call

1-800-252-1382 toll free nationwide. The local number in Austin is 512/463-4600.

If you are calling from a Telecommunications Device for the Deaf (TDD), the toll free

333 A

number is 1-800-248-4099, or in Austin, 512/463-4621.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1