Form Cst-200cu - West Virginia Sales And Use Tax Return

ADVERTISEMENT

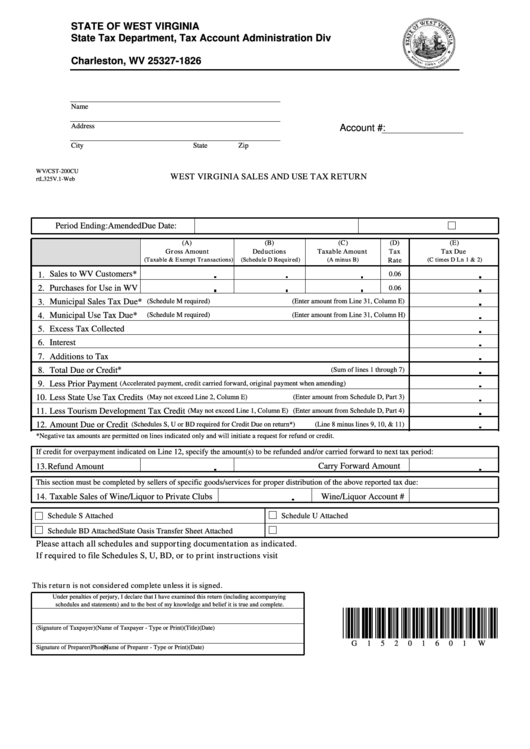

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 1826

Charleston, WV 25327-1826

Name

Address

Account #:

City

State

Zip

WV/CST-200CU

WEST VIRGINIA SALES AND USE TAX RETURN

rtL325V.1-Web

Period Ending:

Due Date:

Amended

(A)

(B)

(C)

(D)

(E)

Gross Amount

Deductions

Taxable Amount

Tax

Tax Due

(Taxable & Exempt Transactions)

(Schedule D Required)

(A minus B)

Rate

(C times D Ln 1 & 2)

Sales to WV Customers*

1.

0.06

Purchases for Use in WV

2.

0.06

Municipal Sales Tax Due*

3.

(Schedule M required)

(Enter amount from Line 31, Column E)

Municipal Use Tax Due*

4.

(Schedule M required)

(Enter amount from Line 31, Column H)

5. Excess Tax Collected

6. Interest

7. Additions to Tax

8. Total Due or Credit*

(Sum of lines 1 through 7)

9. Less Prior Payment

(Accelerated payment, credit carried forward, original payment when amending)

10. Less State Use Tax Credits

(May not exceed Line 2, Column E)

(Enter amount from Schedule D, Part 3)

11. Less Tourism Development Tax Credit

(May not exceed Line 1, Column E)

(Enter amount from Schedule D, Part 4)

12. Amount Due or Credit

(Schedules S, U or BD required for Credit Due on return*)

(Line 8 minus lines 9, 10, & 11)

*Negative tax amounts are permitted on lines indicated only and will initiate a request for refund or credit.

If credit for overpayment indicated on Line 12, specify the amount(s) to be refunded and/or carried forward to next tax period:

Carry Forward Amount

13.Refund Amount

This section must be completed by sellers of specific goods/services for proper distribution of the above reported tax due:

14. Taxable Sales of Wine/Liquor to Private Clubs

Wine/Liquor Account #

Schedule S Attached

Schedule U Attached

Schedule BD Attached

State Oasis Transfer Sheet Attached

Please attach all schedules and supporting documentation as indicated.

If required to file Schedules S, U, BD, or to print instructions visit

This return is not considered complete unless it is signed.

Under penalties of perjury, I declare that I have examined this return (including accompanying

schedules and statements) and to the best of my knowledge and belief it is true and complete.

(Signature of Taxpayer)

(Name of Taxpayer - Type or Print)

(Title)

(Date)

G

1

5

2

0

1

6

0

1

W

Signature of Preparer

(Name of Preparer - Type or Print)

(Phone)

(Date)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3