Form Ia 100a - Iowa Capital Gain Deduction - Cattle, Horses Or Breeding Livestock - 2016

ADVERTISEMENT

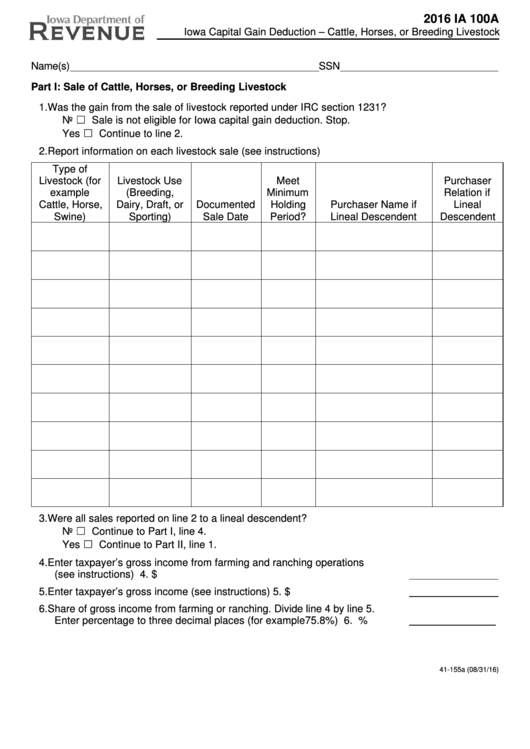

2016 IA 100A

Iowa Capital Gain Deduction – Cattle, Horses, or Breeding Livestock

https://tax.iowa.gov

Name(s)

SSN

Part I: Sale of Cattle, Horses, or Breeding Livestock

1. Was the gain from the sale of livestock reported under IRC section 1231?

No ☐ ...... Sale is not eligible for Iowa capital gain deduction. Stop.

Yes ☐ .... Continue to line 2.

2. Report information on each livestock sale (see instructions)

Type of

Livestock (for

Livestock Use

Meet

Purchaser

example

(Breeding,

Minimum

Relation if

Cattle, Horse,

Dairy, Draft, or

Documented

Holding

Purchaser Name if

Lineal

Swine)

Sporting)

Sale Date

Period?

Lineal Descendent

Descendent

3. Were all sales reported on line 2 to a lineal descendent?

No ☐ ...... Continue to Part I, line 4.

Yes ☐ .... Continue to Part II, line 1.

4. Enter taxpayer’s gross income from farming and ranching operations

(see instructions) .......................................................................................... 4. $

5. Enter taxpayer’s gross income (see instructions)......................................... 5. $

6. Share of gross income from farming or ranching. Divide line 4 by line 5.

Enter percentage to three decimal places (for example 75.8%) .................. 6.

%

41-155a (08/31/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2