Instructions For Form 5458 - City Of Detroit Income Tax Partnership Return

ADVERTISEMENT

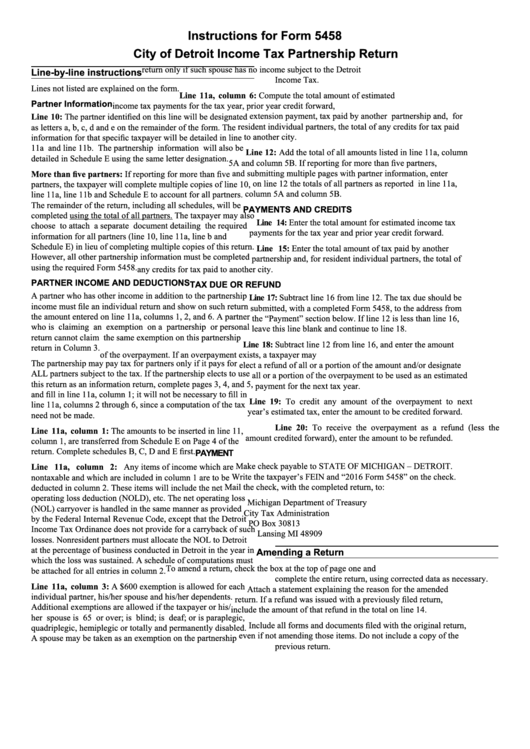

Instructions for Form 5458

City of Detroit Income Tax Partnership Return

return only if such spouse has no income subject to the Detroit

line-by-line instructions

Income Tax.

Lines not listed are explained on the form.

Line 11a, column 6: Compute the total amount of estimated

Partner Information

income tax payments for the tax year, prior year credit forward,

extension payment, tax paid by another partnership and, for

Line 10: The partner identified on this line will be designated

resident individual partners, the total of any credits for tax paid

as letters a, b, c, d and e on the remainder of the form. The

to another city.

information for that specific taxpayer will be detailed in line

11a and line 11b. The partnership information will also be

Line 12: Add the total of all amounts listed in line 11a, column

detailed in Schedule E using the same letter designation.

5A and column 5B. If reporting for more than five partners,

and submitting multiple pages with partner information, enter

More than five partners: If reporting for more than five

on line 12 the totals of all partners as reported in line 11a,

partners, the taxpayer will complete multiple copies of line 10,

column 5A and column 5B.

line 11a, line 11b and Schedule E to account for all partners.

The remainder of the return, including all schedules, will be

PAYMENTS AND CREDITS

completed using the total of all partners. The taxpayer may also

Line 14: Enter the total amount for estimated income tax

choose to attach a separate document detailing the required

payments for the tax year and prior year credit forward.

information for all partners (line 10, line 11a, line b and

Schedule E) in lieu of completing multiple copies of this return.

Line 15: Enter the total amount of tax paid by another

However, all other partnership information must be completed

partnership and, for resident individual partners, the total of

using the required Form 5458.

any credits for tax paid to another city.

PARTNER INCOME AND DEDuCTIONS

TAX DuE OR REFuND

A partner who has other income in addition to the partnership

Line 17: Subtract line 16 from line 12. The tax due should be

income must file an individual return and show on such return

submitted, with a completed Form 5458, to the address from

the amount entered on line 11a, columns 1, 2, and 6. A partner

the “Payment” section below. If line 12 is less than line 16,

who is claiming an exemption on a partnership or personal

leave this line blank and continue to line 18.

return cannot claim the same exemption on this partnership

Line 18: Subtract line 12 from line 16, and enter the amount

return in Column 3.

of the overpayment. If an overpayment exists, a taxpayer may

The partnership may pay tax for partners only if it pays for

elect a refund of all or a portion of the amount and/or designate

ALL partners subject to the tax. If the partnership elects to use

all or a portion of the overpayment to be used as an estimated

this return as an information return, complete pages 3, 4, and 5,

payment for the next tax year.

and fill in line 11a, column 1; it will not be necessary to fill in

Line 19: To credit any amount of the overpayment to next

line 11a, columns 2 through 6, since a computation of the tax

year’s estimated tax, enter the amount to be credited forward.

need not be made.

Line 20: To receive the overpayment as a refund (less the

Line 11a, column 1: The amounts to be inserted in line 11,

amount credited forward), enter the amount to be refunded.

column 1, are transferred from Schedule E on Page 4 of the

return. Complete schedules B, C, D and E first.

PAYMENT

Make check payable to STATE OF MICHIGAN – DETROIT.

Line 11a, column 2: Any items of income which are

Write the taxpayer’s FEIN and “2016 Form 5458” on the check.

nontaxable and which are included in column 1 are to be

Mail the check, with the completed return, to:

deducted in column 2. These items will include the net

operating loss deduction (NOLD), etc. The net operating loss

Michigan Department of Treasury

(NOL) carryover is handled in the same manner as provided

City Tax Administration

by the Federal Internal Revenue Code, except that the Detroit

PO Box 30813

Income Tax Ordinance does not provide for a carryback of such

Lansing MI 48909

losses. Nonresident partners must allocate the NOL to Detroit

at the percentage of business conducted in Detroit in the year in

Amending a Return

which the loss was sustained. A schedule of computations must

To amend a return, check the box at the top of page one and

be attached for all entries in column 2.

complete the entire return, using corrected data as necessary.

Line 11a, column 3: A $600 exemption is allowed for each

Attach a statement explaining the reason for the amended

individual partner, his/her spouse and his/her dependents.

return. If a refund was issued with a previously filed return,

Additional exemptions are allowed if the taxpayer or his/

include the amount of that refund in the total on line 14.

her spouse is 65 or over; is blind; is deaf; or is paraplegic,

Include all forms and documents filed with the original return,

quadriplegic, hemiplegic or totally and permanently disabled.

even if not amending those items. Do not include a copy of the

A spouse may be taken as an exemption on the partnership

previous return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3