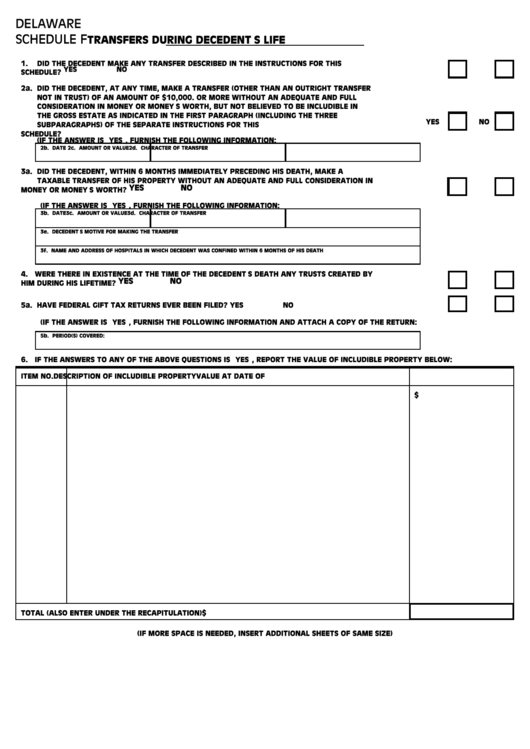

DELAWARE

SCHEDULE F

TRANSFERS DURING DECEDENT’S LIFE

1.

DID THE DECEDENT MAKE ANY TRANSFER DESCRIBED IN THE INSTRUCTIONS FOR THIS

SCHEDULE?...................................................................................................................................................... YES

NO

2a. DID THE DECEDENT, AT ANY TIME, MAKE A TRANSFER (OTHER THAN AN OUTRIGHT TRANSFER

NOT IN TRUST) OF AN AMOUNT OF $10,000. OR MORE WITHOUT AN ADEQUATE AND FULL

CONSIDERATION IN MONEY OR MONEY’S WORTH, BUT NOT BELIEVED TO BE INCLUDIBLE IN

THE GROSS ESTATE AS INDICATED IN THE FIRST PARAGRAPH (INCLUDING THE THREE

YES

NO

SUBPARAGRAPHS) OF THE SEPARATE INSTRUCTIONS FOR THIS

SCHEDULE?.....................................................

(IF THE ANSWER IS “YES”, FURNISH THE FOLLOWING INFORMATION:

2b. DATE

2c. AMOUNT OR VALUE

2d. CHARACTER OF TRANSFER

3a. DID THE DECEDENT, WITHIN 6 MONTHS IMMEDIATELY PRECEDING HIS DEATH, MAKE A

TAXABLE TRANSFER OF HIS PROPERTY WITHOUT AN ADEQUATE AND FULL CONSIDERATION IN

YES

NO

MONEY OR MONEY’S WORTH?.........................................................................................................................

(IF THE ANSWER IS “YES”, FURNISH THE FOLLOWING INFORMATION:

3b. DATE

3c. AMOUNT OR VALUE

3d. CHARACTER OF TRANSFER

3e. DECEDENT’S MOTIVE FOR MAKING THE TRANSFER

3f. NAME AND ADDRESS OF HOSPITALS IN WHICH DECEDENT WAS CONFINED WITHIN 6 MONTHS OF HIS DEATH

4. WERE THERE IN EXISTENCE AT THE TIME OF THE DECEDENT’S DEATH ANY TRUSTS CREATED BY

YES

NO

HIM DURING HIS LIFETIME?...............................................................................................................................

5a. HAVE FEDERAL GIFT TAX RETURNS EVER BEEN FILED?.................................................................................... YES

NO

(IF THE ANSWER IS “YES”, FURNISH THE FOLLOWING INFORMATION AND ATTACH A COPY OF THE RETURN:

5b. PERIOD(S) COVERED:

6. IF THE ANSWERS TO ANY OF THE ABOVE QUESTIONS IS “YES”, REPORT THE VALUE OF INCLUDIBLE PROPERTY BELOW:

ITEM NO.

DESCRIPTION OF INCLUDIBLE PROPERTY

VALUE AT DATE OF

$

TOTAL (ALSO ENTER UNDER THE RECAPITULATION)

$

(IF MORE SPACE IS NEEDED, INSERT ADDITIONAL SHEETS OF SAME SIZE)

1

1 2

2