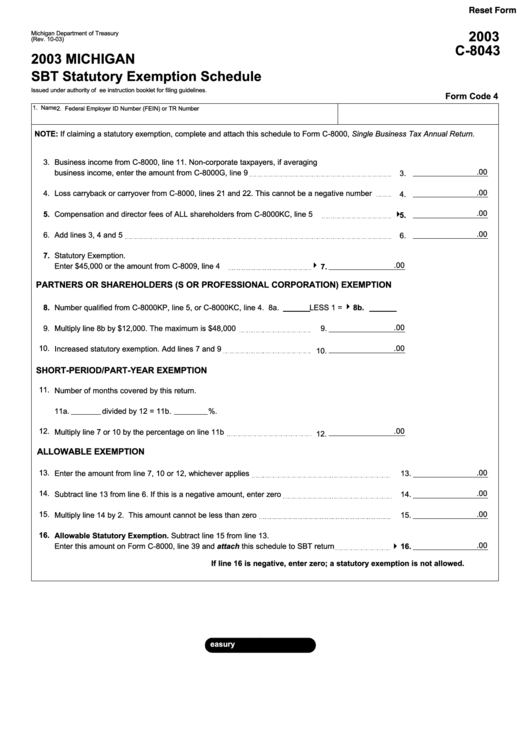

Reset Form

2003

Michigan Department of Treasury

(Rev. 10-03)

C-8043

2003 MICHIGAN

SBT Statutory Exemption Schedule

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

Form Code 4

1. Name

2. Federal Employer ID Number (FEIN) or TR Number

NOTE: If claiming a statutory exemption, complete and attach this schedule to Form C-8000, Single Business Tax Annual Return.

3.

Business income from C-8000, line 11. Non-corporate taxpayers, if averaging

.00

business income, enter the amount from C-8000G, line 9

3.

.00

4.

Loss carryback or carryover from C-8000, lines 21 and 22. This cannot be a negative number

4.

4

.00

5.

Compensation and director fees of ALL shareholders from C-8000KC, line 5

5.

.00

6.

Add lines 3, 4 and 5

6.

7.

Statutory Exemption.

4

.00

Enter $45,000 or the amount from C-8009, line 4

7.

PARTNERS OR SHAREHOLDERS (S OR PROFESSIONAL CORPORATION) EXEMPTION

4

8.

Number qualified from C-8000KP, line 5, or C-8000KC, line 4. 8a.

LESS 1 =

8b.

.00

9.

Multiply line 8b by $12,000. The maximum is $48,000

9.

10.

.00

Increased statutory exemption. Add lines 7 and 9

10.

SHORT-PERIOD/PART-YEAR EXEMPTION

11.

Number of months covered by this return.

11a.

divided by 12 = 11b.

%.

12.

.00

Multiply line 7 or 10 by the percentage on line 11b

12.

ALLOWABLE EXEMPTION

13.

.00

Enter the amount from line 7, 10 or 12, whichever applies

13.

14.

.00

Subtract line 13 from line 6. If this is a negative amount, enter zero

14.

15.

.00

Multiply line 14 by 2. This amount cannot be less than zero

15.

16.

Allowable Statutory Exemption. Subtract line 15 from line 13.

4

.00

Enter this amount on Form C-8000, line 39 and attach this schedule to SBT return

16.

If line 16 is negative, enter zero; a statutory exemption is not allowed.

1

1