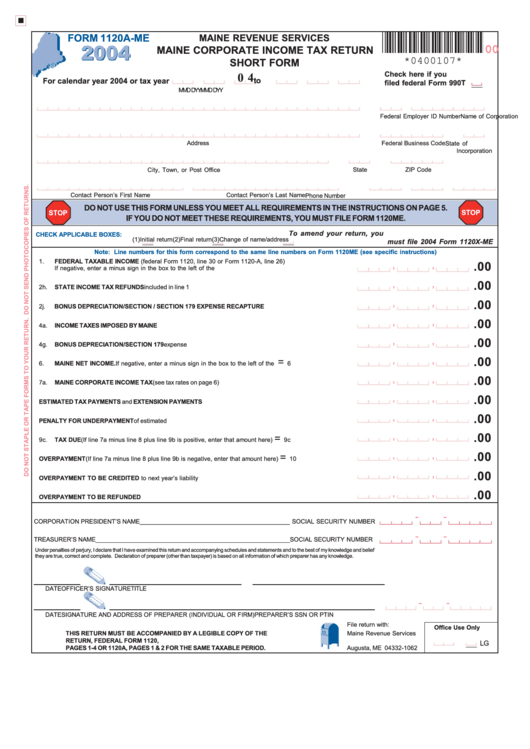

Form 1120a-Me - Maine Corporate Income Tax Return - Short Form - 2004

ADVERTISEMENT

FORM 1120A-ME

MAINE REVENUE SERVICES

MAINE CORPORATE INCOME TAX RETURN

00

SHORT FORM

*0400107*

Check here if you

0 4

For calendar year 2004 or tax year

to

filed federal Form 990T

MM

DD

Y Y

MM

DD

Y Y

Name of Corporation

Federal Employer ID Number

Address

Federal Business Code

State of

Incorporation

City, Town, or Post Office

State

ZIP Code

Contact Person’s First Name

Contact Person’s Last Name

Phone Number

DO NOT USE THIS FORM UNLESS YOU MEET ALL REQUIREMENTS IN THE INSTRUCTIONS ON PAGE 5.

STOP

STOP

IF YOU DO NOT MEET THESE REQUIREMENTS, YOU MUST FILE FORM 1120ME.

To amend your return, you

CHECK APPLICABLE BOXES:

(1)

Initial return

(2)

Final return

(3)

Change of name/address

must file 2004 Form 1120X-ME

Note: Line numbers for this form correspond to the same line numbers on Form 1120ME (see specific instructions)

1.

FEDERAL TAXABLE INCOME (federal Form 1120, line 30 or Form 1120-A, line 26)

,

,

.00

If negative, enter a minus sign in the box to the left of the number ................................................................ 1

,

,

.00

2h.

STATE INCOME TAX REFUNDS included in line 1 above .................................................................. MINUS 2h

,

,

.00

2j.

BONUS DEPRECIATION/SECTION / SECTION 179 EXPENSE RECAPTURE ................................. MINUS 2j

,

,

.00

4a.

INCOME TAXES IMPOSED BY MAINE ................................................................................................. PLUS 4a

,

,

.00

4g.

BONUS DEPRECIATION/SECTION 179 expense add-back ............................................................... PLUS 4g

,

,

.00

=

6.

MAINE NET INCOME. If negative, enter a minus sign in the box to the left of the number .....................

6

,

,

.00

7a.

MAINE CORPORATE INCOME TAX (see tax rates on page 6) ........................................................................ 7a

,

,

.00

8.

Enter the amount of any ESTIMATED TAX PAYMENTS and EXTENSION PAYMENTS .......................... MINUS 8

,

,

.00

9b.

Enter PENALTY FOR UNDERPAYMENT of estimated tax ................................................................... PLUS 9b

,

,

.00

=

9c.

TAX DUE (If line 7a minus line 8 plus line 9b is positive, enter that amount here) ...................................

9c

,

,

.00

=

10.

Amount of OVERPAYMENT (If line 7a minus line 8 plus line 9b is negative, enter that amount here) ......

10

,

,

.00

11a. Amount of OVERPAYMENT TO BE CREDITED to next year’s liability ......................................................... 11a

,

,

.00

11b. Amount of OVERPAYMENT TO BE REFUNDED ........................................................................................... 11b

-

-

CORPORATION PRESIDENT’S NAME ____________________________________________ SOCIAL SECURITY NUMBER

-

-

TREASURER’S NAME _________________________________________________________ SOCIAL SECURITY NUMBER

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief

they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

DATE

OFFICER’S SIGNATURE

TITLE

-

-

DATE

SIGNATURE AND ADDRESS OF PREPARER (INDIVIDUAL OR FIRM)

PREPARER’S SSN OR PTIN

File return with:

Office Use Only

THIS RETURN MUST BE ACCOMPANIED BY A LEGIBLE COPY OF THE

Maine Revenue Services

U.S. CORPORATION INCOME TAX RETURN, FEDERAL FORM 1120,

P.O. Box 1062

LG

PAGES 1-4 OR 1120A, PAGES 1 & 2 FOR THE SAME TAXABLE PERIOD.

Augusta, ME 04332-1062

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1