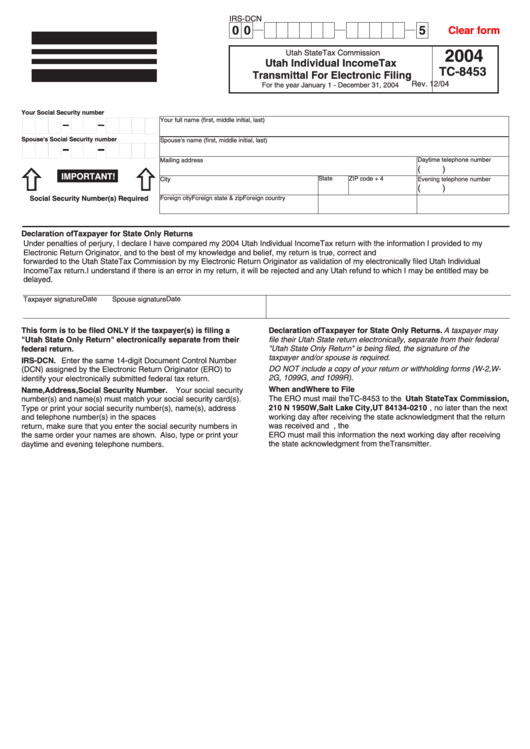

IRS-DCN

0 0

5

Clear form

2004

Utah State Tax Commission

Utah Individual Income Tax

TC-8453

Transmittal For Electronic Filing

Rev. 12/04

For the year January 1 - December 31, 2004

Your Social Security number

Your full name (first, middle initial, last)

Spouse's Social Security number

Spouse's name (first, middle initial, last)

Daytime telephone number

Mailing address

(

)

IMPORTANT!

State

ZIP code + 4

City

Evening telephone number

(

)

Social Security Number(s) Required

Foreign city

Foreign state & zip

Foreign country

Declaration of Taxpayer for State Only Returns

Under penalties of perjury, I declare I have compared my 2004 Utah Individual Income Tax return with the information I provided to my

Electronic Return Originator, and to the best of my knowledge and belief, my return is true, correct and complete. This declaration is to be

forwarded to the Utah State Tax Commission by my Electronic Return Originator as validation of my electronically filed Utah Individual

Income Tax return. I understand if there is an error in my return, it will be rejected and any Utah refund to which I may be entitled may be

delayed.

Date

Date

Taxpayer signature

Spouse signature

This form is to be filed ONLY if the taxpayer(s) is filing a

Declaration of Taxpayer for State Only Returns.

A taxpayer may

"Utah State Only Return" electronically separate from their

file their Utah State return electronically, separate from their federal

return. If a "Utah State Only Return" is being filed, the signature of the

federal return.

taxpayer and/or spouse is required.

IRS-DCN.

Enter the same 14-digit Document Control Number

DO NOT include a copy of your return or withholding forms (W-2, W-

(DCN) assigned by the Electronic Return Originator (ERO) to

2G, 1099G, and 1099R).

identify your electronically submitted federal tax return.

When and Where to File

Name, Address, Social Security Number.

Your social security

The ERO must mail the TC-8453 to the

Utah State Tax Commission,

number(s) and name(s) must match your social security card(s).

Type or print your social security number(s), name(s), address

210 N 1950 W, Salt Lake City, UT 84134-0210

, no later than the next

and telephone number(s) in the spaces provided. If you file a joint

working day after receiving the state acknowledgment that the return

was received and accepted. If a third-party transmitter is used, the

return, make sure that you enter the social security numbers in

ERO must mail this information the next working day after receiving

the same order your names are shown.

Also, type or print your

the state acknowledgment from the Transmitter.

daytime and evening telephone numbers.

1

1