Instructions For Schedule H (Form 1040) - Household Employment Taxes - 2009

ADVERTISEMENT

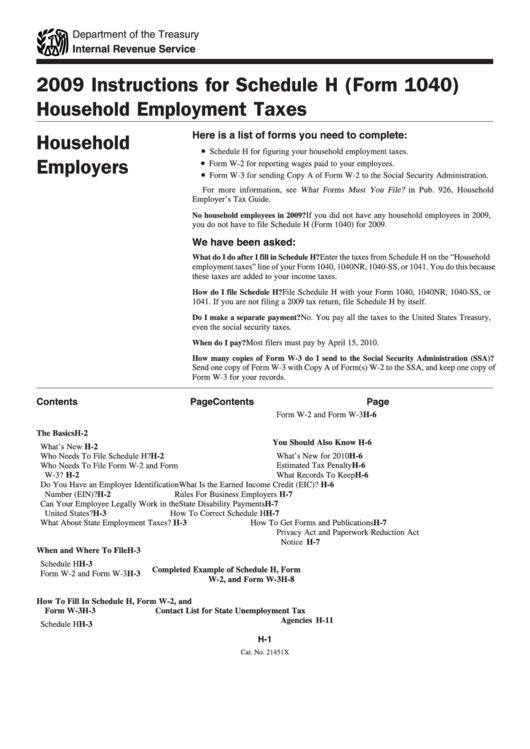

Department of the Treasury

Internal Revenue Service

2009 Instructions for Schedule H (Form 1040)

Household Employment Taxes

Here is a list of forms you need to complete:

Household

•

Schedule H for figuring your household employment taxes.

•

Employers

Form W-2 for reporting wages paid to your employees.

•

Form W-3 for sending Copy A of Form W-2 to the Social Security Administration.

For more information, see What Forms Must You File? in Pub. 926, Household

Employer’s Tax Guide.

If you did not have any household employees in 2009,

No household employees in 2009?

you do not have to file Schedule H (Form 1040) for 2009.

We have been asked:

Enter the taxes from Schedule H on the “Household

What do I do after I fill in Schedule H?

employment taxes” line of your Form 1040, 1040NR, 1040-SS, or 1041. You do this because

these taxes are added to your income taxes.

File Schedule H with your Form 1040, 1040NR, 1040-SS, or

How do I file Schedule H?

1041. If you are not filing a 2009 tax return, file Schedule H by itself.

Do I make a separate payment?

No. You pay all the taxes to the United States Treasury,

even the social security taxes.

Most filers must pay by April 15, 2010.

When do I pay?

How many copies of Form W-3 do I send to the Social Security Administration (SSA)?

Send one copy of Form W-3 with Copy A of Form(s) W-2 to the SSA, and keep one copy of

Form W-3 for your records.

Contents

Page

Contents

Page

Form W-2 and Form W-3 . . . . . . . . . . . . . . . H-6

The Basics . . . . . . . . . . . . . . . . . . . . . . . . . . H-2

You Should Also Know . . . . . . . . . . . . . . . . . H-6

What’s New . . . . . . . . . . . . . . . . . . . . . . . . . H-2

Who Needs To File Schedule H? . . . . . . . . . . H-2

What’s New for 2010 . . . . . . . . . . . . . . . . . . H-6

Who Needs To File Form W-2 and Form

Estimated Tax Penalty . . . . . . . . . . . . . . . . . . H-6

W-3? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-2

What Records To Keep . . . . . . . . . . . . . . . . . H-6

Do You Have an Employer Identification

What Is the Earned Income Credit (EIC)? . . . . H-6

Number (EIN)? . . . . . . . . . . . . . . . . . . . . . . H-2

Rules For Business Employers . . . . . . . . . . . . H-7

Can Your Employee Legally Work in the

State Disability Payments . . . . . . . . . . . . . . . H-7

United States? . . . . . . . . . . . . . . . . . . . . . . H-3

How To Correct Schedule H . . . . . . . . . . . . . H-7

What About State Employment Taxes? . . . . . . H-3

How To Get Forms and Publications . . . . . . . H-7

Privacy Act and Paperwork Reduction Act

Notice . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-7

When and Where To File . . . . . . . . . . . . . . . H-3

Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . H-3

Completed Example of Schedule H, Form

Form W-2 and Form W-3 . . . . . . . . . . . . . . . H-3

W-2, and Form W-3 . . . . . . . . . . . . . . . . . H-8

How To Fill In Schedule H, Form W-2, and

Form W-3 . . . . . . . . . . . . . . . . . . . . . . . . . H-3

Contact List for State Unemployment Tax

Agencies . . . . . . . . . . . . . . . . . . . . . . . . . H-11

Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . H-3

H-1

Cat. No. 21451X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12