Print

Clear

Page 1

(Revised 11/10)

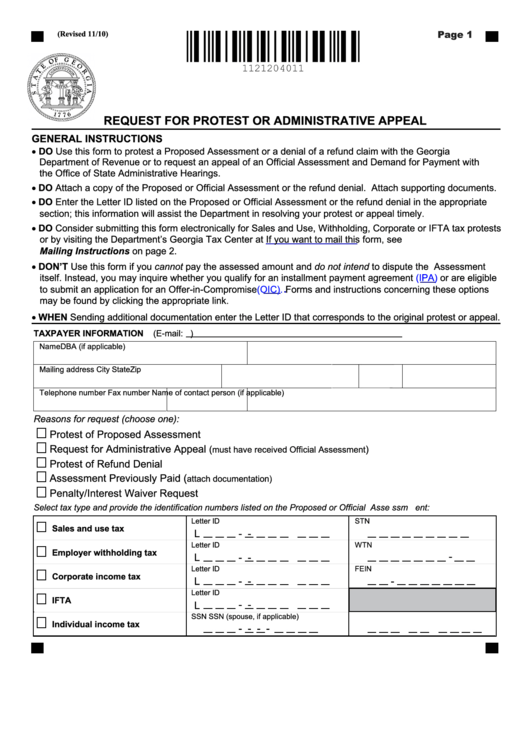

REQUEST FOR PROTEST OR ADMINISTRATIVE APPEAL

GENERAL INSTRUCTIONS

• DO Use this form to p rotest a Proposed Assessment or a denial of a refund claim with the Georgia

Department of Revenue or to request an appeal of an Official Assessment and Demand for Payment with

the Office of State Administrative Hearings.

• DO Attach a copy of the Proposed or Official Assessment or the refund denial. Attach supporting documents.

• DO Enter the Letter ID listed on the Proposed or Official Assessment or the refund denial in the appropriate

section; this information will assist the Department in resolving your protest or appeal timely.

• DO Consider submitting this form electronically for Sales and Use, Withholding, Corporate or IFTA tax protests

https://gtc.dor.ga.gov.

or by visiting the Department’s Georgia Tax Center at

If you want to mail this form, see

Mailing Instructions on page 2.

• DON’T Use this form if you cannot pay the assessed amount and do not intend to dispute the Assessment

itself. Instead, you may inquire whether you qualify for an installment payment agreement

(IPA)

or are eligible

to submit an application for an Offer-in-Compromise

(OIC).

Forms and instructions concerning these options

may be found by clicking the appropriate link.

• WHEN Sending additional documentation enter the Letter ID that corresponds to the original protest or appeal.

TAXPAYER INFORMATION

(E-mail:

)

Name

DBA (if applicable)

Mailing address

City

State

Zip

Telephone number

Fax number

Name of contact person (if applicable)

Reasons for request (choose one):

Protest of Proposed Assessment

Request for Administrative Appeal

(

)

must have received Official Assessment

Protest of Refund Denial

Assessment Previously Paid (

attach documentation)

Penalty/Interest Waiver Request

Select tax type and provide the identification numbers listed on the Proposed or Official Asse ssm ent:

Letter ID

STN

Sales and use tax

L

-

-

Letter ID

WTN

Employer withholding tax

-

L

-

-

Letter ID

FEIN

Corporate income tax

L

-

-

-

Letter ID

IFTA

-

-

L

SSN

SSN (spouse, if applicable)

Individual income tax

-

-

-

-

1

1 2

2