Form Pr-26 - Personal Property Return - 2010

ADVERTISEMENT

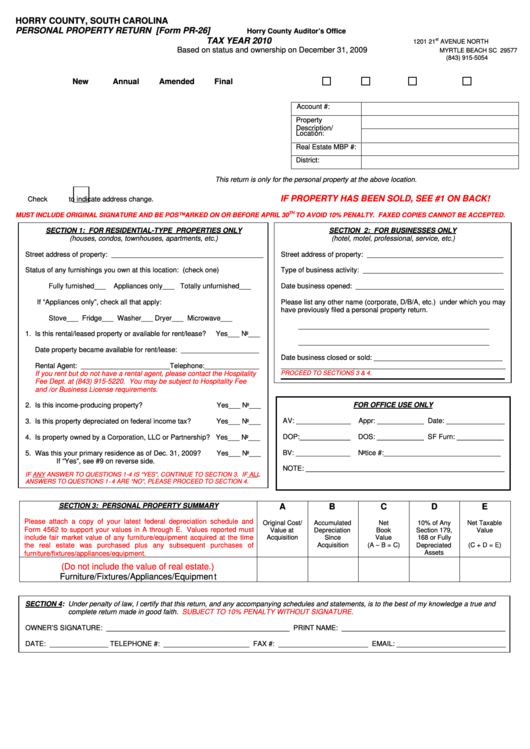

HORRY COUNTY, SOUTH CAROLINA

PERSONAL PROPERTY RETURN [Form PR-26]

Horry County Auditor’s Office

TAX YEAR 2010

st

1201 21

AVENUE NORTH

Based on status and ownership on December 31, 2009

MYRTLE BEACH SC 29577

(843) 915-5054

New

Annual

Amended

Final

Account #:

Property

Description/

Location:

Real Estate MBP #:

District:

This return is only for the personal property at the above location.

IF PROPERTY HAS BEEN SOLD, SEE #1 ON BACK!

Check

to indicate address change.

TH

MUST INCLUDE ORIGINAL SIGNATURE AND BE POSTMARKED ON OR BEFORE APRIL 30

TO AVOID 10% PENALTY. FAXED COPIES CANNOT BE ACCEPTED.

SECTION 1: FOR RESIDENTIAL-TYPE PROPERTIES ONLY

SECTION 2: FOR BUSINESSES ONLY

(houses, condos, townhouses, apartments, etc.)

(hotel, motel, professional, service, etc.)

Street address of property: _______________________________________

Street address of property: ___________________________________

Status of any furnishings you own at this location: (check one)

Type of business activity: ____________________________________

Fully furnished___

Appliances only___ Totally unfurnished___

Date business opened: ______________________________________

If “Appliances only”, check all that apply:

Please list any other name (corporate, D/B/A, etc.) under which you may

have previously filed a personal property return.

Stove___ Fridge___ Washer___ Dryer___ Microwave___

_________________________________________________

1. Is this rental/leased property or available for rent/lease?

Yes___ No___

_________________________________________________

Date property became available for rent/lease: ____________________

Date business closed or sold: _________________________________

Rental Agent: _______________________Telephone:______________

__________________________________________________________

If you rent but do not have a rental agent, please contact the Hospitality

PROCEED TO SECTIONS 3 & 4.

Fee Dept. at (843) 915-5220. You may be subject to Hospitality Fee

and /or Business License requirements.

FOR OFFICE USE ONLY

2. Is this income-producing property?

Yes___ No___

AV: ______________

Appr: ____________ Date: _______________

3. Is this property depreciated on federal income tax?

Yes___ No___

DOP:_____________

DOS: ____________ SF Furn: ____________

4. Is property owned by a Corporation, LLC or Partnership? Yes___ No___

BV: ______________

Notice #:______________________________

5. Was this your primary residence as of Dec. 31, 2009?

Yes___ No___

If “Yes”, see #9 on reverse side.

NOTE: ___________________________________________________

IF ANY ANSWER TO QUESTIONS 1-4 IS “YES”, CONTINUE TO SECTION 3. IF ALL

ANSWERS TO QUESTIONS 1-4 ARE “NO”, PLEASE PROCEED TO SECTION 4.

SECTION 3: PERSONAL PROPERTY SUMMARY

A

B

C

D

E

Please attach a copy of your latest federal depreciation schedule and

Original Cost/

Accumulated

Net

10% of Any

Net Taxable

Form 4562 to support your values in A through E. Values reported must

Value at

Depreciation

Book

Section 179,

Value

include fair market value of any furniture/equipment acquired at the time

Acquisition

Since

Value

168 or Fully

the real estate was purchased plus any subsequent purchases of

Acquisition

(A – B = C)

Depreciated

(C + D = E)

Assets

furniture/fixtures/appliances/equipment.

(Do not include the value of real estate.)

Furniture/Fixtures/Appliances/Equipment

SECTION 4: Under penalty of law, I certify that this return, and any accompanying schedules and statements, is to the best of my knowledge a true and

complete return made in good faith.

SUBJECT TO 10% PENALTY WITHOUT SIGNATURE.

OWNER’S SIGNATURE: _______________________________________________ PRINT NAME: __________________________________________

DATE: _______________ TELEPHONE #: ______________________ FAX #: _______________________ EMAIL: ____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1