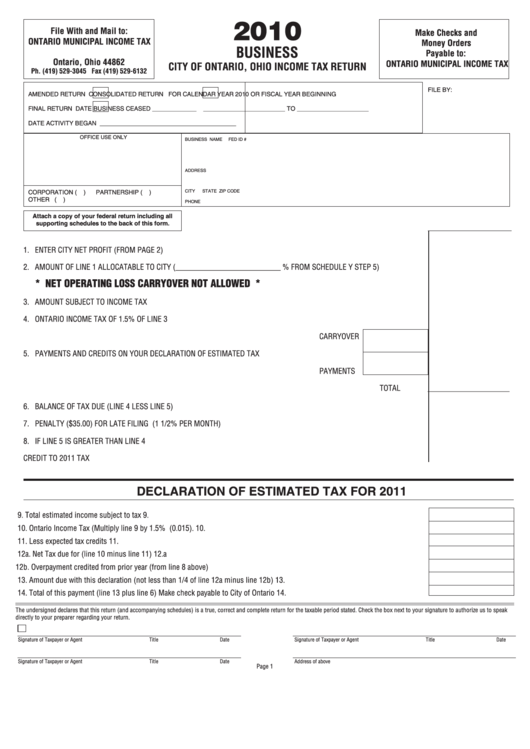

Income Tax Return - Business - City Of Ontario, Ohio - 2010

ADVERTISEMENT

2010

File With and Mail to:

Make Checks and

ONTARIO MUNICIPAL INCOME TAX

Money Orders

BUSINESS

P.O. Box 166

Payable to:

Ontario, Ohio 44862

ONTARIO MUNICIPAL INCOME TAX

CITY OF ONTARIO, OHIO INCOME TAX RETURN

Ph. (419) 529-3045 Fax (419) 529-6132

FILE BY:

AMENDED RETURN

CONSOLIDATED RETURN

FOR CALENDAR YEAR 2010 OR FISCAL YEAR BEGINNING

FINAL RETURN

DATE BUSINESS CEASED _____________

________________________ TO _____________________

DATE ACTIVITY BEGAN ________________________________________

OFFICE USE ONLY

BUSINESS NAME

FED ID #

ADDRESS

CITY

STATE

ZIP CODE

CORPORATION (

)

PARTNERSHIP (

)

OTHER (

)

PHONE

Attach a copy of your federal return including all

supporting schedules to the back of this form.

1 . ENTER CITY NET PROFIT (FROM PAGE 2) .................................................................................................................................. _____________________

2. AMOUNT OF LINE 1 ALLOCATABLE TO CITY (___________________________ % FROM SCHEDULE Y STEP 5) . ................... _____________________

* NET OPERATING LOSS CARRYOVER NOT ALLOWED *

3. AMOUNT SUBJECT TO INCOME TAX ............................................................................................................................................ _____________________

4. ONTARIO INCOME TAX OF 1.5% OF LINE 3 . ................................................................................................................................ _____________________

CARRYOVER

5. PAYMENTS AND CREDITS ON YOUR DECLARATION OF ESTIMATED TAX .........................

PAYMENTS

TOTAL _____________________

6. BALANCE OF TAX DUE (LINE 4 LESS LINE 5) . .............................................................................................................................. _____________________

7. PENALTY ($35.00) FOR LATE FILING ............... INTEREST (1 1/2% PER MONTH) ..................................................................... _____________________

8. IF LINE 5 IS GREATER THAN LINE 4 ............... ENTER OVERPAYMENT . ..................................................................................... _____________________

CREDIT TO 2011 TAX ................................ ____________________________ AMOUNT TO BE REFUNDED .......... _____________________

DECLARATION OF ESTIMATED TAX FOR 2011

9. Total estimated income subject to tax

9.

10. Ontario Income Tax (Multiply line 9 by 1.5% (0.015).

10.

11. Less expected tax credits

11.

1 2a. Net Tax due for (line 10 minus line 11)

12.a

1 2b. Overpayment credited from prior year (from line 8 above)

12.b.

13. Amount due with this declaration (not less than 1/4 of line 12a minus line 12b)

13.

14. Total of this payment (line 13 plus line 6) Make check payable to City of Ontario

14.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated. Check the box next to your signature to authorize us to speak

directly to your preparer regarding your return.

Signature of Taxpayer or Agent Title Date

Signature of Taxpayer or Agent Title Date

Signature of Taxpayer or Agent Title Date

Address of above

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2