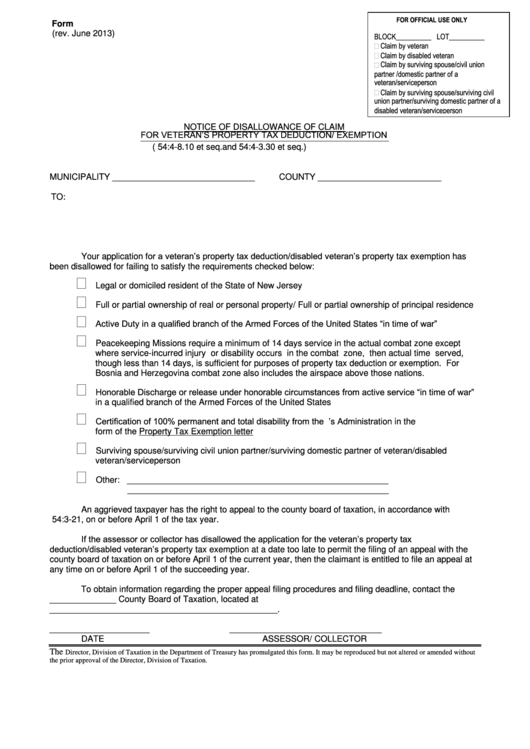

FOR OFFICIAL USE ONLY

Form V.N.D.A.

(rev. June 2013)

BLOCK__________ LOT__________

Claim by veteran

Claim by disabled veteran

Claim by surviving spouse/civil union

partner /domestic partner of a

veteran/serviceperson

Claim by surviving spouse/surviving civil

union partner/surviving domestic partner of a

disabled veteran/serviceperson

NOTICE OF DISALLOWANCE OF CLAIM

FOR VETERAN’S PROPERTY TAX DEDUCTION/ EXEMPTION

(N.J.S.A. 54:4-8.10 et seq. and N.J.S.A. 54:4-3.30 et seq.)

MUNICIPALITY ______________________________

COUNTY __________________________

TO:

Your application for a veteran’s property tax deduction/disabled veteran’s property tax exemption has

been disallowed for failing to satisfy the requirements checked below:

Legal or domiciled resident of the State of New Jersey

Full or partial ownership of real or personal property/ Full or partial ownership of principal residence

Active Duty in a qualified branch of the Armed Forces of the United States “in time of war”

Peacekeeping Missions require a minimum of 14 days service in the actual combat zone except

where service-incurred injury or disability occurs in the combat zone, then actual time served,

though less than 14 days, is sufficient for purposes of property tax deduction or exemption. For

Bosnia and Herzegovina combat zone also includes the airspace above those nations.

Honorable Discharge or release under honorable circumstances from active service “in time of war”

in a qualified branch of the Armed Forces of the United States

Certification of 100% permanent and total disability from the U.S. Veteran’s Administration in the

form of the Property Tax Exemption letter

Surviving spouse/surviving civil union partner/surviving domestic partner of veteran/disabled

veteran/serviceperson

Other: _______________________________________________________

_______________________________________________________

An aggrieved taxpayer has the right to appeal to the county board of taxation, in accordance with

N.J.S.A. 54:3-21, on or before April 1 of the tax year.

If the assessor or collector has disallowed the application for the veteran’s property tax

deduction/disabled veteran’s property tax exemption at a date too late to permit the filing of an appeal with the

county board of taxation on or before April 1 of the current year, then the claimant is entitled to file an appeal at

any time on or before April 1 of the succeeding year.

To obtain information regarding the proper appeal filing procedures and filing deadline, contact the

______________ County Board of Taxation, located at

________________________________________________.

_____________________

________________________________

DATE

ASSESSOR/ COLLECTOR

The

Director, Division of Taxation in the Department of Treasury has promulgated this form. It may be reproduced but not altered or amended without

the prior approval of the Director, Division of Taxation.

1

1