Form Cig-2 - Cigarette Tax Refund Application - Maine Revenue Services

ADVERTISEMENT

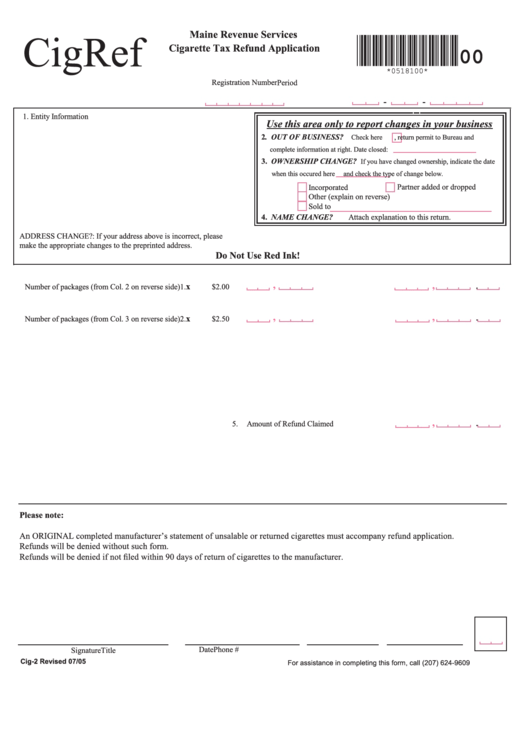

CigRef

Maine Revenue Services

00

Cigarette Tax Refund Application

*0518100*

Registration Number

Period

-

-

1. Entity Information

Use this area only to report changes in your business

2. OUT OF BUSINESS?

Check here

, return permit to Bureau and

complete information at right. Date closed:

3. OWNERSHIP CHANGE?

If you have changed ownership, indicate the date

when this occured here

and check the type of change below.

Partner added or dropped

Incorporated

Other (explain on reverse)

Sold to

4. NAME CHANGE?

Attach explanation to this return.

ADDRESS CHANGE?: If your address above is incorrect, please

make the appropriate changes to the preprinted address.

Do Not Use Red Ink!

,

,

.

x

Number of packages (from Col. 2 on reverse side)

1.

$2.00

,

,

.

x

Number of packages (from Col. 3 on reverse side)

2.

$2.50

,

.

5.

Amount of Refund Claimed

Please note:

An ORIGINAL completed manufacturer’s statement of unsalable or returned cigarettes must accompany refund application.

Refunds will be denied without such form.

Refunds will be denied if not filed within 90 days of return of cigarettes to the manufacturer.

Date

Phone #

Signature

Title

Cig-2 Revised 07/05

For assistance in completing this form, call (207) 624-9609

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2