Form St-103p Sample - Prepaid Sales Tax - 2003

ADVERTISEMENT

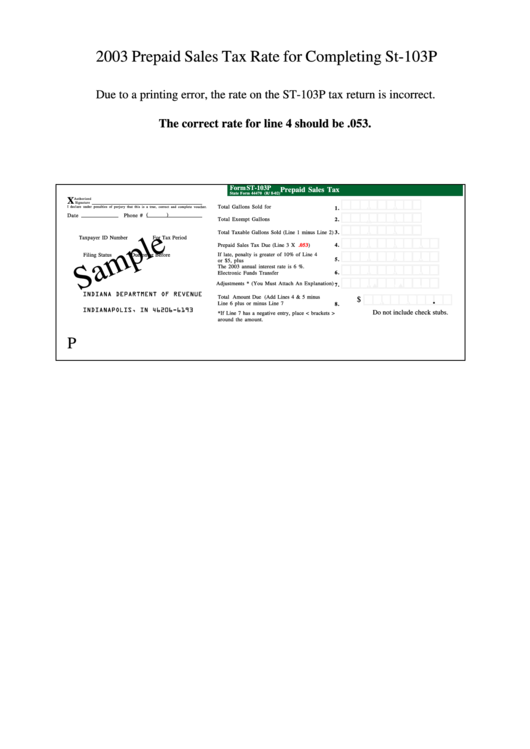

2003 Prepaid Sales Tax Rate for Completing St-103P

Due to a printing error, the rate on the ST-103P tax return is incorrect.

The correct rate for line 4 should be .053.

Form ST-103P

Prepaid Sales Tax

State Form 44470 (R/ 8-02)

,

,

▲

▲

Total Gallons Sold for Period..............................

1.

.

Phone #

,

,

▲

▲

Total Exempt Gallons Sold..................................

2.

,

,

▲

▲

Total Taxable Gallons Sold (Line 1 minus Line 2)

3.

Taxpayer ID Number

For Tax Period

.

,

,

▲

▲

▲

Prepaid Sales Tax Due (Line 3 X

.053

)..............

4.

.

If late, penalty is greater of 10% of Line 4

Filing Status

Due on or Before

,

,

▲

▲

▲

5.

or $5, plus interest...............................................

.

The 2003 annual interest rate is 6 %.

,

,

▲

▲

▲

6 .

Electronic Funds Transfer Credit..........................

.

,

,

Adjustments * (You Must Attach An Explanation)

▲

▲

▲

7.

INDIANA DEPARTMENT OF REVENUE

.

Total Amount Due (Add Lines 4 & 5 minus

,

,

$

P.O. BOX 6193

▲

▲

Line 6 plus or minus Line 7 ................................

8.

INDIANAPOLIS, IN 46206-6193

Do not include check stubs.

*If Line 7 has a negative entry, place < brackets >

around the amount.

P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1