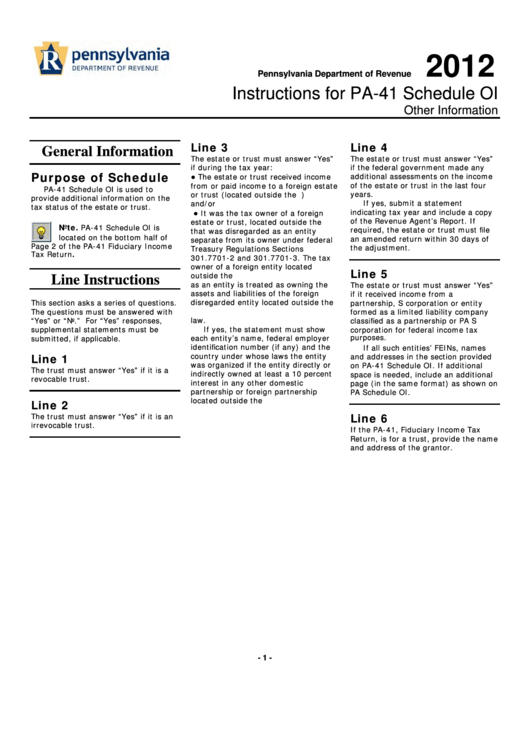

Instructions For Form Pa-41 - Schedule Oi - Other Information - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-41 Schedule OI

Other Information

Line 3

Line 4

General Information

The estate or trust must answer “Yes”

The estate or trust must answer “Yes”

if during the tax year:

if the federal government made any

Purpose of Schedule

●

additional assessments on the income

The estate or trust received income

of the estate or trust in the last four

from or paid income to a foreign estate

PA-41 Schedule OI is used to

years.

or trust (located outside the U.S.)

provide additional information on the

If yes, submit a statement

and/or

tax status of the estate or trust.

indicating tax year and include a copy

●

It was the tax owner of a foreign

of the Revenue Agent’s Report. If

estate or trust, located outside the U.S.

Note.

PA-41 Schedule OI is

required, the estate or trust must file

that was disregarded as an entity

located on the bottom half of

an amended return within 30 days of

separate from its owner under federal

Page 2 of the PA-41 Fiduciary Income

the adjustment.

Treasury Regulations Sections

Tax Return.

301.7701-2 and 301.7701-3. The tax

owner of a foreign entity located

Line 5

outside the U.S. that was disregarded

Line Instructions

as an entity is treated as owning the

The estate or trust must answer “Yes”

assets and liabilities of the foreign

if it received income from a

disregarded entity located outside the

This section asks a series of questions.

partnership, S corporation or entity

U.S. for purposes of U.S. income tax

The questions must be answered with

formed as a limited liability company

law.

“Yes” or “No.” For “Yes” responses,

classified as a partnership or PA S

If yes, the statement must show

supplemental statements must be

corporation for federal income tax

each entity’s name, federal employer

submitted, if applicable.

purposes.

identification number (if any) and the

If all such entities’ FEINs, names

country under whose laws the entity

Line 1

and addresses in the section provided

was organized if the entity directly or

on PA-41 Schedule OI. If additional

The trust must answer “Yes” if it is a

indirectly owned at least a 10 percent

space is needed, include an additional

revocable trust.

interest in any other domestic

page (in the same format) as shown on

partnership or foreign partnership

PA Schedule OI.

located outside the U.S.

Line 2

Line 6

The trust must answer “Yes” if it is an

irrevocable trust.

If the PA-41, Fiduciary Income Tax

Return, is for a trust, provide the name

and address of the grantor.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1