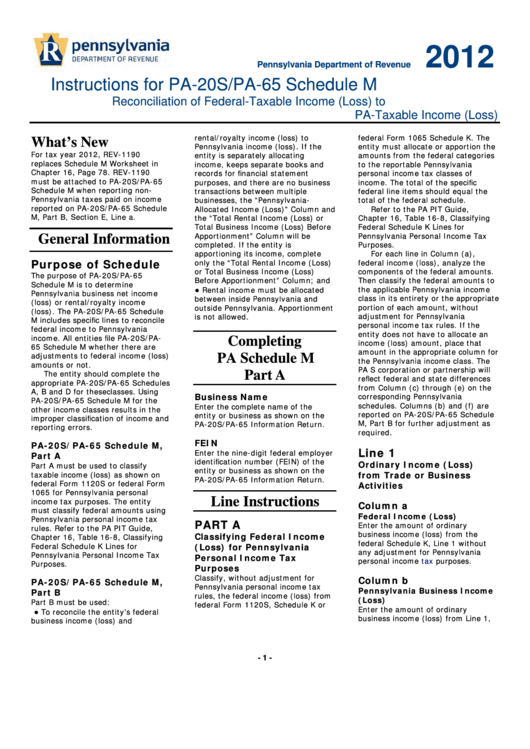

Instructions For Pa-20s/pa-65 Schedule M - Pennsylvania Department Of Revenue - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule M

Reconciliation of Federal-Taxable Income (Loss) to

PA-Taxable Income (Loss)

rental/royalty income (loss) to

federal Form 1065 Schedule K. The

What’s New

Pennsylvania income (loss). If the

entity must allocate or apportion the

For tax year 2012, REV-1190

entity is separately allocating

amounts from the federal categories

replaces Schedule M Worksheet in

income, keeps separate books and

to the reportable Pennsylvania

Chapter 16, Page 78. REV-1190

records for financial statement

personal income tax classes of

must be attached to PA-20S/PA-65

purposes, and there are no business

income. The total of the specific

Schedule M when reporting non-

transactions between multiple

federal line items should equal the

Pennsylvania taxes paid on income

businesses, the “Pennsylvania-

total of the federal schedule.

reported on PA-20S/PA-65 Schedule

Allocated Income (Loss)” Column and

Refer to the PA PIT Guide,

M, Part B, Section E, Line a.

the “Total Rental Income (Loss) or

Chapter 16, Table 16-8, Classifying

Total Business Income (Loss) Before

Federal Schedule K Lines for

Apportionment” Column will be

Pennsylvania Personal Income Tax

General Information

completed. If the entity is

Purposes.

apportioning its income, complete

For each line in Column (a),

Purpose of Schedule

only the “Total Rental Income (Loss)

federal income (loss), analyze the

or Total Business Income (Loss)

components of the federal amounts.

The purpose of PA-20S/PA-65

Before Apportionment” Column; and

Then classify the federal amounts to

Schedule M is to determine

●

the applicable Pennsylvania income

Rental income must be allocated

Pennsylvania business net income

class in its entirety or the appropriate

between inside Pennsylvania and

(loss) or rental/royalty income

portion of each amount, without

outside Pennsylvania. Apportionment

(loss). The PA-20S/PA-65 Schedule

adjustment for Pennsylvania

is not allowed.

M includes specific lines to reconcile

personal income tax rules. If the

federal income to Pennsylvania

entity does not have to allocate an

income. All entities file PA-20S/PA-

Completing

income (loss) amount, place that

65 Schedule M whether there are

amount in the appropriate column for

adjustments to federal income (loss)

PA Schedule M

the Pennsylvania income class. The

amounts or not.

PA S corporation or partnership will

The entity should complete the

Part A

reflect federal and state differences

appropriate PA-20S/PA-65 Schedules

from Column (c) through (e) on the

A, B and D for these classes. Using

Business Name

corresponding Pennsylvania

PA-20S/PA-65 Schedule M for the

schedules. Columns (b) and (f) are

Enter the complete name of the

other income classes results in the

reported on PA-20S/PA-65 Schedule

entity or business as shown on the

improper classification of income and

M, Part B for further adjustment as

PA-20S/PA-65 Information Return.

reporting errors.

required.

FEIN

PA-20S/PA-65 Schedule M,

Line 1

Enter the nine-digit federal employer

Part A

identification number (FEIN) of the

Ordinary Income (Loss)

Part A must be used to classify

entity or business as shown on the

taxable income (loss) as shown on

from Trade or Business

PA-20S/PA-65 Information Return.

federal Form 1120S or federal Form

Activities

1065 for Pennsylvania personal

Line Instructions

income tax purposes. The entity

Column a

must classify federal amounts using

Federal Income (Loss)

Pennsylvania personal income tax

PART A

Enter the amount of ordinary

rules. Refer to the PA PIT Guide,

business income (loss) from the

Classifying Federal Income

Chapter 16, Table 16-8, Classifying

federal Schedule K, Line 1 without

Federal Schedule K Lines for

(Loss) for Pennsylvania

any adjustment for Pennsylvania

Pennsylvania Personal Income Tax

Personal Income Tax

personal income

tax

purposes.

Purposes.

Purposes

Classify, without adjustment for

Column b

PA-20S/PA-65 Schedule M,

Pennsylvania personal income tax

Pennsylvania Business Income

Part B

rules, the federal income (loss) from

(Loss)

Part B must be used:

federal Form 1120S, Schedule K or

Enter the amount of ordinary

●

To reconcile the entity’s federal

business income (loss) from Line 1,

business income (loss) and

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8