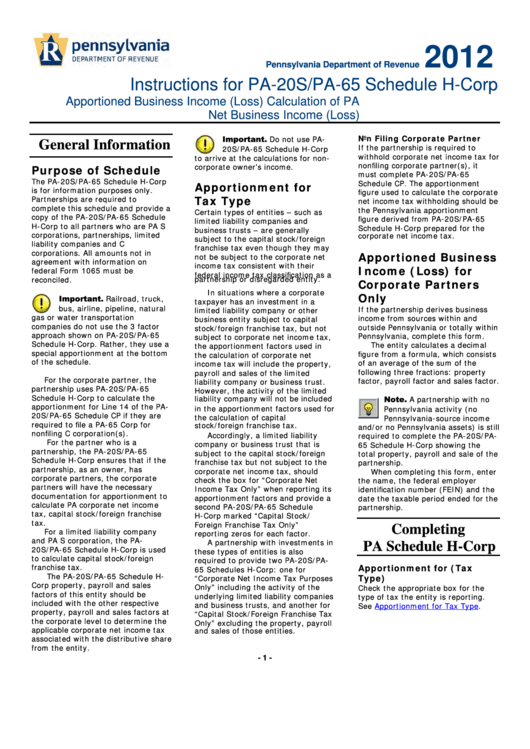

Instructions For Pa-20s/pa-65 Schedule H-Corp - Pennsylvania Department Of Revenue - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule H-Corp

Apportioned Business Income (Loss) Calculation of PA

Net Business Income (Loss)

Important.

Non Filing Corporate Partner

Do not use PA-

General Information

If the partnership is required to

20S/PA-65 Schedule H-Corp

withhold corporate net income tax for

to arrive at the calculations for non-

nonfiling corporate partner(s), it

corporate owner’s income.

Purpose of Schedule

must complete PA-20S/PA-65

The PA-20S/PA-65 Schedule H-Corp

Schedule CP. The apportionment

Apportionment for

is for information purposes only.

figure used to calculate the corporate

Tax Type

Partnerships are required to

net income tax withholding should be

complete this schedule and provide a

the Pennsylvania apportionment

Certain types of entities – such as

copy of the PA-20S/PA-65 Schedule

figure derived from PA-20S/PA-65

limited liability companies and

H-Corp to all partners who are PA S

Schedule H-Corp prepared for the

business trusts – are generally

corporations, partnerships, limited

corporate net income tax.

subject to the capital stock/foreign

liability companies and C

franchise tax even though they may

corporations. All amounts not in

Apportioned Business

not be subject to the corporate net

agreement with information on

income tax consistent with their

Income (Loss) for

federal Form 1065 must be

federal income tax classification as a

reconciled.

Corporate Partners

partnership or disregarded entity.

In situations where a corporate

Only

Important.

Railroad, truck,

taxpayer has an investment in a

bus, airline, pipeline, natural

If the partnership derives business

limited liability company or other

gas or water transportation

income from sources within and

business entity subject to capital

companies do not use the 3 factor

outside Pennsylvania or totally within

stock/foreign franchise tax, but not

approach shown on PA-20S/PA-65

Pennsylvania, complete this form.

subject to corporate net income tax,

Schedule H-Corp. Rather, they use a

The entity calculates a decimal

the apportionment factors used in

special apportionment at the bottom

figure from a formula, which consists

the calculation of corporate net

of the schedule.

of an average of the sum of the

income tax will include the property,

following three fractions: property

payroll and sales of the limited

For the corporate partner, the

factor, payroll factor and sales factor.

liability company or business trust.

partnership uses PA-20S/PA-65

However, the activity of the limited

Schedule H-Corp to calculate the

Note.

A partnership with no

liability company will not be included

apportionment for Line 14 of the PA-

in the apportionment factors used for

Pennsylvania activity (no

20S/PA-65 Schedule CP if they are

the calculation of capital

Pennsylvania-source income

required to file a PA-65 Corp for

stock/foreign franchise tax.

and/or no Pennsylvania assets) is still

nonfiling C corporation(s).

Accordingly, a limited liability

required to complete the PA-20S/PA-

For the partner who is a

company or business trust that is

65 Schedule H-Corp showing the

partnership, the PA-20S/PA-65

subject to the capital stock/foreign

total property, payroll and sale of the

Schedule H-Corp ensures that if the

franchise tax but not subject to the

partnership.

partnership, as an owner, has

corporate net income tax, should

When completing this form, enter

corporate partners, the corporate

check the box for “Corporate Net

the name, the federal employer

partners will have the necessary

Income Tax Only” when reporting its

identification number (FEIN) and the

documentation for apportionment to

apportionment factors and provide a

date the taxable period ended for the

calculate PA corporate net income

second PA-20S/PA-65 Schedule

partnership.

tax, capital stock/foreign franchise

H-Corp marked “Capital Stock/

tax.

Foreign Franchise Tax Only”

Completing

For a limited liability company

reporting zeros for each factor.

and PA S corporation, the PA-

A partnership with investments in

PA Schedule H-Corp

20S/PA-65 Schedule H-Corp is used

these types of entities is also

to calculate capital stock/foreign

required to provide two PA-20S/PA-

franchise tax.

Apportionment for (Tax

65 Schedules H-Corp: one for

The PA-20S/PA-65 Schedule H-

Type)

“Corporate Net Income Tax Purposes

Corp property, payroll and sales

Only” including the activity of the

Check the appropriate box for the

factors of this entity should be

underlying limited liability companies

type of tax the entity is reporting.

included with the other respective

and business trusts, and another for

See

Apportionment for Tax

Type.

property, payroll and sales factors at

“Capital Stock/Foreign Franchise Tax

the corporate level to determine the

Only” excluding the property, payroll

applicable corporate net income tax

and sales of those entities.

associated with the distributive share

from the entity.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3