Instructions For Form N-342 - Department Of Taxation State Of Hawaii

ADVERTISEMENT

Clear Form

INSTRUCTIONS

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM N-342

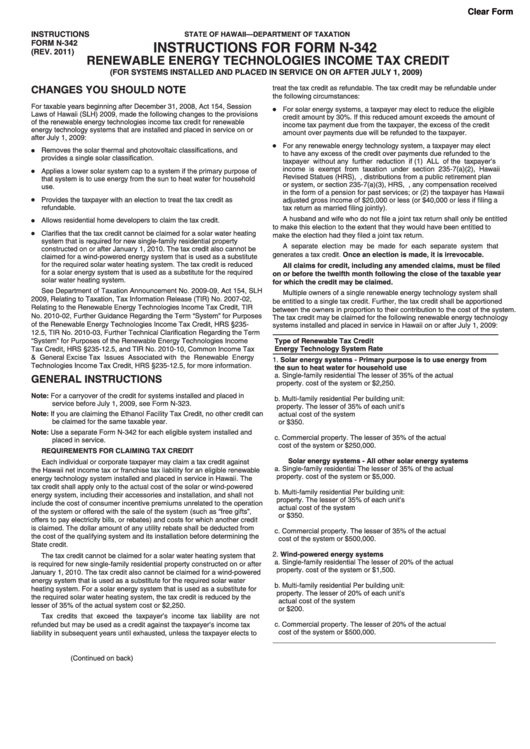

INSTRUCTIONS FOR FORM N-342

(REV. 2011)

RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT

(FOR SYSTEMS INSTALLED AND PLACED IN SERVICE ON OR AFTER JULY 1, 2009)

CHANGES YOU SHOULD NOTE

treat the tax credit as refundable. The tax credit may be refundable under

the following circumstances:

For taxable years beginning after December 31, 2008, Act 154, Session

•

For solar energy systems, a taxpayer may elect to reduce the eligible

Laws of Hawaii (SLH) 2009, made the following changes to the provisions

credit amount by 30%. If this reduced amount exceeds the amount of

of the renewable energy technologies income tax credit for renewable

income tax payment due from the taxpayer, the excess of the credit

energy technology systems that are installed and placed in service on or

amount over payments due will be refunded to the taxpayer.

after July 1, 2009:

•

For any renewable energy technology system, a taxpayer may elect

•

Removes the solar thermal and photovoltaic classifications, and

to have any excess of the credit over payments due refunded to the

provides a single solar classification.

taxpayer without any further reduction if (1) ALL of the taxpayer’s

income is exempt from taxation under section 235-7(a)(2), Hawaii

•

Applies a lower solar system cap to a system if the primary purpose of

Revised Statues (HRS), i.e., distributions from a public retirement plan

that system is to use energy from the sun to heat water for household

or system, or section 235-7(a)(3), HRS, i.e., any compensation received

use.

in the form of a pension for past services; or (2) the taxpayer has Hawaii

•

Provides the taxpayer with an election to treat the tax credit as

adjusted gross income of $20,000 or less (or $40,000 or less if filing a

refundable.

tax return as married filing jointly).

•

A husband and wife who do not file a joint tax return shall only be entitled

Allows residential home developers to claim the tax credit.

to make this election to the extent that they would have been entitled to

•

Clarifies that the tax credit cannot be claimed for a solar water heating

make the election had they filed a joint tax return.

system that is required for new single-family residential property

A separate election may be made for each separate system that

constructed on or after January 1, 2010. The tax credit also cannot be

generates a tax credit. Once an election is made, it is irrevocable.

claimed for a wind-powered energy system that is used as a substitute

for the required solar water heating system. The tax credit is reduced

All claims for credit, including any amended claims, must be filed

for a solar energy system that is used as a substitute for the required

on or before the twelfth month following the close of the taxable year

solar water heating system.

for which the credit may be claimed.

See Department of Taxation Announcement No. 2009-09, Act 154, SLH

Multiple owners of a single renewable energy technology system shall

2009, Relating to Taxation, Tax Information Release (TIR) No. 2007-02,

be entitled to a single tax credit. Further, the tax credit shall be apportioned

Relating to the Renewable Energy Technologies Income Tax Credit, TIR

between the owners in proportion to their contribution to the cost of the system.

No. 2010-02, Further Guidance Regarding the Term “System” for Purposes

The tax credit may be claimed for the following renewable energy technology

of the Renewable Energy Technologies Income Tax Credit, HRS §235-

systems installed and placed in service in Hawaii on or after July 1, 2009:

12.5, TIR No. 2010-03, Further Technical Clarification Regarding the Term

“System” for Purposes of the Renewable Energy Technologies Income

Type of Renewable

Tax Credit

Energy Technology System

Rate

Tax Credit, HRS §235-12.5, and TIR No. 2010-10, Common Income Tax

& General Excise Tax Issues Associated with the Renewable Energy

1.

Solar energy systems - Primary purpose is to use energy from

Technologies Income Tax Credit, HRS §235-12.5, for more information.

the sun to heat water for household use

a. Single-family residential

The lesser of 35% of the actual

GENERAL INSTRUCTIONS

property.

cost of the system or $2,250.

Note: For a carryover of the credit for systems installed and placed in

b. Multi-family residential

Per building unit:

service before July 1, 2009, see Form N-323.

property.

The lesser of 35% of each unit’s

Note: If you are claiming the Ethanol Facility Tax Credit, no other credit can

actual cost of the system

be claimed for the same taxable year.

or $350.

Note: Use a separate Form N-342 for each eligible system installed and

c. Commercial property.

The lesser of 35% of the actual

placed in service.

cost of the system or $250,000.

REQUIREMENTS FOR CLAIMING TAX CREDIT

Solar energy systems - All other solar energy systems

Each individual or corporate taxpayer may claim a tax credit against

a. Single-family residential

The lesser of 35% of the actual

the Hawaii net income tax or franchise tax liability for an eligible renewable

property.

cost of the system or $5,000.

energy technology system installed and placed in service in Hawaii. The

tax credit shall apply only to the actual cost of the solar or wind-powered

b. Multi-family residential

Per building unit:

energy system, including their accessories and installation, and shall not

property.

The lesser of 35% of each unit’s

include the cost of consumer incentive premiums unrelated to the operation

actual cost of the system

of the system or offered with the sale of the system (such as “free gifts”,

or $350.

offers to pay electricity bills, or rebates) and costs for which another credit

is claimed. The dollar amount of any utility rebate shall be deducted from

c. Commercial property.

The lesser of 35% of the actual

the cost of the qualifying system and its installation before determining the

cost of the system or $500,000.

State credit.

2.

Wind-powered energy systems

The tax credit cannot be claimed for a solar water heating system that

a. Single-family residential

The lesser of 20% of the actual

is required for new single-family residential property constructed on or after

property.

cost of the system or $1,500.

January 1, 2010. The tax credit also cannot be claimed for a wind-powered

energy system that is used as a substitute for the required solar water

b. Multi-family residential

Per building unit:

heating system. For a solar energy system that is used as a substitute for

property.

The lesser of 20% of each unit’s

the required solar water heating system, the tax credit is reduced by the

actual cost of the system

lesser of 35% of the actual system cost or $2,250.

or $200.

Tax credits that exceed the taxpayer’s income tax liability are not

c. Commercial property.

The lesser of 20% of the actual

refunded but may be used as a credit against the taxpayer’s income tax

cost of the system or $500,000.

liability in subsequent years until exhausted, unless the taxpayer elects to

(Continued on back)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2