Form 1040me Schedule 2 - Itemized Deductions - 2015

ADVERTISEMENT

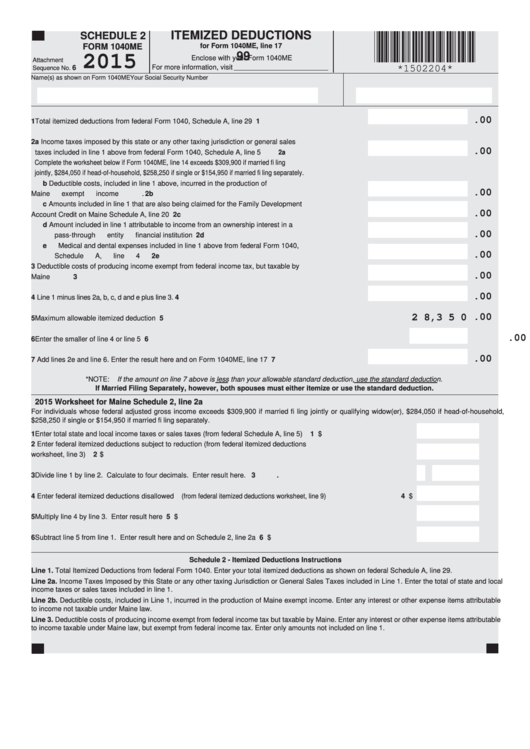

ITEMIZED DEDUCTIONS

SCHEDULE 2

FORM 1040ME

for Form 1040ME, line 17

99

2015

Enclose with your Form 1040ME

Attachment

6

For more information, visit

*1502204*

Sequence No.

Name(s) as shown on Form 1040ME

Your Social Security Number

.00

1

Total itemized deductions from federal Form 1040, Schedule A, line 29 ...................................... 1

2

a

Income taxes imposed by this state or any other taxing jurisdiction or general sales

.00

taxes included in line 1 above from federal Form 1040, Schedule A, line 5 ............................ 2a

Complete the worksheet below if Form 1040ME, line 14 exceeds $309,900 if married fi ling

jointly, $284,050 if head-of-household, $258,250 if single or $154,950 if married fi ling separately.

b

Deductible costs, included in line 1 above, incurred in the production of

.00

Maine exempt income .......................................................................................................... 2b

c

Amounts included in line 1 that are also being claimed for the Family Development

.00

Account Credit on Maine Schedule A, line 20 ...................................................................... 2c

d

Amount included in line 1 attributable to income from an ownership interest in a

.00

pass-through entity fi nancial institution ................................................................................ 2d

e

Medical and dental expenses included in line 1 above from federal Form 1040,

.00

Schedule A, line 4 ................................................................................................................. 2e

3

Deductible costs of producing income exempt from federal income tax, but taxable by

.00

Maine ............................................................................................................................................ 3

.00

4

Line 1 minus lines 2a, b, c, d and e plus line 3. ............................................................................... 4

.00

2 8,3 5 0

5

Maximum allowable itemized deduction ....................................................................................... 5

.00

6

Enter the smaller of line 4 or line 5 ............................................................................................... 6

.00

7

Add lines 2e and line 6. Enter the result here and on Form 1040ME, line 17 .............................. 7

*NOTE:

If the amount on line 7 above is less than your allowable standard deduction, use the standard deduction.

If Married Filing Separately, however, both spouses must either itemize or use the standard deduction.

2015 Worksheet for Maine Schedule 2, line 2a

For individuals whose federal adjusted gross income exceeds $309,900 if married fi ling jointly or qualifying widow(er), $284,050 if head-of-household,

$258,250 if single or $154,950 if married fi ling separately.

1

Enter total state and local income taxes or sales taxes (from federal Schedule A, line 5) .............................................1 $

2

Enter federal itemized deductions subject to reduction (from federal itemized deductions

worksheet, line 3) ........................................................................................................................................................... 2 $

3

Divide line 1 by line 2. Calculate to four decimals. Enter result here. ........................................................................... 3

.

4

Enter federal itemized deductions disallowed (from federal itemized deductions worksheet, line 9) .......................................... 4 $

5

Multiply line 4 by line 3. Enter result here .........................................................................................................................5 $

6

Subtract line 5 from line 1. Enter result here and on Schedule 2, line 2a ........................................................................6 $

Schedule 2 - Itemized Deductions Instructions

Line 1. Total Itemized Deductions from federal Form 1040. Enter your total itemized deductions as shown on federal Schedule A, line 29.

Line 2a. Income Taxes Imposed by this State or any other taxing Jurisdiction or General Sales Taxes included in Line 1. Enter the total of state and local

income taxes or sales taxes included in line 1.

Line 2b. Deductible costs, included in Line 1, incurred in the production of Maine exempt income. Enter any interest or other expense items attributable

to income not taxable under Maine law.

Line 3. Deductible costs of producing income exempt from federal income tax but taxable by Maine. Enter any interest or other expense items attributable

to income taxable under Maine law, but exempt from federal income tax. Enter only amounts not included on line 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1