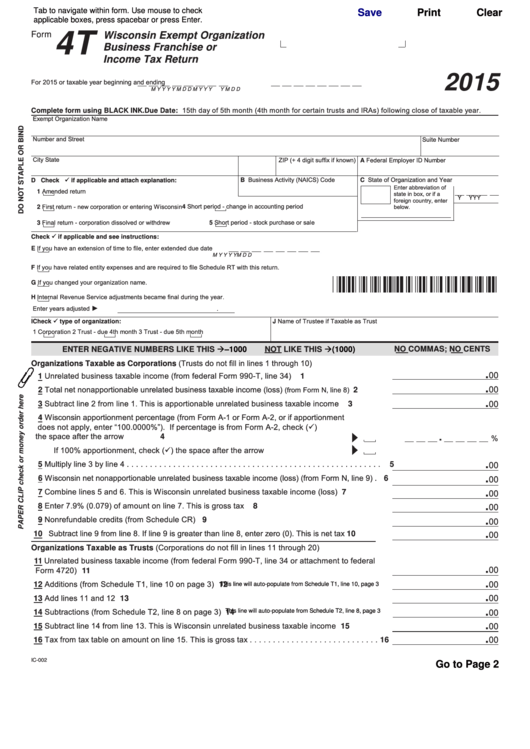

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

4T

Form

Wisconsin Exempt Organization

Business Franchise or

Income Tax Return

2015

For 2015 or taxable year beginning

and ending

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

Due Date: 15th day of 5th month (4th month for certain trusts and IRAs) following close of taxable year.

Complete form using BLACK INK.

Exempt Organization Name

Number and Street

Suite Number

City

State

ZIP (+ 4 digit suffix if known)

A Federal Employer ID Number

B Business Activity (NAICS) Code

C State of Organization

and

Year

ü

D Check

if applicable and attach explanation:

Enter abbreviation of

Amended return

1

state in box, or if a

Y

Y

Y

Y

foreign country, enter

Short period - change in accounting period

First return - new corporation or entering Wisconsin

below.

4

2

Final return - corporation dissolved or withdrew

Short period - stock purchase or sale

3

5

ü

Check

if applicable and see instructions:

If you have an extension of time to file, enter extended due date

E

M

M

D

D

Y

Y

Y

Y

If you have related entity expenses and are required to file Schedule RT with this return.

F

If you changed your organization name.

G

Internal Revenue Service adjustments became final during the year.

H

►

Enter years adjusted

.

J Name of Trustee if Taxable as Trust

ü

I Check

type of organization:

1

Corporation

2

Trust - due 4th month

3

Trust - due 5th month

–1000

(1000)

NO COMMAS; NO CENTS

ENTER NEGATIVE NUMBERS LIKE THIS

NOT LIKE THIS

Organizations Taxable as Corporations (Trusts do not fill in lines 1 through 10)

.

1 Unrelated business taxable income (from federal Form 990-T, line 34) . . . . . . . . . . . . . . . . . .

00

1

.

2 Total net nonapportionable unrelated business taxable income (loss)

(from Form N, line 8)

00

. . . . .

2

3 Subtract line 2 from line 1. This is apportionable unrelated business taxable income . . . . . . .

.

3

00

4 Wisconsin apportionment percentage (from Form A-1 or Form A-2, or if apportionment

does not apply, enter “100.0000%”). If percentage is from Form A-2, check (ü)

the space after the arrow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

%

4

If 100% apportionment, check (ü) the space after the arrow . . . . . . . . . . . . . . . . . . . .

5 Multiply line 3 by line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

5

00

6 Wisconsin net nonapportionable unrelated business taxable income (loss) (from Form N, line 9) . 6

.

00

7 Combine lines 5 and 6. This is Wisconsin unrelated business taxable income (loss) . . . . . . .

.

7

00

8 Enter 7.9% (0.079) of amount on line 7. This is gross tax . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

8

00

9 Nonrefundable credits (from Schedule CR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

9

00

10 Subtract line 9 from line 8. If line 9 is greater than line 8, enter zero (0). This is net tax . . . . . . 10

.

00

Organizations Taxable as Trusts (Corporations do not fill in lines 11 through 20)

11 Unrelated business taxable income (from federal Form 990-T, line 34 or attachment to federal

.

Form 4720) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

12 Additions (from Schedule T1, line 10 on page 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

.

00

This line will auto-populate from Schedule T1, line 10, page 3

.

13 Add lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

14 Subtractions (from Schedule T2, line 8 on page 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

.

This line will auto-populate from Schedule T2, line 8, page 3

00

15 Subtract line 14 from line 13. This is Wisconsin unrelated business taxable income . . . . . . . . 15

.

00

.

16 Tax from tax table on amount on line 15. This is gross tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

IC-002

Go to Page 2

1

1 2

2 3

3