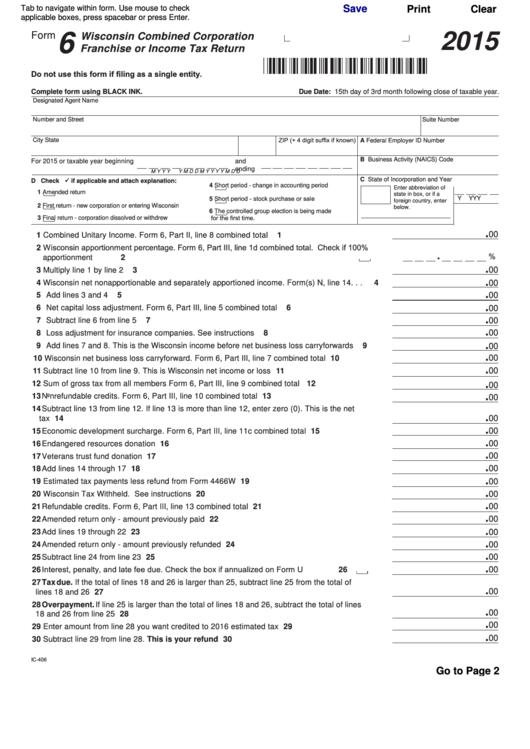

Save

Tab to navigate within form. Use mouse to check

Print

Clear

applicable boxes, press spacebar or press Enter.

Form

2015

6

Wisconsin Combined Corporation

Franchise or Income Tax Return

Do not use this form if filing as a single entity.

Complete form using BLACK INK.

Due Date: 15th day of 3rd month following close of taxable year.

Designated Agent Name

Number and Street

Suite Number

ZIP (+ 4 digit suffix if known)

City

State

A Federal Employer ID Number

B Business Activity (NAICS) Code

For 2015 or taxable year beginning

and

ending

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

C State of Incorporation

and

Year

D Check

if applicable and attach explanation:

4

Short period - change in accounting period

Enter abbreviation of

1

Amended return

state in box, or if a

Short period - stock purchase or sale

5

Y

Y

Y

Y

foreign country, enter

2

First return - new corporation or entering Wisconsin

below.

6

The controlled group election is being made

for the first time.

3

Final return - corporation dissolved or withdrew

.

00

1 Combined Unitary Income. Form 6, Part II, line 8 combined total . . . . . . . . . . . . . . . . . . . . . .

1

2 Wisconsin apportionment percentage. Form 6, Part III, line 1d combined total. Check if 100%

%

.

apportionment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

.

00

3 Multiply line 1 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

.

4 Wisconsin net nonapportionable and separately apportioned income. Form(s) N, line 14 . . .

4

00

.

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

.

6 Net capital loss adjustment. Form 6, Part III, line 5 combined total . . . . . . . . . . . . . . . . . . . . .

6

00

.

00

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

00

8 Loss adjustment for insurance companies. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.

9 Add lines 7 and 8. This is the Wisconsin income before net business loss carryforwards . . . .

9

00

.

00

10 Wisconsin net business loss carryforward. Form 6, Part III, line 7 combined total . . . . . . . . . 10

.

00

11 Subtract line 10 from line 9. This is Wisconsin net income or loss . . . . . . . . . . . . . . . . . . . . . 11

.

12 Sum of gross tax from all members Form 6, Part III, line 9 combined total . . . . . . . . . . . . . . 12

00

.

13 Nonrefundable credits. Form 6, Part III, line 10 combined total . . . . . . . . . . . . . . . . . . . . . . . . 13

00

14 Subtract line 13 from line 12. If line 13 is more than line 12, enter zero (0). This is the net

.

tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

00

.

00

15 Economic development surcharge. Form 6, Part III, line 11c combined total . . . . . . . . . . . . . 15

.

00

16 Endangered resources donation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

.

00

17 Veterans trust fund donation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

.

00

18 Add lines 14 through 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

.

00

19 Estimated tax payments less refund from Form 4466W . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

.

20 Wisconsin Tax Withheld. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

00

.

00

21 Refundable credits. Form 6, Part III, line 13 combined total . . . . . . . . . . . . . . . . . . . . . . . . . . 21

.

00

22 Amended return only - amount previously paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

.

23 Add lines 19 through 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

00

.

00

24 Amended return only - amount previously refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

.

00

25 Subtract line 24 from line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

.

26 Interest, penalty, and late fee due. Check the box if annualized on Form U. . . . . . . . . .

00

26

27 Tax due. If the total of lines 18 and 26 is larger than 25, subtract line 25 from the total of

.

00

lines 18 and 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Overpayment. If line 25 is larger than the total of lines 18 and 26, subtract the total of lines

.

00

18 and 26 from line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

.

00

29 Enter amount from line 28 you want credited to 2016 estimated tax . . . . . . . . . . . . . . . . . . . . 29

.

00

30 Subtract line 29 from line 28. This is your refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

IC-406

Go to Page 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14