Save

Print

Clear

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

Page 1 of 3

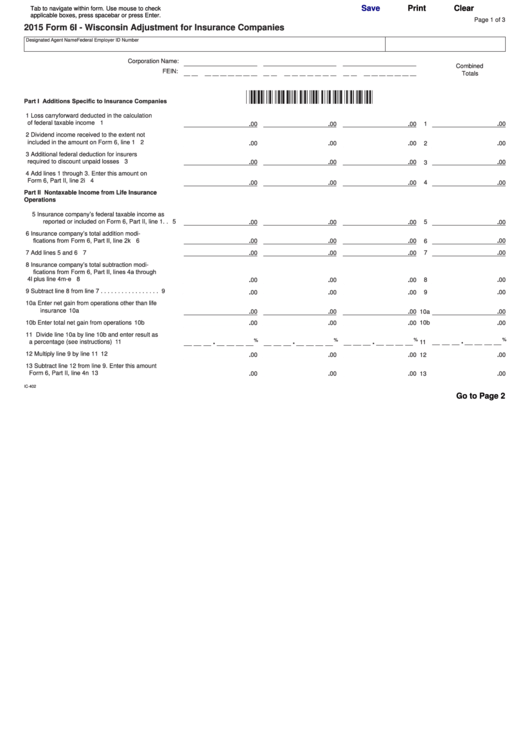

2015 Form 6I - Wisconsin Adjustment for Insurance Companies

Designated Agent Name

Federal Employer ID Number

Corporation Name:

Combined

FEIN:

Totals

Part I Additions Specific to Insurance Companies

1

Loss carryforward deducted in the calculation

of federal taxable income . . . . . . . . . . . . . . . . .

1

.00

.00

.00

1

.00

2

Dividend income received to the extent not

included in the amount on Form 6, line 1 . . . . .

2

.00

.00

.00

2

.00

3

Additional federal deduction for insurers

required to discount unpaid losses . . . . . . . . . .

3

.00

.00

.00

.00

3

4

Add lines 1 through 3 . Enter this amount on

Form 6, Part II, line 2i . . . . . . . . . . . . . . . . . . . .

4

4

.00

.00

.00

.00

Part II Nontaxable Income from Life Insurance

Operations

5

Insurance company’s federal taxable income as

reported or included on Form 6, Part II, line 1 . .

5

.00

.00

5

.00

.00

6

Insurance company’s total addition modi-

fications from Form 6, Part II, line 2k . . . . . . . . .

6

.00

.00

.00

.00

6

7

Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . .

7

7

.00

.00

.00

.00

8

Insurance company’s total subtraction modi-

fications from Form 6, Part II, lines 4a through

4l plus line 4m-e . . . . . . . . . . . . . . . . . . . . . . . .

8

.00

.00

.00

8

.00

9

Subtract line 8 from line 7 . . . . . . . . . . . . . . . . .

9

.00

.00

.00

9

.00

10a Enter net gain from operations other than life

insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10a

.00

.00

.00

10a

.00

10b Enter total net gain from operations . . . . . . . . . 10b

10b

.00

.00

.00

.00

11

Divide line 10a by line 10b and enter result as

%

.

%

.

%

.

%

.

a percentage (see instructions) . . . . . . . . . . . . . 11

11

12

Multiply line 9 by line 11 . . . . . . . . . . . . . . . . . . 12

.00

.00

.00

12

.00

13

Subtract line 12 from line 9 . Enter this amount

Form 6, Part II, line 4n . . . . . . . . . . . . . . . . . . . . 13

.00

.00

13

.00

.00

IC-402

Go to Page 2

1

1 2

2 3

3