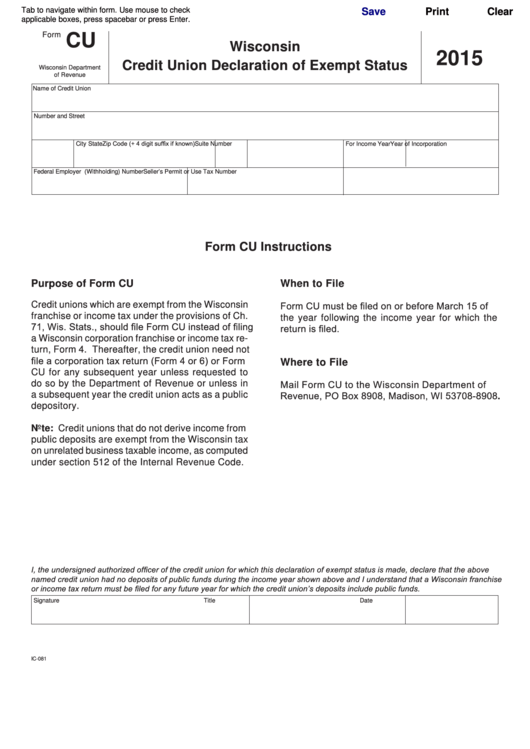

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

Form

CU

Wisconsin

2015

Credit Union Declaration of Exempt Status

Wisconsin Department

of Revenue

Name of Credit Union

Number and Street

Zip Code (+ 4 digit suffix if known)

Suite Number

City

State

For Income Year

Year of Incorporation

Federal Employer I.D. Number

Wis. Employer I.D. (Withholding) Number

Seller’s Permit or Use Tax Number

Form CU Instructions

Purpose of Form CU

When to File

Form CU must be filed on or before March 15 of

Credit unions which are exempt from the Wisconsin

franchise or income tax under the provisions of Ch.

the year following the income year for which the

71, Wis. Stats., should file Form CU instead of filing

return is filed.

a Wisconsin corporation franchise or income tax re-

turn, Form 4. Thereafter, the credit union need not

file a corporation tax return (Form 4 or 6) or Form

Where to File

CU for any subsequent year unless requested to

Mail Form CU to the Wisconsin Department of

do so by the Department of Revenue or unless in

Revenue, PO Box 8908, Madison, WI 53708-8908.

a subsequent year the credit union acts as a public

depository.

Note: Credit unions that do not derive income from

public deposits are exempt from the Wisconsin tax

on unrelated business taxable income, as computed

under section 512 of the Internal Revenue Code.

I, the undersigned authorized officer of the credit union for which this declaration of exempt status is made, declare that the above

named credit union had no deposits of public funds during the income year shown above and I understand that a Wisconsin franchise

or income tax return must be filed for any future year for which the credit union’s deposits include public funds.

Signature

Title

Date

IC-081

1

1