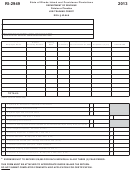

Form Ri-1040 - Rhode Island Tax Computation Worksheet - 2013

ADVERTISEMENT

2013 INSTRUCTIONS FOR FILING RI-1040

GENERAL INSTRUCTIONS

This booklet contains returns and instructions for filing the 2013 Rhode

ice pay of members of the armed forces can only be subject to income tax

Island Resident Individual Income Tax Return. Read the instructions in this

by the state of which they are legal residents. Place of legal residence at

booklet carefully. For your convenience we have provided “line by line in-

the time of entry into the service is normally presumed to be the legal state

structions” which will aid you in completing your return. Please print or type

of residence and remains so until legal residence in another state is estab-

so that it will be legible. For the first time this year, fillable forms will be avail-

lished and service records are changed accordingly. The Rhode Island in-

able on our website at Check the accuracy of your name(s),

come tax is imposed on all the federal taxable income of a resident who is

address, social security number(s) and the federal identification numbers

a member of the armed forces, regardless of where such income is received.

listed on Schedule W.

Military pay received by a nonresident service person stationed in Rhode

Most resident taxpayers will only need to complete the first two pages of

Island is not subject to Rhode Island income tax. This does not apply to

Form RI-1040 and RI Schedule W. Those taxpayers claiming modifications

other income derived from Rhode Island sources, e.g., if the service person

to federal adjusted gross income must complete RI Schedule M on page 5.

holds a separate job, not connected with his or her military service, income

Taxpayers claiming a credit for income taxes paid to another state must com-

received from that job is subject to Rhode Island income tax.

plete RI Schedule II on page 2.

In addition, under the provisions of the Military Spouses Residency Relief

Nonresidents and part-year residents will file their Rhode Island Individual

Act, income for services performed by the servicemember’s spouse can only

Income Tax Returns using Form RI-1040NR.

be subject to income tax by the state of his/her legal residency if the ser-

vicemember’s spouse meets certain conditions.

Complete your 2013 Federal Income Tax Return first.

Income for services performed by the servicemember’s spouse in Rhode

It is the basis for preparing your Rhode Island income tax return. In gen-

Island would be exempt from Rhode Island income tax if the servicemem-

eral, the Rhode Island income tax is based on your federal taxable income.

ber’s spouse moved to Rhode Island solely to be with the servicemember

Accuracy and attention to detail in completing the return in accordance

complying with military orders sending the servicemember to Rhode Island.

with these instructions will facilitate the processing of your tax return. You

The servicemember and the servicemember’s spouse must also share the

may find the following points helpful in preparing your Rhode Island Income

same non-Rhode Island domicile.

Tax Return.

However, other income derived from Rhode Island sources such as busi-

ness income, ownership or disposition of any interest in real or tangible per-

WHO MUST FILE A RETURN

sonal property and gambling winnings are still subject to Rhode Island

RESIDENT INDIVIDUALS – Every resident individual of Rhode Island re-

income tax.

quired to file a federal income tax return must file a Rhode Island individual

Internal Revenue Code provisions governing armed forces pay while serv-

income tax return (RI-1040).

ing in a “combat zone” or in an area under conditions that qualify for Hostile

A resident individual who is not required to file a federal income tax return

Fire Pay are applicable for Rhode Island purposes.

may be required to file a Rhode Island income tax return if his/her income

for the taxable year is in excess of the sum of his/her personal exemptions

DECEASED TAXPAYERS

and applicable standard deduction.

If the taxpayer died before filing a return for 2013, the taxpayer’s spouse

“Resident” means an individual who is domiciled in the State of Rhode

or personal representative must file and sign a return for the person who

Island or an individual who maintains a permanent place of abode in Rhode

died if the deceased was required to file a return. A personal representative

Island and spends more than 183 days of the year in Rhode Island.

can be an executor, administrator or anyone who is in charge of the tax-

For purposes of the above definition, domicile is found to be a place an

payer’s property.

individual regards as his or her permanent home – the place to which he or

The person filing the return should write “deceased” after the deceased’s

she intends to return after a period of absence. A domicile, once established,

name and show the date of death in the name and address space on the

continues until a new fixed and permanent home is acquired. No change of

return.

domicile results from moving to a new location if the intention is to remain

If you are claiming a refund as a surviving spouse filing a joint return with

only for a limited time, even if it is for a relatively long duration. For a married

the deceased, no other form is needed to have the refund issued to you.

couple, normally both individuals have the same domicile.

However, all other filers requesting a refund due the deceased, must file

Any person asserting a change in domicile must show:

Form RI-1310, Statement of Person Claiming Refund Due a Deceased Tax-

(1) an intent to abandon the former domicile,

payer, to claim the refund.

(2) an intent to acquire a new domicile and

If you are filing Form RI-1040H, the right to file a claim does not survive

(3) actual physical presence in a new domicile.

a person's death. Therefore, a claim filed on behalf of a deceased person

cannot be allowed. If the claimant dies after having filed a timely claim, the

amount thereof will be disbursed to another member of the household as

JOINT AND SEPARATE RETURNS

determined by the Tax Administrator.

JOINT RETURNS: Generally, if two married individuals file a joint federal

income tax return, they also must file a joint Rhode Island income tax return.

WHERE AND WHEN TO FILE

However, if either one of the married individuals is a resident and the other

Rhode Island income tax returns must be filed by Tuesday, April 15, 2014.

is a non-resident, they must file separate returns, unless they elect to file a

joint return as if both were residents of Rhode Island. If the resident spouse

If you are claiming a refund, mail your return to:

files separately in Rhode Island and a joint federal return is filed for both

Rhode Island Division of Taxation

spouses, the resident spouse must compute income, exemptions and tax

One Capitol Hill

as if a separate federal return had been filed.

Providence, RI 02908 – 5806

If neither spouse is required to file a federal income tax return and either

or both are required to file a Rhode Island income tax return, they may elect

If you are making a payment, mail your return to:

to file a joint Rhode Island income tax return.

Rhode Island Division of Taxation

Individuals filing joint Rhode Island income tax returns are both equally li-

One Capitol Hill

able to pay the tax. They incur what is known as “joint and several liability”

Providence, RI 02908 – 5807

for Rhode Island income tax.

and mail your payment with Form RI-1040V to:

SEPARATE RETURNS: Married individuals filing separate federal income

Rhode Island Division of Taxation

tax returns must file separate Rhode Island income tax returns.

DEPT #85

PO Box 9703

MILITARY PERSONNEL

Providence, RI 02940 – 9703

Under the provisions of the Soldiers and Sailors Civil Relief Act, the serv-

Page I-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8