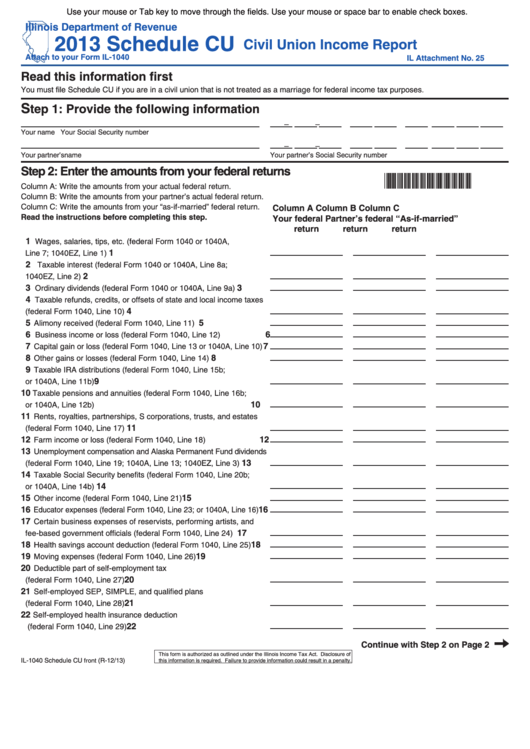

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2013 Schedule CU

Civil Union Income Report

Attach to your Form IL-1040

IL Attachment No. 25

Read this information first

You must file Schedule CU if you are in a civil union that is not treated as a marriage for federal income tax purposes.

S

tep 1: Provide the following information

–

–

Your name

Your Social Security number

–

–

Your partner’s name

Your partner’s Social Security number

Step 2: Enter the amounts from your federal returns

*365801110*

Column A: Write the amounts from your actual federal return.

Column B: Write the amounts from your partner’s actual federal return.

Column C: Write the amounts from your “as-if-married” federal return.

Column A

Column B

Column C

Read the instructions before completing this step.

Your federal

Partner’s federal

“As-if-married”

return

return

return

1

Wages, salaries, tips, etc. (federal Form 1040 or 1040A,

1

Line 7; 1040EZ, Line 1)

2

Taxable interest (federal Form 1040 or 1040A, Line 8a;

2

1040EZ, Line 2)

3

3

Ordinary dividends (federal Form 1040 or 1040A, Line 9a)

4

Taxable refunds, credits, or offsets of state and local income taxes

4

(federal Form 1040, Line 10)

5

5

Alimony received (federal Form 1040, Line 11)

6

6

Business income or loss (federal Form 1040, Line 12)

7

7

Capital gain or loss (federal Form 1040, Line 13 or 1040A, Line 10)

8

8

Other gains or losses (federal Form 1040, Line 14)

9

Taxable IRA distributions (federal Form 1040, Line 15b;

9

or 1040A, Line 11b)

10

Taxable pensions and annuities (federal Form 1040, Line 16b;

10

or 1040A, Line 12b)

11

Rents, royalties, partnerships, S corporations, trusts, and estates

11

(federal Form 1040, Line 17)

12

12

Farm income or loss (federal Form 1040, Line 18)

13

Unemployment compensation and Alaska Permanent Fund dividends

13

(federal Form 1040, Line 19; 1040A, Line 13; 1040EZ, Line 3)

14

Taxable Social Security benefits (federal Form 1040, Line 20b;

14

or 1040A, Line 14b)

15

15

Other income (federal Form 1040, Line 21)

16

16

Educator expenses (federal Form 1040, Line 23; or 1040A, Line 16)

17

Certain business expenses of reservists, performing artists, and

17

fee-based government officials (federal Form 1040, Line 24)

18

18

Health savings account deduction (federal Form 1040, Line 25)

19

19

Moving expenses (federal Form 1040, Line 26)

20

Deductible part of self-employment tax

20

(federal Form 1040, Line 27)

21

Self-employed SEP, SIMPLE, and qualified plans

21

(federal Form 1040, Line 28)

22

Self-employed health insurance deduction

22

(federal Form 1040, Line 29)

Continue with Step 2 on Page 2

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

IL-1040 Schedule CU

(R-12/13)

front

this information is required. Failure to provide information could result in a penalty.

1

1 2

2