Form Nyc-5ubti - Declaration Of Estimated Unincorporated Business Tax - 2003

ADVERTISEMENT

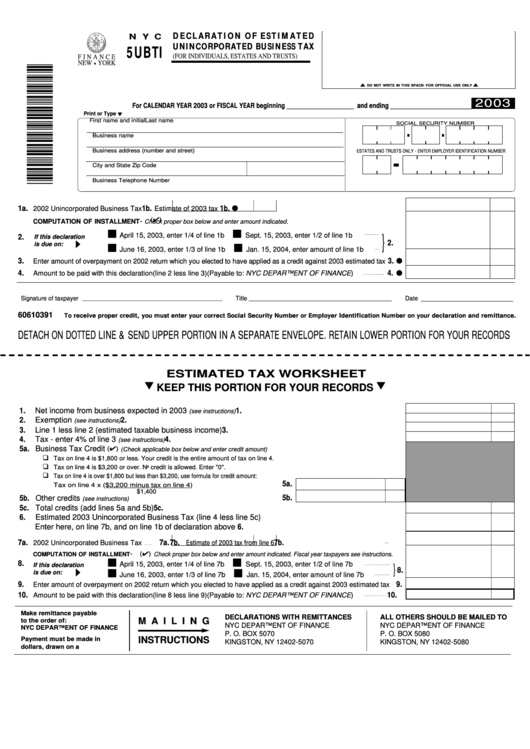

DECLARATION OF ESTIMATED

N Y C

UNINCORPORATED BUSINESS TAX

5UBTI

(FOR INDIVIDUALS, ESTATES AND TRUSTS)

F I N A N C E

NEW YORK

-

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

2003

For CALENDAR YEAR 2003 or FISCAL YEAR beginning ___________________ and ending _______________________

Print or Type

First name and initial

Last name

SOCIAL SECURITY NUMBER

Business name

Business address (number and street)

ESTATES AND TRUSTS ONLY - ENTER EMPLOYER IDENTIFICATION NUMBER

City and State

Zip Code

Business Telephone Number

1a.

1b.

1b.

2002 Unincorporated Business Tax

Estimate of 2003 tax

( )

-

COMPUTATION OF INSTALLMENT

Check proper box below and enter amount indicated.

April 15, 2003, enter 1/4 of line 1b

Sept. 15, 2003, enter 1/2 of line 1b

2.

}

If this declaration

2.

is due on:

June 16, 2003, enter 1/3 of line 1b

Jan. 15, 2004, enter amount of line 1b

3.

3.

Enter amount of overpayment on 2002 return which you elected to have applied as a credit against 2003 estimated tax

4.

4.

Amount to be paid with this declaration (line 2 less line 3) (Payable to: NYC DEPARTMENT OF FINANCE)

Signature of taxpayer

Title _______________________________________________

Date ___________________________

________________________________________________________________________

60610391

To receive proper credit, you must enter your correct Social Security Number or Employer Identification Number on your declaration and remittance.

DETACH ON DOTTED LINE & SEND UPPER PORTION IN A SEPARATE ENVELOPE. RETAIN LOWER PORTION FOR YOUR RECORDS

ESTIMATED TAX WORKSHEET

KEEP THIS PORTION FOR YOUR RECORDS

1.

Net income from business expected in 2003

1.

(see instructions)

...................................................................................................................................

2.

2.

Exemption

(see instructions)

...................................................................................................................................................................................................................................

3.

3.

Line 1 less line 2 (estimated taxable business income)

..............................................................................................................................................

4.

Tax - enter 4% of line 3

4.

(see instructions)

..............................................................................................................................................................................................

5a. Business Tax Credit

( ) (Check applicable box below and enter credit amount)

Tax on line 4 is $1,800 or less. Your credit is the entire amount of tax on line 4.

Tax on line 4 is $3,200 or over. No credit is allowed. Enter "0".

Tax on line 4 is over $1,800 but less than $3,200, use formula for credit amount:

5a.

Tax on line 4 x ($3,200 minus tax on line 4)

...........................................................

$1,400

5b. Other credits

5b.

(see instructions)

............................................................................................................................

5c. Total credits (add lines 5a and 5b)

5c.

.....................................................................................................................................................................................................

6.

Estimated 2003 Unincorporated Business Tax (line 4 less line 5c)

Enter here, on line 7b, and on line 1b of declaration above

6.

...............................................................................................................................

7a.

7a.

7b.

7b.

Estimate of 2003 tax from line 6

2002 Unincorporated Business Tax

-

( )

COMPUTATION OF INSTALLMENT

Check proper box below and enter amount indicated. Fiscal year taxpayers see instructions.

8.

April 15, 2003, enter 1/4 of line 7b

Sept. 15, 2003, enter 1/2 of line 7b

If this declaration

}

8.

is due on:

June 16, 2003, enter 1/3 of line 7b

Jan. 15, 2004, enter amount of line 7b

9.

9.

Enter amount of overpayment on 2002 return which you elected to have applied as a credit against 2003 estimated tax

10.

10.

Amount to be paid with this declaration (line 8 less line 9) (Payable to: NYC DEPARTMENT OF FINANCE)

Make remittance payable

DECLARATIONS WITH REMITTANCES

ALL OTHERS SHOULD BE MAILED TO

M A I L I N G

to the order of:

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

P. O. BOX 5070

P. O. BOX 5080

INSTRUCTIONS

Payment must be made in U.S.

KINGSTON, NY 12402-5070

KINGSTON, NY 12402-5080

dollars, drawn on a U.S. bank.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1