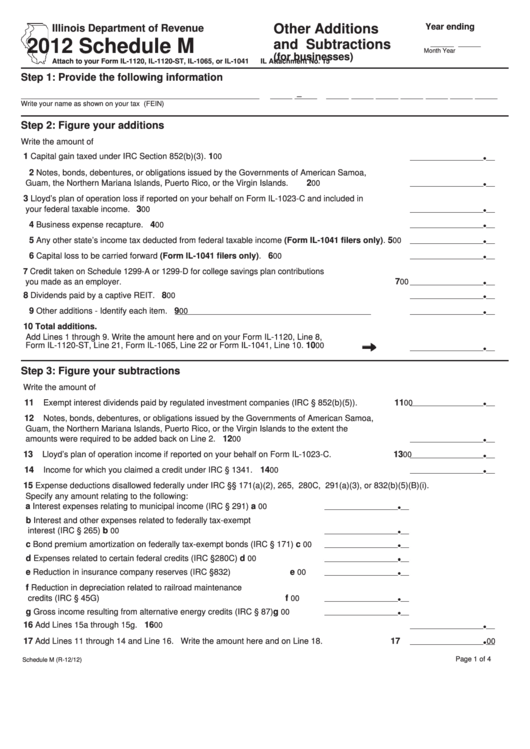

Other Additions

Year ending

Illinois Department of Revenue

2012 Schedule M

and Subtractions

Month

Year

(for businesses)

Attach to your Form IL-1120, IL-1120-ST, IL-1065, or IL-1041

IL Attachment No. 15

Step 1: Provide the following information

–

Write your name as shown on your tax return.

Write your Federal Employer Identification no. (FEIN)

Step 2: Figure your additions

Write the amount of

1

1

Capital gain taxed under IRC Section 852(b)(3).

00

2

Notes, bonds, debentures, or obligations issued by the Governments of American Samoa,

Guam, the Northern Mariana Islands, Puerto Rico, or the Virgin Islands.

2

00

3

Lloyd’s plan of operation loss if reported on your behalf on Form IL-1023-C and included in

3

your federal taxable income.

00

4

4

Business expense recapture.

00

5

Any other state’s income tax deducted from federal taxable income (Form IL-1041 filers only).

5

00

6

6

Capital loss to be carried forward (Form IL-1041 filers only).

00

7

Credit taken on Schedule 1299-A or 1299-D for college savings plan contributions

you made as an employer.

7

00

8

8

Dividends paid by a captive REIT.

00

9

9

Other additions - Identify each item.

00

10

Total additions.

Add Lines 1 through 9. Write the amount here and on your Form IL-1120, Line 8,

10

Form IL-1120-ST, Line 21, Form IL-1065, Line 22 or Form IL-1041, Line 10.

00

Step 3: Figure your subtractions

Write the amount of

11

11

Exempt interest dividends paid by regulated investment companies (IRC § 852(b)(5)).

00

12

Notes, bonds, debentures, or obligations issued by the Governments of American Samoa,

Guam, the Northern Mariana Islands, Puerto Rico, or the Virgin Islands to the extent the

12

amounts were required to be added back on Line 2.

00

13

13

Lloyd’s plan of operation income if reported on your behalf on Form IL-1023-C.

00

14

Income for which you claimed a credit under IRC § 1341.

14

00

15

Expense deductions disallowed federally under IRC §§ 171(a)(2), 265, 280C, 291(a)(3), or 832(b)(5)(B)(i).

Specify any amount relating to the following:

a

a

Interest expenses relating to municipal income (IRC § 291)

00

b

Interest and other expenses related to federally tax-exempt

b

interest (IRC § 265)

00

c

c

Bond premium amortization on federally tax-exempt bonds (IRC § 171)

00

d

d

Expenses related to certain federal credits (IRC §280C)

00

e

Reduction in insurance company reserves (IRC §832)

e

00

f

Reduction in depreciation related to railroad maintenance

f

credits (IRC § 45G)

00

g

Gross income resulting from alternative energy credits (IRC § 87)

g

00

16

16

Add Lines 15a through 15g.

00

17

Add Lines 11 through 14 and Line 16. Write the amount here and on Line 18.

17

00

Page 1 of 4

Schedule M (R-12/12)

1

1 2

2 3

3 4

4