Instructions For Schedule 2a

ADVERTISEMENT

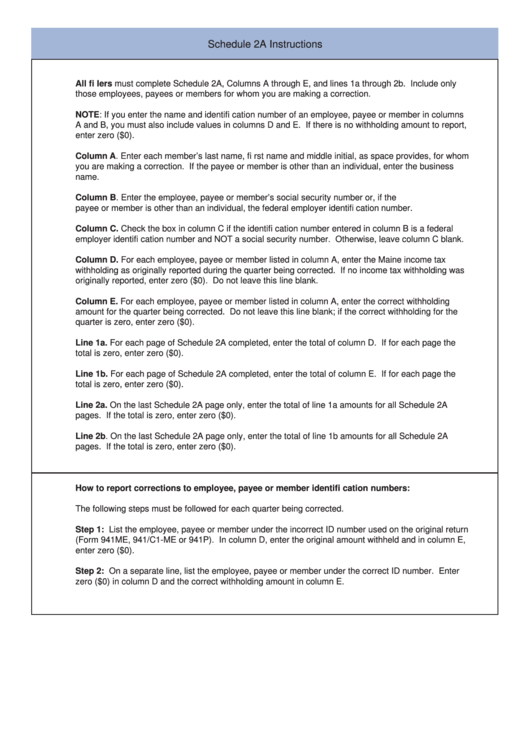

Schedule 2A Instructions

All fi lers must complete Schedule 2A, Columns A through E, and lines 1a through 2b. Include only

those employees, payees or members for whom you are making a correction.

NOTE: If you enter the name and identifi cation number of an employee, payee or member in columns

A and B, you must also include values in columns D and E. If there is no withholding amount to report,

enter zero ($0).

Column A. Enter each member’s last name, fi rst name and middle initial, as space provides, for whom

you are making a correction. If the payee or member is other than an individual, enter the business

name.

Column B. Enter the employee, payee or member’s social security number or, if the

payee or member is other than an individual, the federal employer identifi cation number.

Column C. Check the box in column C if the identifi cation number entered in column B is a federal

employer identifi cation number and NOT a social security number. Otherwise, leave column C blank.

Column D. For each employee, payee or member listed in column A, enter the Maine income tax

withholding as originally reported during the quarter being corrected. If no income tax withholding was

originally reported, enter zero ($0). Do not leave this line blank.

Column E. For each employee, payee or member listed in column A, enter the correct withholding

amount for the quarter being corrected. Do not leave this line blank; if the correct withholding for the

quarter is zero, enter zero ($0).

Line 1a. For each page of Schedule 2A completed, enter the total of column D. If for each page the

total is zero, enter zero ($0).

Line 1b. For each page of Schedule 2A completed, enter the total of column E. If for each page the

total is zero, enter zero ($0).

Line 2a. On the last Schedule 2A page only, enter the total of line 1a amounts for all Schedule 2A

pages. If the total is zero, enter zero ($0).

Line 2b. On the last Schedule 2A page only, enter the total of line 1b amounts for all Schedule 2A

pages. If the total is zero, enter zero ($0).

How to report corrections to employee, payee or member identifi cation numbers:

The following steps must be followed for each quarter being corrected.

Step 1: List the employee, payee or member under the incorrect ID number used on the original return

(Form 941ME, 941/C1-ME or 941P). In column D, enter the original amount withheld and in column E,

enter zero ($0).

Step 2: On a separate line, list the employee, payee or member under the correct ID number. Enter

zero ($0) in column D and the correct withholding amount in column E.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1